SWIFT, the financial messaging provider for more than 10,000 financial institutions and corporations in 212 countries, today at confirmed that the SWFT Index accurately forecast the current economic recovery growth levels for the UK, the US and OECD region seven months ago.

Based on an average of 2 million SWIFT payments messages per day, the SWIFT Index produces quarterly GDP growth nowcasts and forecasts for the UK, EU27, Germany, US and OECD economies and publishes these on a monthly basis.

Today, as SWIFT releases the August SWIFT Index forecasts, it is expected that the UK economy will see further growth in Q4 with a year-on-year GDP growth rate of 1.7% as the country is on the path to recover the pre-financial crisis levels of growth.

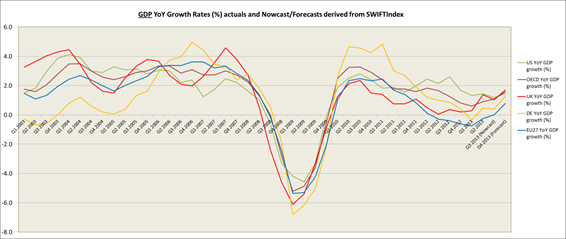

The following graph shows year-on-year GDP growth based on the SWIFT Index, clearly indicating improving growth for the UK, Germany, US, EU27 and OECD aggregates.

For the EU27 region, the SWIFT Index points to significant GDP growth moving from -0.3% in Q2 to 0.8% by the end of 2013.

Similarly, the German economy will continue to pick up with year-on-year GDP growth moving from 0.5% at the end of Q2 to 1.3% growth by the end of Q4 2013.

Continuing the SWIFT Index’s prediction in February that the US economy would reach 1.6% growth by the end of Q2, further growth is expected in Q4 2013 reaching 1.5% year-one-year GDP growth.

Underpinning the combined regional growth, the OECD region will also grow from 0.9% at the end of Q2 2013 to 1.6% year-on-year GDP growth by the end of 2013 signaling the world economy will have overcome the worst of the financial crisis.

“A combination of our own algorithm based on SWIFT payments volumes and OECD data, the SWIFT Index has accurately forecasted the GDP growth rates for the UK at a time when other organisations downgraded their growth outlook for the UK. As such, the SWIFT Index is increasingly being used by banks and corporates as a leading metric for GDP growth” commented Andre Boico, Head of Pricing & Analytics, SWIFT. “With our latest SWIFT Index results now published, global economic recovery is set to continue mainly in the US and in Europe.”

Background:

Below, you can find a summary table of the GDP estimates derived from the SWIFT Index and the forecast trend compared to the last actual figure (Q2-2013).

|

Region/ Country |

Q2-2013 vs. Q2-2012 (Year-on-Year %) |

Q3-2013 vs. Q3-2012 (Year-on-Year %) |

Q4-2013 vs. Q4-2012 (Year-on-Year %) |

Forecast Q4-2013 Trend |

|

|

GDP Actual (1) (published by OECD) |

GDP Nowcast |

GDP Forecast |

Direction(2) |

Rate of change(3) |

|

|

OECD |

0.9% |

1.1% |

1.6% |

Growing |

Faster |

|

EU27 |

-0.3% |

0.0% |

0.8% |

Growing |

From Contracting |

|

US |

1.6% |

1.2% |

1.5% |

Growing |

Stable |

|

UK |

1.5% |

1.0% |

1.7% |

Growing |

Slightly Faster |

|

Germany |

0.5% |

0.4% |

1.3% |

Growing |

Faster |

Dictionary of terms:

(1) Published by OECD & downloaded on 20 August 2013. When no actual is available, SWIFT will use its previous nowcasted GDP growth rate.

(2) Direction: sign of the GDP forecast figure. Positive growth rate (>0%) is equivalent to ‘Growing’. Negative growth rate (<0%) is equivalent to ‘Contracting’. Flat is used when GDP shows no change at 0%.

(3) Rate of change: we compare the GDP growth rate forecast to the last known actual. If the forecasted GDP growth rate is higher than the last actual, then the “rate of change” can be ‘Faster’,’ Slightly Faster’ or ‘From Contracting’ (if there is a change in sign from negative growth to positive growth). If the forecasted GDP growth rate is lower than the last actual, then the “rate of change” can be ‘Slower’, ’Slightly Slower’ or ‘From Growing’ (if there is a change in sign from positive growth to negative growth).

.jpg)