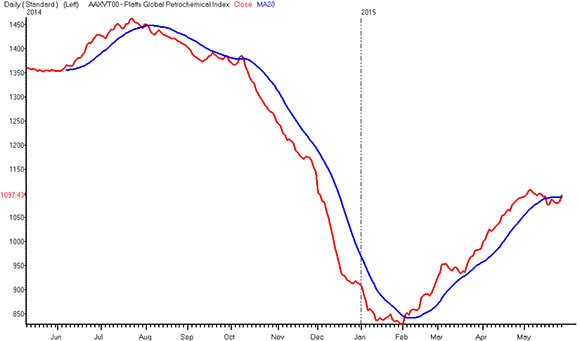

Prices in the $3-trillion-plus global petrochemicals market climbed another 4% month over month in May, for a fourth month of rebound following six consecutive months of falling prices. Petrochemical prices, expressed as a monthly average, increased $41 per metric ton (/mt) from April to $1,093/mt in May, according to the just-released monthly Platts Global Petrochemical Index (PGPI).

The PGPI is a benchmark basket of seven widely used petrochemicals and is published by Platts, a leading global provider of energy, petrochemicals, metals and agriculture information and a top source of benchmark price references.

“Global petrochemical prices continue to climb, but remain well below last year’s prices,” said Jim Foster, director of petrochemical analysis at Platts. “Since January, petrochemical prices have advanced 29%, mostly because of stronger crude oil and naphtha prices. But on a year-over-year basis, May 2015 prices are down 20%. In May 2014, the PGPI index was at $1,361/mt.”

PLATTS GLOBAL PETROCHEMICAL INDEX IN DOLLARS PER METRIC TON

The daily price reflected as a monthly average

|

May 2015 |

Monthly % Change |

Annual % Change |

May 2014 |

April 2015 |

March 2015 |

Feb 2015 |

Jan 2015 |

|

$1,093 |

4% |

-20% |

$1,361 |

$1,052 |

$954 |

$873 |

$850 |

The chart above shows the daily end-of-day Platts Global Petrochemical Index (PGPI) price in red and also displays the 20-day PGPI moving average (MA) in blue. If you have trouble viewing the graphic, visit this link: PGPI Averages.

Crude oil prices were up 8% in May from April and naphtha prices were up 6%. Olefins prices tend to track naphtha prices, given that naphtha is the most widely used cracker feedstock worldwide.

Petrochemicals are used to make plastic, rubber, nylon and other consumer products and are utilized in manufacturing, construction, pharmaceuticals, aviation, electronics and nearly every commercial industry.

OLEFINS

Prices of olefins – a group of hydrocarbon compounds which are the building blocks to many petrochemical products used to produce everyday goods – jumped 2% to 5% in May on the back of stronger naphtha prices. Ethylene prices gained 5% in May from April to $1,151/mt and propylene prices were up 2% to $936/mt.

Polyethylene and polypropylene, plastics manufactured from ethylene and propylene respectively, posted similar month-over-month price gains. Global polyethylene prices increased 7% to $1,529/mt, while polypropylene prices were up 6% to $1,444/mt.

AROMATICS

Prices of aromatics – a group of scented hydrocarbons with benzene rings used to make a variety of petrochemicals – were mixed last month. Benzene was the only component in the PGPI to post lower prices in May, falling 5% to $787/mt.

“Benzene prices were lower due to the substantial demand gap from downstream derivatives,” Foster said. “For example, at least 10% of European styrene capacity – which totals more than 6.6 million metric tons per year – is estimated to be offline in June. Phenol production, the second largest use of benzene after styrene, experienced planned and unplanned maintenance turnarounds at various plants, which had an impact on benzene demand.”

Toluene and paraxylene, the two other aromatic PGPI components, saw stronger prices in May. Toluene was up 7% to $778/mt while paraxylene increased 3% to $888/mt.

Global equity markets were higher in May. The NIKKEI 225 was up 5%. The Dow Jones Industrial Average and The London Stock Exchange Index (FTSE) both posted less than 1% gains.

The PGPI reflects a compilation of the daily price assessments of physical spot market ethylene, propylene, benzene, toluene, paraxylene, low-density polyethylene (LDPE) and polypropylene as published by Platts and is weighted by the three regions of Asia, Europe and the United States. Used as a price reference, a gauge of sector activity, and a measure of comparison for determining the profitability of selling a barrel of crude oil intact or refining it into products, the PGPI was first published by Platts in August 2007.

Published daily in a real-time news service Platts Petrochemical Alert and other Platts publications, the PGPI is anchored by Platts’ robust and long-established price assessment methodology and the firm’s 100-year history of energy price reporting.

Platts petrochemicals experts are available for media interviews. A sample list of experts may be found at the Platts Media Center. For more information on petrochemicals, visit the Platts website at www.platts.com.