FTSE Mondo Visione Exchanges Index:

News Centre

-

Moscow Exchange: Updated Constituents List For OFZ Zero Coupon Yield Curve To Come Into Force On 15 August 2022

Date 12/08/2022

On 15 August 2022, the following updated constituents list for OFZ Zero Coupon Yield Curve will come into force.

-

Lori H. Price Named Director Of Office Of Credit Ratings

Date 12/08/2022

The Securities and Exchange Commission today announced that Lori H. Price has been named Director of the Office of Credit Ratings (OCR), effective Aug. 14, 2022. She has served as Acting Director since February 2022 and has more than 30 years of experience in various roles at the SEC.

-

Deutsche Börse Group: Business Indicators For July 2022

Date 12/08/2022

A summary of Deutsche Börse Group's business indicators for July 2022 is now available on our website:

-

Minutes Of Bank Of England Call With GEMMs On Its Provisional Approach To APF Gilt Sales – 5 August 2022

Date 12/08/2022

Following publication of the Bank’s Provisional Market Notice on Asset Purchase Facility (APF) gilt sales on 4 August 2022, the Bank invited Gilt-edge Market Makers (GEMMs), as the Bank’s counterparties in these operations, to a virtual meeting to provide an opportunity for questions on the operational implications and to gather any initial feedback. The discussion is summarised in the minutes below for transparency.

-

Bank Of England: Minutes Of The CBDC Engagement Forum - July 2022: Fourth Meeting Of The CBDC Engagement Forum

Date 12/08/2022

Co-chairs Gwyneth Nurse and Jon Cunliffe welcomed Members to the fourth meeting of the CBDC Engagement Forum.

-

Malawi Stock Exchange Weekly Summary - 12 August 2022

Date 12/08/2022

Click here to download Malawi Stock Exchange's weekly summary.

-

HKEX Welcomes Enhancement To Stock Connect Trading Calendar

Date 12/08/2022

Hong Kong Exchanges and Clearing Limited (HKEX) welcomes the joint announcement today (Friday) by Hong Kong’s Securities and Futures Commission and the China Securities Regulatory Commission on the adjustments to the trading calendar between the Hong Kong and Mainland China markets under Stock Connect.

-

Latoken.com: BaFin Investigates LiquiTrade Limited

Date 12/08/2022

In accordance with section 37 (4) of the German Banking Act (Kreditwesengesetz – KWG), BaFin would like to make clear that LiquiTrade Limited, Cayman Islands, does not have authorisation under the KWG to conduct banking business or provide financial services. The company is not supervised by BaFin. The information provided on the company’s website, latoken.com, gives reasonable grounds to suspect that LiquiTrade Limited is conducting banking business and providing financial services in Germany without the required authorisation.

-

Optimizing And Adjusting Trading Calendar Of Shanghai-Shenzhen-Hong Kong Stock Connect To Optimize The Chinese Mainland-Hong Kong Stock Connect Mechanism

Date 12/08/2022

Today, the China Securities Regulatory Commission (CSRC) and the Securities and Futures Commission of Hong Kong (SFC) issued a Joint Announcement, which in principle approved the Shanghai Stock Exchange (SSE), the Shenzhen Stock Exchange (SZSE), the Stock Exchange of Hong Kong Ltd. (SEHK), China Securities Depository and Clearing Corporation Limited (CSDC) and Hong Kong Securities Clearing Company Ltd. (HKSCC) to optimize and adjust the trading calendar of Shanghai-Shenzhen-Hong Kong Stock Connect. By increasing the number of trading days for investors, this optimization better ensures the trading continuity of investors and is expected to deepen the stock connect between the capital markets of mainland and Hong Kong.

-

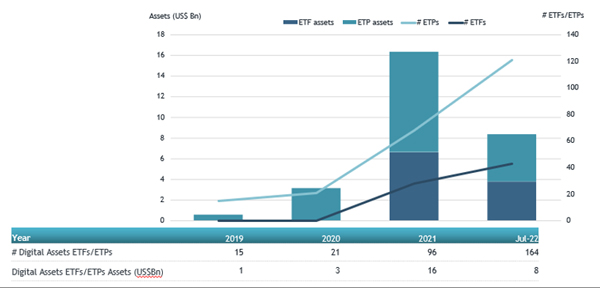

ETFGI Reports Crypto ETPs Listed Globally Gathered Net Inflows Of US$227 Million During July 2022

Date 12/08/2022

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that Crypto ETFs and ETPs listed globally gathered net inflows of US$227 million during July, bringing year-to-date net inflows to US$727 million, which is much lower than the US$4.07 billion gathered at this point last year. Total assets invested in Crypto ETFs and ETPs increased by 38.7% from US$6.02 billion at the end of June 2022 to US$8.35 billion, according to ETFGI’s July 2022 ETF and ETP Crypto industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- First

- Previous

- 3290

- 3291

- 3292

- 3293

- 3294

- 3295

- 3296

- 3297

- 3298

- 3299

- 3300

- 3301

- 3302

- 3303

- 3304

- 3305

- 3306

- Next

- Last