Market briefing

March was, given the highly volatile markets, of course, bursting with hedging activity on Eurex. However, rather than discussing volumes, I’d like to focus on the performance of the Eurex market infrastructure in this briefing. [...]

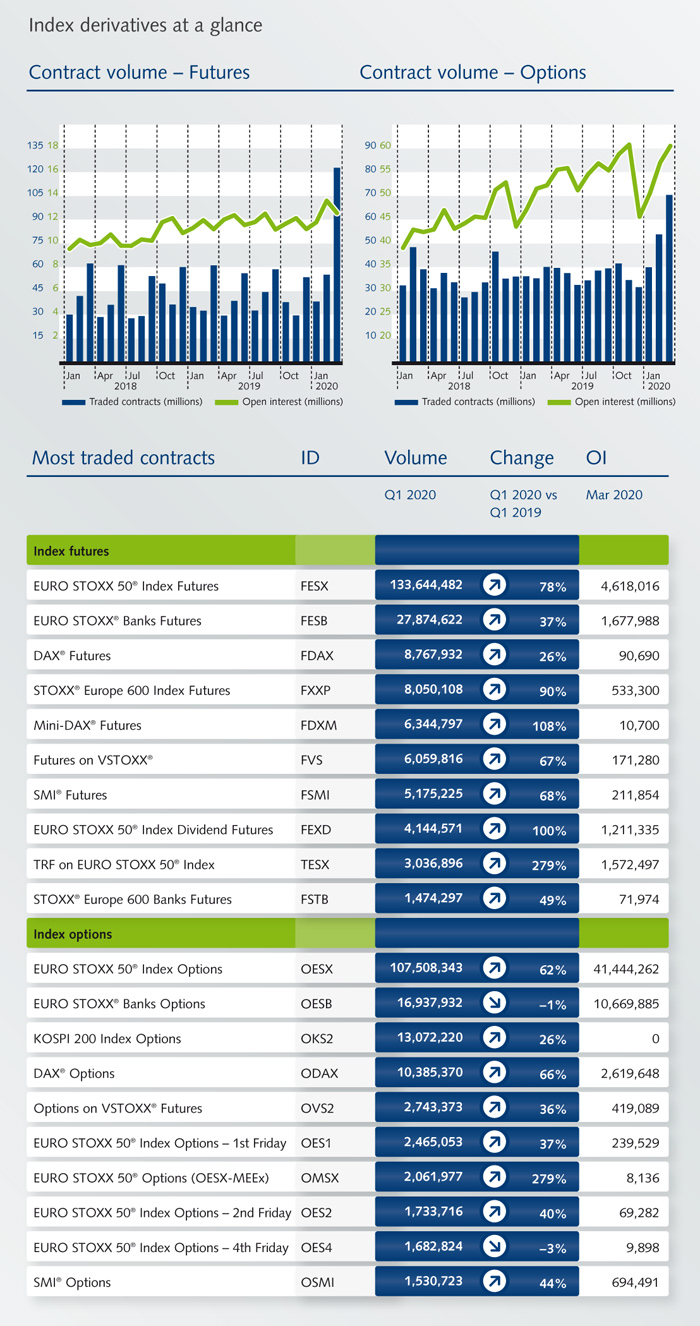

Facts & figures

News

Eurex ESG derivatives look back on a successful March roll

The March/June roll in our ESG segment has proven that investors continue the trend towards sustainable investing. Eurex's Vassilis Vergotis, explains how the current market turmoil formed a first crucial test for the longevity of the segment.

Our recently launched futures on STOXX® USA 500 ESG-X Index (FSUS) can now be traded by U.S. market participants after having received CFTC approval.

Market Continuity

The business continuity of the exchange is essential to the continuity of its members and their clients. Find out more about our policies, our opinions on how to keep markets efficient, and how we will continue to be a trusted market partner under these testing circumstances.

Joint usage of Eurex Improve by affiliated Exchange Participants

As of 14 April 2020, Eurex Improve can now also be jointly used by affiliated Exchange Participants, independent of the organizational set-up. Eurex Improve provides Trading Participants with a tool suited to guarantee their customers complete execution of orders below minimum block trade sizes at the best available price. After its successful launch in February 2020, the functionality is available for all equity and equity index options.

Sustainably successful

Since the launch of Eurex EnLight in March 2018, more than 2.3 million contracts have been traded on the RFQ platform. Eurex EnLight is a fully integrated exchange RFQ platform combining off-book liquidity with on-exchange efficiency. Learn more on how to benefit.

With the new API, we merge available product information into a single, machine-readable source. No more downloading, polling and parsing of files should be necessary. It offers information about Products, Contracts, TES configuration, Trading hours and Expirations. We provide a cutting-edge API based on GraphQL and JSON, giving clients efficiency and Eurex flexibility and a shorter time to market.

Events

The third Derivatives Forum in Frankfurt, held on 27 February in the beautiful surroundings of the "Gesellschaftshaus Palmengarten", was a huge success. It was organized by Eurex, featuring eleven renowned co-sponsors and 550 participants from more than 180 buy- and sell-side firms, regulators and associations.

Wednesday, 29 April

10:00 London | 11:00 Frankfurt | 18:00 Singapore

While portfolios are already shifting from existing benchmarks to sustainable alternatives, 71% of institutional investors stated that all their portfolios will be managed according to ESG principles by 2030. With the recent introduction of five futures on key global, regional and local MSCI Indices, Eurex further extends its ESG derivatives suite and currently offers 12 contracts. With 1.000.000 contracts traded, Eurex is the leading liquidity pool for ESG Derivatives worldwide.

In this webinar, we will discuss:

• MSCI ESG ratings – a beginners guide

• Index methodologies: Screened, Leaders, Universal – which methodology for what purpose?

• What are the use-cases for ESG derivatives?

• Stages in ESG investing – where are we and what's next

• How to integrate ESG Derivatives into Portfolio Management