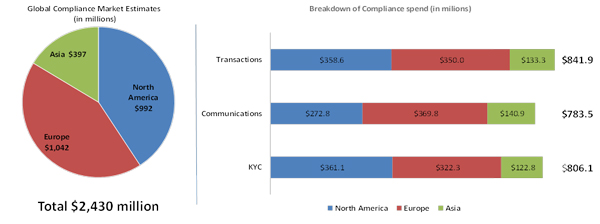

TABB Group forecasts global compliance market spend will rise 7.5% to 8% in 2015, reaching $2.592 billion from $2.430 billion in 2014, and growing at a similar pace for 2016, driven by global regulations that require institutions to expand coverage, enhance existing capabilities and standardize compliance solutions and processes.

2014 GRC Market Size | Geographical breakout of the Global Compliance Market

Because of this heightened regulatory scrutiny, TABB Group sees an increase in compliance- and surveillance-related projects within the buy- and sell-side communities in North America (41%), Europe (43%) and Asia-Pacific (16%) to keep pace with a “tsunami” of governance, risk and compliance (GRC) data.

“Dodd Frank, the Volcker rule and the Consolidated Audit Trail (CAT) in the US and EMIR and MiFID2 in Europe are giving sleepless nights to senior executives,” writes Shagun Bali, TABB technology analyst and author of “The Data Tsunami: Combating the Overwhelming Supply of GRC Data,” which examines the deeper GRC issues, challenges and trends; describes forward-looking solutions; and highlights five leading providers of GRC tools: AxiomXL, Bloomberg Vault, Nasdaq BWise, NICE Actimize and SunGard.

These mandates, Bali says, are forcing firms to increase reporting frequency, increasing data capture and management within tighter timeframes.

Many firms unfortunately lack systems or control over their data to make complex analytics an integral part of workflow or enable information to pass back and forth within different functions, incorporating functionality for both internally generated structured data and unstructured data generated by third parties.

“The idea of a single GRC Platform to meet all of an institution’s needs is a myth,” says Bali, “there’s no one-stop shop for GRC spreading across business functions, assets classes and geographies.” The best practice for institutions, she points out, is to approach GRC as a federated architecture that allows for best-of-breed solutions as required, and does not force the institution into one platform that tries to fulfill all needs. “But no single IT tool has all the answers, which is why firms need to create cohesive business processes to manage various functions and technologies in sync.”

Compliance analytics is no longer a nice-to-have tool – it’s a must-have tool, says Bali, “but enterprise-wide compliance requires a push from top management to introduce a new, efficient architectural paradigm that enables a holistic and unified view of internal and external data, working with vendors and automating parts of the compliance process.”

The 19-page, 9-exhibit report can be downloaded by Research Alliance Data and Analytics clients and qualified media at http://www.tabbgroup.com/Login.aspx. For the Executive Summary or to purchase the report, write to info@tabbgroup.com.

.jpg)