In this release, CCData explores the highly anticipated upcoming verdict regarding the approval of a spot Bitcoin Exchange-Traded Fund (ETF) by the U.S. Securities and Exchange Commission (SEC). CCData's discussion navigates through several key themes and areas, including:

- A background Into ETFs in Crypto

- Key Quotes and Insights

- Market Anticipation and ETF Applications

- Regulatory Compliance and Institutional Investment

- The Nature and Impact of Bitcoin ETFs

- Current ETF Landscape and Market Dynamics

- Probability of ETF Approval and Regulatory Concerns - Is This Time Different?

- Impact of a Potential ETF Approval

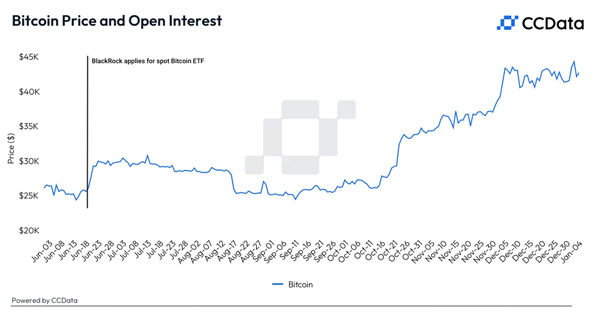

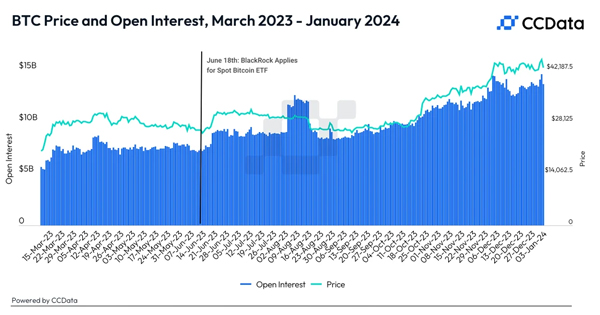

Though spot trading volumes have been outpacing the derivatives market, the open interest in the market has reached multi-year highs, with BTC instruments recording an aggregate open interest as high as $14.6bn. Whilst, the high funding rate and the open interest underscore the positive sentiment and the market’s belief that the ETF is imminent, the heightened leverage in the system makes markets more vulnerable to liquidation cascade and high volatile movements as observed on January 3rd.

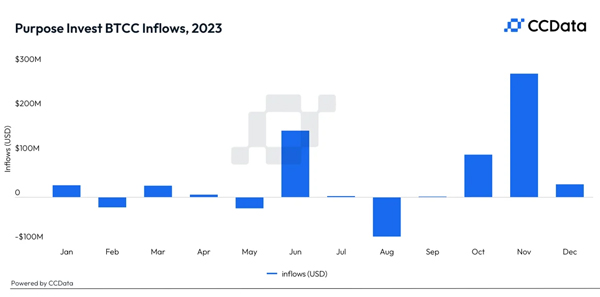

Inflows into digital assets have also seen a remarkable uptick since the announcement of BlackRock’s application, especially in June and November, the month of the launch and the month the approval seemed inevitable. Taking Canada’s Purpose Invest Spot Bitcoin BTCC as an example, the fund saw its AUM increase by around 5000 BTC or $150mn (more than 20% of the fund’s AUM), and in November the fund saw remarkable inflows of 7677 BTC or $277mn.

About CCData

CCData is an FCA-authorised benchmark administrator and global leader in digital asset data, providing institutional-grade digital asset data and settlement indices. By aggregating and analysing tick data from globally recognised exchanges and seamlessly integrating multiple datasets, CCData provides a comprehensive and granular overview of the market across trade, derivatives, order book, historical, social and blockchain data.

The information provided by this report does not constitute any form of advice or recommendation by CCData. Any redistribution of charts appearing in this email must cite CCData as the sole provider and creator.