FTSE Mondo Visione Exchanges Index:

News Centre

-

Statement Of CFTC Commissioner Dan M. Berkovitz Regarding The De Minimis Exception To The Swap Dealer Definition; Final Rule

Date 05/11/2018

I support amending the swap dealer de minimis exception to set the threshold at $8 billion. This limited amendment relies on extensive data analysis to achieve a balance between the policy objectives of the de minimis exception and the registration of swap dealers.

-

FSB RCG For The MENA Discusses SME Financing, The Use Of Suptech And Regtech, And Implementation Of The Net Stable Funding Ratio

Date 05/11/2018

The Financial Stability Board (FSB) Regional Consultative Group (RCG) for the Middle East and North Africa (MENA) met in Istanbul today at a meeting hosted by the Central Bank of the Republic of Turkey.

-

Borsa Italiana Monthly Update October 2018

Date 05/11/2018

Click here to download Borsa Italiana's monthly update.

-

NEX Markets Volumes - October 2018

Date 05/11/2018

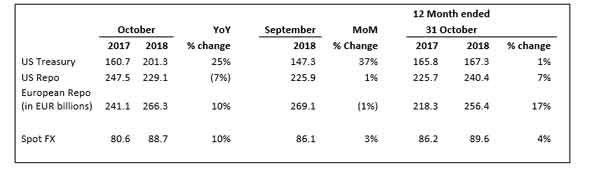

Average Daily Volume (in USD billions unless otherwise stated, single count)

Historical data is available here: http://www.nex.com/investors/monthly-volume-data

-

Deutsche Börse AG: Announcement Of Acquisition Of Own Shares

Date 05/11/2018

In the period from 29 October 2018 to, and including, 02 November 2018, Deutsche Börse AG purchased a number of 166,861 shares within the framework of its ongoing share buy-back program which had been announced by the announcement of 8 August 2018 pursuant to Art. 5 (1) lit. a) of Regulation (EU) No 596/2014 and Art. 2 (1) of Delegated Regulation (EU) No 2016/1052.

-

Statement Of CFTC Chairman J. Christopher Giancarlo Regarding The Final Rule On Swap Dealer De Minimis Calculation

Date 05/11/2018

Today’s final rule on the numeric threshold for swap dealer de minimis will provide the market with certainty that the threshold will not fall from $8 billion to $3 billion. I fully support the proposed final rule.

-

PEGAS Trading Volumes In October 2018 - PEGAS Records Its Best Monthly Volume Of 2018 Supported By Significant All-Around Increases

Date 05/11/2018

PEGAS, the pan-European gas trading platform operated by Powernext, achieved its highest monthly volume of 2018 with 191.5 TWh traded in October. A strong spot segment supported this increase, as well as a flurry of activities on TRS Spot ahead of the French zone merger leading to a final record with 8.2 TWh (previous record: 5.7 TWh in March 2018). The Options segment also registered a volume best since its launch with 2.4 TWh.

-

Statement Of CFTC Chairman J. Christopher Giancarlo Regarding Notice Of Proposed Rulemaking On Swap Execution Facilities And Request For Comment On Post-Trade Name Give-Up

Date 05/11/2018

I start by referencing an important White Paper written in 1970 by a young graduate student in economics at UC Berkeley. That White Paper, entitled, “Preliminary Design for an Electronic Market,” written for the Pacific Commodity Exchange, was the world’s first written conceptualization of a fully electronic, for-profit futures exchange.

-

Ljubljana Stock Exchange Monthly Statistical Report October 2018

Date 05/11/2018

Click here to download comprehensive monthly statistics of the Ljubljana Stock Exchange for October 2018.

-

Intercontinental Exchange Reports October 2018 Statistics

Date 05/11/2018

Intercontinental Exchange, Inc. (NYSE:ICE), a leading operator of global exchanges and clearing houses and provider of data and listings services, today reported October 2018 trading volume and related revenue statistics, which can be viewed on the company’s investor relations website at http://ir.theice.com/ir-resources/supplemental-information in the Monthly Statistics Tracking spreadsheet.

- First

- Previous

- 7561

- 7562

- 7563

- 7564

- 7565

- 7566

- 7567

- 7568

- 7569

- 7570

- 7571

- 7572

- 7573

- 7574

- 7575

- 7576

- 7577

- Next

- Last