- For the Japanese stock market to attract attention from foreign investors, it is necessary to see the currency market stabilise as well as an improvement in corporate earnings

- There is no change in the fact that Japanese stocks are currently undervalued compared to other major markets

- Corporate earnings growth in Japan is therefore expected to be superior compared to other countries

- For private companies to make effective investments in public-private partnerships, it is essential to enhance the predictability of the business operating environment as a national strategy and to redesign regulations to encourage investment

- On ESG, human resource strategies linked to corporate growth strategies and human capital disclosure are also important topics

Robust business outlook

For fiscal 2023, we expect recurring profits to increase by about 6.2%. However, the exchange rate assumption is set at 140 JPY/USD for the fiscal year ending 3/2024 compared with 137 for FY3/2023, and the exchange rate will act as a negative drag on reported earnings if the yen is stronger than this assumption.

While we should bear in mind the risk of such a strong yen, comparisons of the 2023 earnings outlook across Europe, the United States and emerging markets shows that only Japan has been revised upward from its forecast at the beginning of the year.

Against the backdrop of an increase in the number of foreign visitors entering Japan after travel restrictions were eased (an increase in inbound demand) and robust capital investment, domestic demand is expected to support the Japanese economy as a whole for the next fiscal year. Corporate earnings growth in Japan is therefore expected to be superior compared to other countries.

Will there be an adjustment to Japan’s relatively cheap valuation?

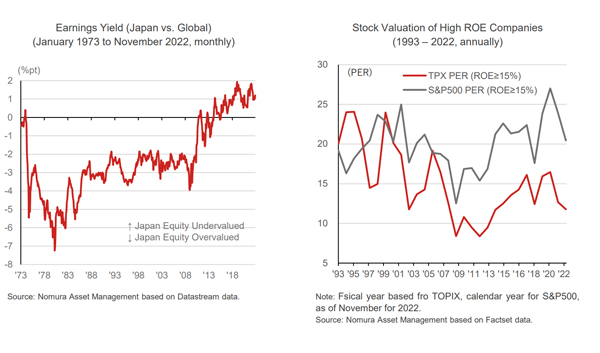

There is no change in the fact that Japanese stocks are currently undervalued compared to other major markets in Europe and the United States. The overall Japanese market continues to underperform other markets in terms of return on equity (ROE). However, even when we select and compare groups of companies with similar ROE levels (15% or higher) from among listed companies in both the Japanese and U.S. markets, the Japanese stocks have lower P/E ratios than their U.S. peers.

Japanese companies will need to achieve high growth and high ROE through active investment to raise their equity valuations from undervalued levels. The effectiveness of many of the "investments" included in the policy announcements from the Kishida administration in the name of its "new form of capitalism" will be of particular interest.

The four investment areas listed are "people," "science, technology and innovation," "start-ups," and "GX and DX” (Green Transformation and Digital Transformation). For private companies to make effective investments in public-private partnerships, it is essential to enhance the predictability of the business operating environment as a national strategy and to redesign regulations to encourage investment.

ESG outlook

In the environmental, social, and corporate governance (ESG) fields, assessment of whether a company can capture risks and opportunities in corporate management and to increase sustainable corporate value is linked to the medium-term stock valuation. Regarding climate change, in accordance with the framework of the Task Force on Climate-related Financial Disclosures (TCFD), companies have been required to disclose their efforts related to transition risks, physical risks, etc. toward the realisation of a decarbonized society.

Human resource strategies linked to corporate growth strategies and human capital disclosure are also important topics. We believe that creating an environment where people can work with a sense of satisfaction and "well-being", with increased employee engagement will lead to sustained increases in corporate value.

Institutional investors are expected to engage in constructive dialogue (engagement) in pursuit of active commitments from companies regarding natural and human capital and information disclosure. Nomura Asset Management has conducted a quantitative analysis of how our own engagement activities have affected corporate management and stock valuations.

We persevere in urging companies to make efforts to increase the value of intangible assets such as natural and human capital, which can take a while to materialise as corporate value.