FTSE Mondo Visione Exchanges Index:

News Centre

-

CFTC’s Division Of Swap Dealer And Intermediary Oversight Issues No-Action Relief Regarding The Treatment Of Swap Transactions Arising From Multilateral Portfolio Compression Exercises For Purposes Of Making Calculations Under The Swap Dealer Definition

Date 21/12/2012

The Commodity Futures Trading Commission’s (CFTC) Division of Swap Dealer and Intermediary Oversight (DSIO) today issued a no-action letter that provides relief for persons engaging in multilateral portfolio compression exercises.

-

SEC Announces Agenda For Roundtable On Decimalization

Date 21/12/2012

The Securities and Exchange Commission today announced the agenda for its upcoming staff roundtable that will evaluate the impact of tick sizes on the securities markets.

-

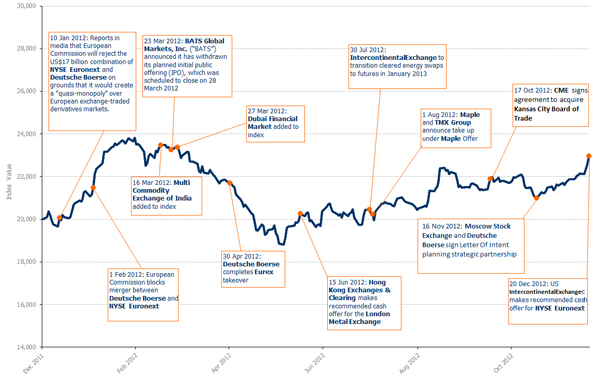

IntercontinentalExchange Makes Recommended Cash Offer For NYSE Euronext - 1-Year Performance Chart Of The FTSE Mondo Visione Exchanges Index (USD Capital Return)

Date 21/12/2012

-

Robert Litzenberger Selected As The Recipient Of The 2012 IAFE/SunGard Financial Engineer Of The Year Award

Date 21/12/2012

The International Association of Financial Engineers (www.iafe.org) and SunGard (http://www.sungard.com) today announced Robert Litzenberger, Professor Emeritus at the Wharton School of the University of Pennsylvania, a Director at RGM Advisors, and a retired Goldman Sachs partner has been named the 2012 IAFE/SunGard Financial Engineer of the Year (FEOY). The award will be presented to Dr. Litzenberger on February 7, 2013, at the newly opened Museum of Mathematics in New York City, during the IAFE/SunGard FEOY Award Gala Dinner.

-

IOSCO Publishes Two Reports Advancing Its Work On Credit Rating Agencies

Date 21/12/2012

The International Organization of Securities Commissions (IOSCO) published today two reports Credit Rating Agencies: the final report on Credit Rating Agencies: Internal Controls Designed to Ensure the Integrity of the Credit Rating Process and Procedures to Manage Conflicts of Interest and a consultation report on Supervisory Colleges for Credit Rating Agencies.

-

Direct Edge Trading Notice #12-61: Direct Edge To Observe A Moment of Silence This Morning At 9:30 a.m.

Date 21/12/2012

Direct Edge will join the State of Connecticut in observing a moment of silence at 9:30 a.m. ET, today, December 21, 2012, in honor of Sandy Hook Elementary School victims and their families. While trading will not be affected, we encourage market participants to join us in a silent remembrance to recognize the tragedy experienced by those in Newtown, CT.

-

Thai Alternative Bourse Marks Record Highs

Date 21/12/2012

The Market for Alternative Investment (mai), under The Stock Exchange of Thailand (SET), makes all-time highs since it was established in terms of the mai index, market capitalization, fundraising valuation, and number of investment tools used.

-

Japan's Financial Services Agency: Public Consultation On The Exposure Draft “Standards For Addressing Fraud Risk In An Audit (Provisional Translation)”

Date 21/12/2012

The Audit Committee of the Business Accounting Council (Chairman: Mr. Yoshikazu Wakita, Professor at Nagoya Keizai University) has published the Exposure Draft “Standards for Addressing Fraud Risk in an Audit (Provisional Translation) .”

-

Hong Kong's Securities And Futures Commission Welcomes Re-Appointment Of Non-Executive Directors

Date 21/12/2012

The Securities and Futures Commission (SFC) welcomes the re-appointment by the Financial Secretary of Professor Leonard Cheng Kwok-hon and Mr Anderson Chow Ka-ming, SC as Non-Executive Directors for a term of two years, with effect from 1 January 2013.

-

Poland: KDPW_CCP Ready For OTC Derivatives Clearing From 2 January 2013

Date 21/12/2012

On 19 December 2012, the Polish Financial Supervision Authority (KNF) approved theTransaction Clearing Rules (Non-organised Trading). The Rules take effect as of 2 January 2013. As of that date, the clearing house KDPW_CCP will start clearing trade in the OTC clearing system.

- First

- Previous

- 13380

- 13381

- 13382

- 13383

- 13384

- 13385

- 13386

- 13387

- 13388

- 13389

- 13390

- 13391

- 13392

- 13393

- 13394

- 13395

- 13396

- Next

- Last