- SERIX sentiment index on DAX 40 reached 93 points, its lowest point in two years

- Retail investors grow cautious after German budget crisis

- In November 108.8 million securitised derivatives were traded on Spectrum

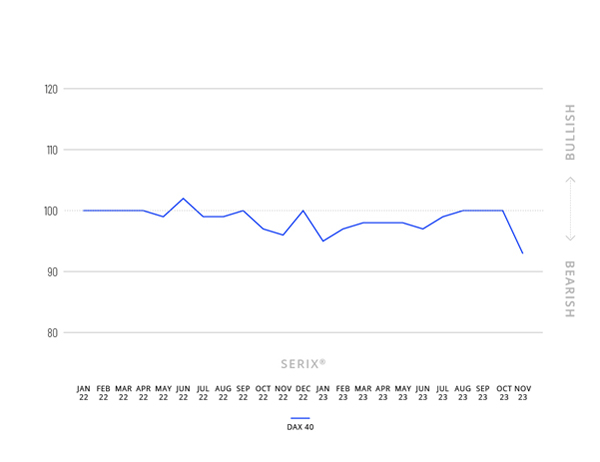

Spectrum Markets (“Spectrum”), the pan-European trading venue for securitised derivatives, has published its SERIX sentiment data for European retail investors for November, revealing a sharp decline in sentiment towards the German DAX 40 index, reaching 93 points this November, its lowest point in the past two years.

The benchmark index DAX 40 comprises the 40 largest German stocks listed on the Frankfurt Stock Exchange.

The SERIX value indicates retail investor sentiment, with a number above 100 marking bullish sentiment, and a number below 100 indicating bearish sentiment. (See below for more information on the methodology).

Market opinion

The DAX 40 index experienced significant shifts throughout the month, dropping below 15,000 points at the beginning of November, but regaining momentum toward the month’s end, returning to the 16,000 mark again.

Various factors are contributing to the downward pressure on German share prices, including declining economic expectations, corporate profit downturns, and geopolitical uncertainties due to the conflicts in the Middle East and Ukraine. Another risk is the threat of rising interest rates on corporate balance sheets, potentially deterring future investments.

“The cautious position of many retail investors may also be caused by the recent German budget crisis. Chancellor Scholz’s unsuccessful attempt to redirect 60 billion euros from pandemic funds to a climate fund, following the German court's decision, has deterred funding opportunities for companies,” explains Michael Hall, Head of Distribution at Spectrum.

Spectrum’s November data

In November 2023, 108.8 million securitised derivatives were traded on Spectrum, with 32.2% of trades taking place outside of traditional hours (i.e., between 17:30 and 9:00 CET).

82.9% of the traded derivatives were on indices, 10% on currency pairs, 3.9% on commodities, 3% on equities and 0.2% on cryptocurrencies, with the top three traded underlying markets being DAX 40 (32.4%), NASDAQ 100 (23.4%), and S&P 500 (11.2%).

Looking at the SERIX data for the top three underlying markets, all moved into bearish territory, with the DAX 40 dropping to 93, S&P 500 to 89, and NASDAQ 100 to 93.

|

Calculating SERIX data The Spectrum European Retail Investor Index (SERIX), uses the exchange’s pan-European trading data to shed light on investor sentiment towards current development in financial markets. The index is calculated on a monthly basis by analysing retail investor trades placed and subtracting the proportion of bearish trades from the proportion of bullish trades, to give a single figure (rebased at 100) that indicates the strength and direction of sentiment: SERIX = (% bullish trades - % bearish trades) + 100 Trades where long instruments are bought and trades where short instruments are sold are both considered bullish trades, while trades where long instruments are sold and trades where short instruments are bought are considered bearish trades. Trades that are matched by retail clients are disregarded. (For a detailed methodology and examples, please visit this link). |