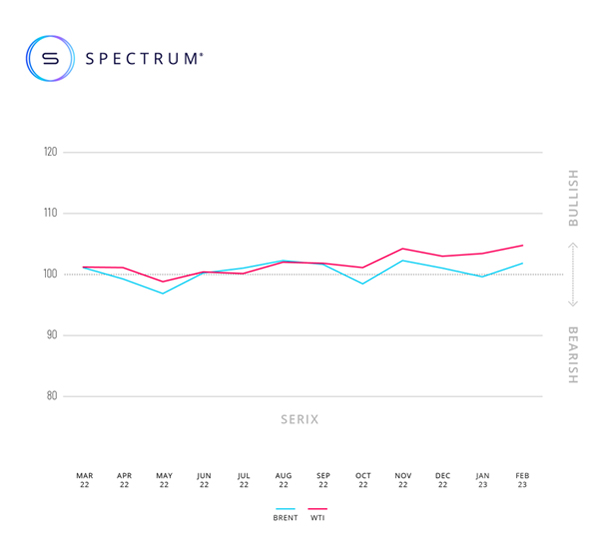

- Monthly SERIX sentiment for both WTI and Brent indices has strengthened steadily since early last year

- Re-opening of Chinese economy and reduced supply forecasts from Russia affecting outlook

- WTI sentiment reached highest point since August 2021

Spectrum Markets (“Spectrum”), the pan-European trading venue for securitised derivatives, has published its SERIX sentiment data for European retail investors for February 2023, revealing positive sentiment towards both major crude oil indices: WTI and Brent, with the value being at 105 and 102 respectively. The SERIX value indicates retail investor sentiment, with a number above 100 marking bullish sentiment, and a number below 100 indicating bearish sentiment. (See below for more information on the methodology).

International oil markets have seen significant volatility in recent months, with prices plummeting from a peak of 120 US Dollars1 per barrel, in June 2022, to around 80 US Dollars2 at the end of last month, on concerns about the US Federal Reserve’s interest rate hike policy. The fall in the oil price occurred despite problems affecting supply chains, and Russia's plan to cut crude oil production by 500,000 barrels per day in March.

The reverse trend in sentiment, indicated by the SERIX data, suggests retail investors have been bullish in the short term, either anticipating a temporary bottom to market prices or trading in response to specific news, like OPEC’s recent report3 projecting increased demand for crude oil.

OPEC’s forecast could be based upon three observations: firstly, the expectation of a global recession seems to be brightening up; secondly, China’s relaxation of COVID-19 restrictions has led to an expectation of economic improvement, and thirdly OPEC has forecast a further decline in Russian output in 2023.

“Our trading data suggests European retail investors are carefully monitoring the major commodity markets right now. Reacting to key macroeconomic developments, especially in Russia and China, it seems like many traders sought to take advantage of low oil price levels and took investment decisions that anticipate an increase in WTI and Brent’s prices,” explains Michael Hall, Head of Distribution at Spectrum Markets. “For retail investors, the OPEC announcement probably came as no surprise, but rather as a confirmation of their own market expectations,” Hall adds.

In February 2023, 113 million securitised derivatives were traded on Spectrum, with 35.7% of trades taking place outside of traditional hours (i.e., between 17:30 and 9:00 CET).

84% of the traded derivatives were on indices, 3.7% on commodities, 9.7% on currency pairs, 2.4% on equities and 0.2% on cryptocurrencies, with the top three traded underlying markets being DAX 40 (28.4%), S&P 500 (21.8%), and NASDAQ 100 (14.7%).

Looking at the SERIX data for the top three underlying markets, the DAX 40 remained bearish at 97, the S&P 500 swayed from a bearish 94 to a bullish sentiment of 101, and the NASDAQ 100 shifted from a bearish 99 to a neutral 100.

Calculating SERIX data

The Spectrum European Retail Investor Index (SERIX), uses the exchange’s pan-European trading data to shed light on investor sentiment towards current development in financial markets.

The index is calculated on a monthly basis by analysing retail investor trades placed and subtracting the proportion of bearish trades from the proportion of bullish trades, to give a single figure (rebased at 100) that indicates the strength and direction of sentiment:

SERIX = (% bullish trades - % bearish trades) + 100

Trades where long instruments are bought and trades where short instruments are sold are both considered bullish trades, while trades where long instruments are sold and trades where short instruments are bought are considered bearish trades. Trades that are matched by retail clients are disregarded. (For a detailed methodology and examples, please visit this link).