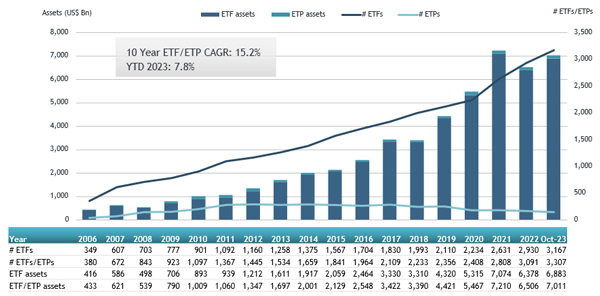

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that reports the ETFs industry in the United States gathered net inflows of US$33.25 billion in October, bringing year-to-date net inflows to US$372.55 billion. Assets have increased 7.8% YTD in 2023, going from US$6.51 trillion at end of 2022 to US$7.01 trillion. During the month, assets invested in US ETF/ETP industry decreased by 2.1%, from US$7.16 trillion, according to ETFGI's October 2023 US ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- ETFs industry in the United States gathered net inflows of $33.25 Bn in October.

- YTD net inflows of $372.55 Bn are the 4th highest, while the highest recorded YTD net inflows are of $732.74 Bn for 2021 and YTD net inflows of $502.74 Bn in 2022.

- 18th month of consecutive net inflows.

- Assets of $7.01 Tn invested in ETFs industry in the United States at the end of October.

- Assets have increased 7.8% YTD in 2023, going from $6.51 Tn at end of 2022 to $7.01 Tn.

“The S&P 500 index declined 2.10% in October but is up 10.69% YTD in 2023. The developed markets excluding the US index declined by 4.62% in October but is up 1.73% YTD in 2023. Israel (down 14.45%) and Luxembourg (down 11.41%) saw the largest decreases amongst the developed markets in October. The emerging markets index declined by 3.55% during October and is down by 0.20% YTD in 2023. Turkey (down 11.71%) and United Arab Emirates (down 8.54%) saw the largest decreases amongst emerging markets in October.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

ETFs industry in the United States asset growth as of the end of October

The ETFs industry in the United States had 3,307 products, assets of $7.01 Tn, from 299 providers listed on 3 exchanges at the end of October.

During October, ETFs gathered net inflows of $33.25 Bn. Equity ETFs gathered net inflows of $9.05 Bn during October, bringing YTD net inflows to $150.82 Bn, significantly lower than the $259.50 Bn in net inflows equity products had attracted at this point in 2022. Fixed income ETFs/ETPs had net inflows of $12.47 Bn during October, bringing net inflows for the year through October 2023 to $129.50 Bn, lower than the $147.13 Bn in net inflows fixed income products had attracted by the end of October 2022. Commodities ETFs/ETPs reported net outflows of $1.44 Bn during October, bringing YTD net outflows to $8.23 Bn, significantly lower than the $4.89 Bn in net outflows commodities products had reported year to date in 2022. Active ETFs/ETPs attracted net inflows of $15.24 Bn over the month, gathering net inflows for the year in the US of $99.70 Bn, much higher than the $76.72 Bn in net inflows active products had reported YTD in 2022.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $45.90 Bn during October. iShares Core S&P 500 ETF (IVV US) gathered $7.79 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets October 2023: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Core S&P 500 ETF |

IVV US |

338,804.70 |

26,382.91 |

7,791.29 |

|

SPDR Bloomberg Barclays 1-3 Month T-Bill ETF |

BIL US |

38,762.91 |

11,937.93 |

7,598.20 |

|

iShares 20+ Year Treasury Bond ETF |

TLT US |

39,598.70 |

19,948.25 |

3,291.75 |

|

Vanguard S&P 500 ETF |

VOO US |

318,545.70 |

32,980.18 |

3,227.63 |

|

Vanguard Intermediate-Term Treasury ETF |

VGIT US |

20,105.92 |

7,240.13 |

2,349.18 |

|

Invesco QQQ Trust |

QQQ US |

194,615.25 |

4,460.15 |

2,267.04 |

|

iShares S&P 100 ETF |

OEF US |

10,488.54 |

2,297.18 |

2,236.45 |

|

iShares 0-3 Month Treasury Bond ETF |

SGOV US |

17,467.70 |

9,997.04 |

1,827.32 |

|

iShares Short Treasury Bond ETF |

SHV US |

22,020.63 |

1,912.88 |

1,702.95 |

|

iShares MSCI Emerging Markets ex China ETF |

EMXC US |

6,761.38 |

3,867.80 |

1,656.58 |

|

Vanguard Total Stock Market ETF |

VTI US |

296,286.65 |

15,480.68 |

1,649.32 |

|

Vanguard Tax-Exempt Bond Index ETF |

VTEB US |

28,020.83 |

4,836.04 |

1,453.17 |

|

Energy Select Sector SPDR Fund |

XLE US |

38,086.85 |

(1,205.77) |

1,372.66 |

|

Vanguard Total Bond Market ETF |

BND US |

94,257.74 |

14,081.40 |

1,299.34 |

|

iShares Edge MSCI USA Quality Factor ETF |

QUAL US |

31,386.47 |

10,602.90 |

1,099.70 |

|

iShares Global Energy ETF |

IXC US |

2,898.84 |

841.02 |

1,073.01 |

|

PIMCO Enhanced Short Maturity Strategy Fund |

MINT US |

10,798.86 |

1,853.61 |

1,068.97 |

|

iShares Core MSCI EAFE ETF |

IEFA US |

93,143.01 |

3,857.80 |

1,024.97 |

|

iShares MBS ETF |

MBB US |

26,265.74 |

4,728.54 |

1,017.82 |

|

Vanguard Mortgage-Backed Securities ETF |

VMBS US |

16,494.52 |

2,969.00 |

895.45 |

The top 10 ETPs by net assets collectively gathered $808.52 Mn during October. United States Oil Fund LP (USO US) gathered $413.78 Mn, the largest individual net inflow.

Top 10 ETPs by net new assets October 2023: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

United States Oil Fund LP |

USO US |

1,759.42 |

(329.89) |

413.78 |

|

Invesco DB US Dollar Index Bullish Fund |

UUP US |

625.83 |

(1,065.79) |

89.31 |

|

ProShares Ultra DJ-UBS Crude Oil |

UCO US |

619.47 |

(389.45) |

74.56 |

|

Invesco DB Oil Fund |

DBO US |

293.24 |

(29.44) |

45.29 |

|

ProShares UltraShort DJ-UBS Natural Gas |

KOLD US |

119.64 |

(144.23) |

43.09 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

316.49 |

374.72 |

40.07 |

|

Invesco DB Energy Fund |

DBE US |

124.04 |

(24.94) |

33.98 |

|

MicroSectors Gold Miners 3X Leveraged ETN - Acc |

GDXU US |

139.81 |

80.00 |

31.98 |

|

ProShares Ultra Silver |

AGQ US |

370.62 |

21.86 |

24.01 |

|

Invesco CurrencyShares Japanese Yen Trust |

FXY US |

226.78 |

75.62 |

12.46 |

Investors have tended to invest in Active ETFs during October.