Companies with bonds and certificates listed on the Oslo Børs marketplace have raised more new loan capital this year than ever before, and May was the busiest month so far in 2014.

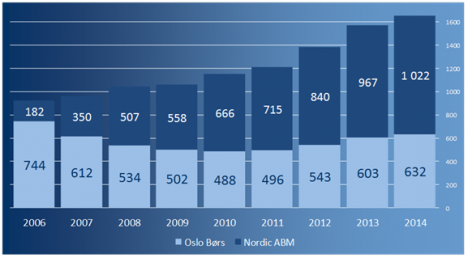

The volume of new issues so far this year is significantly higher than last year. Issuers with bonds and certificates listed on the Oslo Børs and Nordic ABM marketplaces, excluding the Norwegian government, have raised NOK 146.4 billion of loan capital through new issues and increases to existing issues. This is NOK 13.5 billion higher than at the same time last year, which was itself a record year.

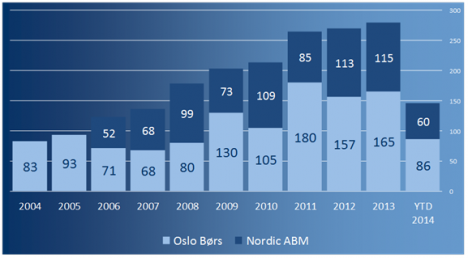

May was the busiest month so far this year. During the course of the month, issuers raised NOK 39.7 billion of loan capital and there were 60 new issues of fixed income securities. This included issues by a number of companies that are new to the Oslo Børs marketplaces: There were six new issuers on the Nordic ABM marketplace and three on the Oslo Børs marketplace (see the table below).

Never before have there been so many borrowers and so many fixed income issues on the Oslo Børs and Nordic ABM marketplaces. In total, there are now 1,654 fixed income issues listed by 192 issuers on the Nordic ABM marketplace and 140 issuers on the Oslo Børs marketplace. The total value of outstanding fixed income issues at the end of May was NOK 1,483 billion.

New issuers in May:

- Eidsberg Sparebank

- Tolga-Os Sparebank

- Brage Finans AS

- Tysnes Sparebank

- Genel Energy Finance plc

- Haltdalen Sparebank

- Curato Holding AS

- General Exploration Partners Inc (ShaMaran Petroleum)

- Northland Resources AB

Source of loan capital (new issues and increases in existing issues - excluding government issues), figures in NOK billion:

Record number of fixed income issues (bonds and certificates):