Market briefing

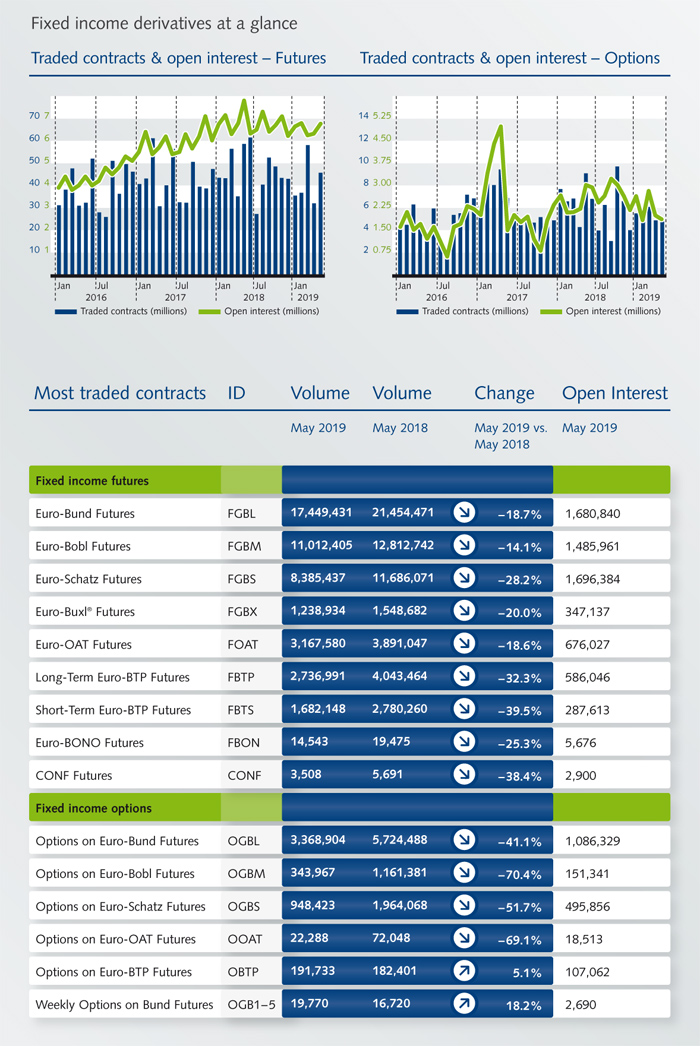

Fixed Income markets across the globe have rallied hard over the past month as trade tensions between China and the US continue to pressure yields and keep volatility low. Any spike in volatility is sold as yields grind lower. Investors continue to favor safe haven buying and there has been heavy buying of US Treasuries. Euro swaps continue to bull flatten as there has been strong interest to receive the long end of the curve from the buy side. Across futures and options, volumes have been low with the only bright spot being French OAT’s. This segment has held up well with volumes up about 5%. In the volatility space both implied and realized vol continues to be sold, with 10 day implied around 1.5%. The July Bund has edged under 3.75% as the market continues to sell calls and buy 1x2 put spreads. It’s hard to get excited about vol at these levels as the market continues to grind higher in futures which helps to keep volatility at all-time lows.

Lee Bartholomew, Head of Fixed Income Product R&D, Eurex

Facts & figures

News

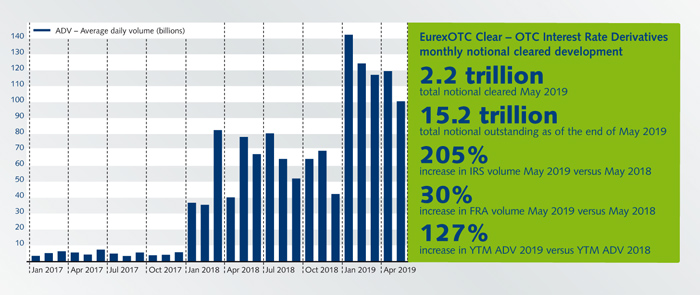

Clients have gained substantial confidence in the quality of euro clearing in Frankfurt. This is demonstrated by increasing volumes across all tenors, a market share of more than 14 percent in notional outstanding of EUR denominated OTC interest rate derivatives (IRD), and a growing demand on the buy side.

Traiana, a leading infrastructure service which provides trade life-cycle and risk management solutions, today announced that it has provided direct central clearing connectivity to Eurex.

As Eurex Clearing’s CCP service continues to establish itself, Matthias Graulich discusses the outlook for the Lending CCP in the latest issue of Securities Lending Times.

Events

Derivatives Forum Amsterdam & Paris: Register now!

Impact investing, technological advancements, regulation and geopolitical developments are rapidly changing our industry. We will touch on this paradigm shift at our Derivatives Forum 2019. Topics of discussions are changing market structures, the impact of ESG and the evolution of the European financial markets landscape. Register now to join us in Amsterdam on 13 June and in Paris on 25 June!

The updated EMIR regulation introduces the new category “Small Financial Counterparties” (e.g. UCITS/AIFs). Such counterparties should now start to calculate and document the CCP clearing thresholds. If no calculation is made, they are automatically subject to the clearing obligation.

Join this webinar to be prepared for the new clearing obligation and to be able to carry out CCP clearing of interest rate derivatives in investment funds (UCITS/AIFs).

From market structures to central clearing to ESG: the agenda of FIA’s International Derivatives Expo (IDX) 2019, which took place from 4 to 5 June at The Brewery in London, was packed with topics catching the attention of the industry.

This one-day seminar provides a brief overview of Eurex Clearing. Participants gain insights into clearing membership requirements and clearing services. In this semiar, Eurex Clearing's risk and default management process will be described. The next seminar takes place on 30 September in London.

Eurex Exchange - The home of the euro yield curve