Kepler Cheuvreux welcomes new prestigious shareholders who are investing in the firm’s long-term development and who are perfectly aligned with the firm’s strategic vision. The new shareholders are Atlas Merchant Capital with 19.7% and ERES (Edmond de Rothschild Equity Strategies) with 8% of the share capital. BlackFin Capital Partners and their co-investors have disposed of their shareholding (see addendum).

Kepler Cheuvreux is an independent financial services company in Europe with a unique open architecture model which has allowed it to forge Equity Capital Markets partnerships with five of Europe’s leading banks: UniCredit, Crédit Agricole CIB, Rabobank, Swedbank and Belfius. All five banks have confirmed their trust in Kepler Cheuvreux and of course remain shareholders in their own right. They also indicated their strong support regarding Kepler Cheuvreux’s decision to welcome these two new shareholders. In the shareholding reorganization, UniCredit has raised its stake from 5.2% to 10.3%.

Management maintains operational control over the company in order to guarantee long term independence and entrepreneurial skills.

Over 20 years, Kepler Cheuvreux has developed a unique business model, becoming one of the European leaders in its sector. Thanks to the help of the new prestigious shareholders, the management will continue to develop this franchise internationally.

The strategy of the company is to continue to develop Research, Execution and Advisory services in all asset classes without using the balance sheet and never being in competition or conflict of interest with our clients and partners.

Laurent Quirin, Kepler Cheuvreux, Chairman of the Supervisory Board:“We are delighted to welcome Atlas Merchant Capital and ERES as important shareholders. BlackFin and its financial partners have been investors since 2011 and we would like to thank them sincerely for their support. We have successfully exploited synergies with BlackFin by leveraging their contacts and expertise in Continental Europe. We now look to leverage the contacts and expertise of Atlas Merchant Capital and Bob Diamond, its founding partner and CEO, on a global scale. Both Atlas and ERES will help us to invest in our organic expansion and in our targeted acquisition strategy. We believe that Mifid II and bank disintermediation create opportunities. We envisage signing more alliances with banks which are looking to outsource processes or businesses. The past ten years since our MBO have been about building an independent, management-lead, leading financial services company which we have achieved with the support of BlackFin. The next chapter, with the arrival of Atlas and ERES, is about expanding our products and services for the next decade”.

Matthew Hansen, Managing Director and Head of U.K. and European Business at Atlas:“The decision to invest in Kepler Cheuvreux was based on an analysis of their market leading positions in pan-European Research, Advisory and Execution. In Research, which is the cornerstone of their business, they have the largest research coverage in mainland Europe and are prospering in the post Mifid II research environment. The Advisory business is perfectly suited to the firm’s partnership model. In Execution, they have an algorithmic trading capability which competes head-to-head with the global brokers. We have been tremendously impressed by the entrepreneurial management and we intend to use our operational skills and financial services expertise to support them”.

The changes in shareholding are subject to regulatory approval.

ADDENDUM

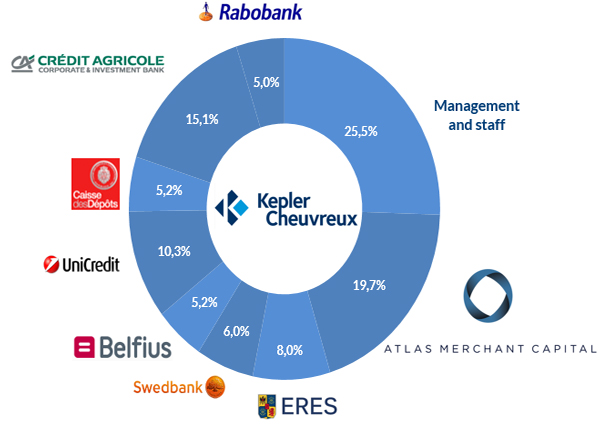

After Atlas / ERES investment in Kepler Cheuvreux

- Management and staff remain the largest shareholders with a stake of 25.5% and 40% voting rights

- Atlas Merchant Capital and ERES (Edmond de Rothschild Equity Strategies) now own 19.7% and 8% respectively of the share capital

- UniCredit has increased its stake from 5.2% to 10.3%

- La Caisse des Dépôts, the French public investment institution, remains an important shareholder with a 5.2% stake

- Atlas Merchant Capital and ERES will have four seats on a management board which comprises 15 seats and where the five ECM partnership banks are also represented

- The changes in shareholding are subject to regulatory approval

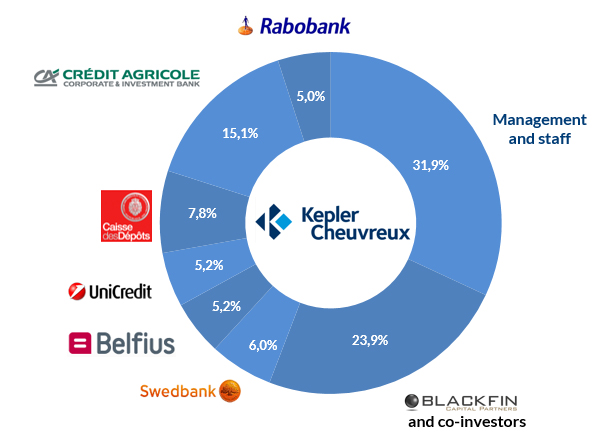

Before divestment of shareholding by BlackFin Capital Partners and co-investors