- The value of non-Treasury bonds listed on Catalyst grew 17% in 2017 breaking an all-time record, according to a report published by Grant Thornton under the auspices of GPW

- Catalyst becomes increasingly popular as demonstrated by the value and number of listed debt instruments

Catalyst broke all-time records in 2017. According to a report published by the audit and consultancy firm Grant Thornton under the auspices of the Warsaw Stock Exchange, issuers raised PLN 12.3 billion in bond issues on Catalyst in 2017 (an increase of 148% year on year) and the market grew by PLN 14 billion year on year in 2017. These are all-time records after 2012 when issuers raised PLN 10.7 billion. The total value of non-Treasury fixed-income instruments listed on Catalyst stood at PLN 95.8 billion as at 31 December 2017, representing an increase of 50% in the last three years.

“This September marks the ninth anniversary of Catalyst. This has been a period of focused development of the market which has become increasingly popular with issuers year after year. Catalyst-listed bonds are an effective source of growth financing for issuers. The situation on the Polish debt market suggests a growing awareness of the benefits of a strong public market, such as Catalyst, as well as the risks of non-public issues which are not listed. We make best efforts to ensure that Catalyst serves both companies and investors. We will continue to offer the broadest possible range of instruments and services on the debt market,” said Jacek Fotek, Vice-President of the Warsaw Stock Exchange.

The growing popularity of Catalyst is proved not only by the value but also the number of debt instruments. In 2017, the number of corporate bonds increased by 8.3%, the number of covered bonds by 13.3% and the number of municipal bonds by a record-high 10.2%. Only the number of co-operative bonds decreased (by 5.6%), as it had in 2016. Excluding Treasury bonds, the number of all debt instruments listed on Catalyst totalled 567 series as at 31 December 2017, which was 43 series more than in 2016.

“The corporate and local government bond market in Poland is no longer seen as a novelty and it has become a natural and important part of the Polish business environment. Although the market is not risk-free, it certainly offers an interesting alternative to both investors and issuers,” said Paulina Zalewska-Wichrzycka, Advisor at Grant Thornton.

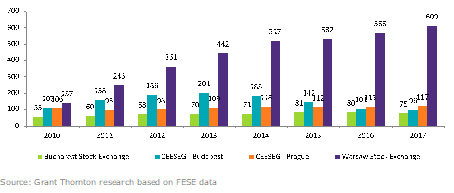

The development of Catalyst has made Poland the CEE leader in terms of using bonds as a source of capital by companies. The number of bond series listed on Catalyst at the end of 2017 was twice as high as the combined number of bonds listed on the three most important regional markets which are Catalyst’s peers: the Czech Republic, Hungary and Romania.

Figure. Number of bonds issued on CEE exchanges