ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs industry in Europe gathered net inflows of US$6.30 billion during December, bringing year-to-date net inflows to US$88.95 billion. During the month, assets invested in the European ETF/ETP industry decreased by 1.8% from US$1.44 trillion at the end of November to US$1.42 trillion, according to ETFGI's December 2022 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- ETFs industry in Europe gathered net inflows of $6.30 Bn in December.

- 2022 net inflows of $88.95 Bn are fifth highest on record, after $193.46 Bn in 2021, $125.18 in 2019, $119.95 in 2020 and $108.17 in 2017.

- 3rd month of net inflows.

- Assets of $1.42 Tn invested in ETFs industry in Europe at end of December.

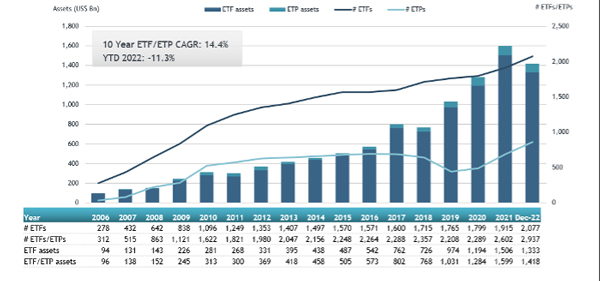

- Assets decreased 11.3% YTD in 2022, going from $1.60 Tn at end of 2021 to $1.42 Tn.

“The S&P 500 was down 5.76 % in December and was down 18.11% for 2022. Developed markets excluding the US were down 0.46% in December and were down 16.06% in 2022. Israel (down 6.05%) and US (down 17.45%) saw the largest decreases amongst the developed markets in December. Emerging markets decreased by 1.07% during December and were down 17.75% in 2022. Qatar (down 10.21%) and Peru (down 7%) saw the largest increases amongst emerging markets in December.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Europe ETFs and ETPs asset growth as at the end of December 2022

The European ETFs industry had 2,937 products, with 11,846 listings, assets of $1.42 Tn, from 95 providers listed on 29 exchanges in 25 countries at the end of December.

During December, ETFs/ETPs gathered net inflows to US$6.30 billion. Equity ETFs/ETPs gathered net inflows of

$3.88 Bn during December, bringing 2022 net inflows to $55.72 Bn, lower than the $136.19 Bn in net inflows equity products 2021. Fixed income ETFs/ETPs had net inflows of $2.96 Bn during December, bringing net inflows for 2022 to $34.14 Bn, lower than the $44.54 Bn in net inflows fixed income products had attracted in 2021. Commodities ETFs/ETPs reported net outflows of $662 Mn during December, bringing 2022 net outflows to $4.67 Bn, lower than the $3.05 Bn in net inflows commodities products had reported in 2021. Active ETFs/ETPs attracted net inflows of $245 Mn over the month, gathering net inflows for 2022 of $2.75 Bn, lower than the $5.40 Bn in net inflows active products reported in 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $8.23 Bn during December. iShares Core MSCI World UCITS ETF - Acc (IWDA LN) gathered $1.14 Bn, the largest individual net inflow.

Top 20 ETFs by net inflows in December 2022: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

IWDA LN |

44,799.43 |

6,324.92 |

1,137.23 |

|

|

iShares $ Treasury Bond 1-3yr UCITS ETF |

IBTS LN |

9,451.67 |

156.20 |

712.83 |

|

iShares € Corp Bond ESG UCITS ETF |

SUOE LN |

4,377.82 |

1,833.32 |

489.57 |

|

iShares MSCI World SRI UCITS ETF - EUR - Acc |

SUSW LN |

6,950.98 |

1,559.27 |

435.83 |

|

AMUNDI S&P 500 UCITS ETF - EUR (C) - Acc |

500 FP |

6,720.83 |

(294.00) |

411.18 |

|

iShares Global High Yield Corp Bond UCITS ETF |

HYLD LN |

2,005.16 |

(533.29) |

410.86 |

|

Invesco US Treasury Bond UCITS ETF |

TRES LN |

2,246.80 |

1,520.95 |

409.90 |

|

iShares $ TIPS UCITS ETF - Acc |

ITPS LN |

4,651.00 |

(516.19) |

406.23 |

|

Amundi US Tech 100 Equal Weight UCITS ETF DR |

WEBA GY |

365.47 |

382.76 |

378.76 |

|

iShares USD Corp Bond ESG UCITS ETF - Acc |

SUOA NA |

2,144.87 |

1,303.70 |

371.80 |

|

AXA IM Nasdaq 100 UCITS ETF - Acc |

ANAU GY |

350.90 |

378.48 |

363.41 |

|

Invesco MSCI USA UCITS ETF - Acc |

SMSUSA GY |

3,076.19 |

272.97 |

333.70 |

|

iShares USD Treasury Bond 0-1yr UCITS ETF |

IBTU LN |

11,886.94 |

370.71 |

321.38 |

|

iShares US Mortgage Backed Securities UCITS ETF |

SMBS LN |

1,658.96 |

552.97 |

307.42 |

|

SPDR S&P US Dividend Aristocrats UCITS ETF |

SPYD GY |

5,071.24 |

1,709.03 |

307.23 |

|

Xtrackers II EUR Corporate Bond UCITS ETF DR - Acc |

XBLC GY |

2,318.22 |

(348.84) |

300.24 |

|

iShares MSCI ACWI UCITS ETF - Acc |

ISAC LN |

6,129.36 |

2,602.28 |

298.00 |

|

SPDR Bloomberg Barclays Global Aggregate Bond UCITS ETF |

SYBZ GY |

2,141.78 |

494.69 |

280.77 |

|

iShares Edge MSCI USA Minimum Volatility ESG UCITS ETF - Acc |

MVEA NA |

779.51 |

(837.98) |

278.88 |

|

iShares MSCI EM SRI UCITS ETF - Acc |

SUES LN |

4,220.39 |

1,280.42 |

275.61 |

The top 10 ETPs by net new assets collectively gathered $1.64 Bn during December. WisdomTree Brent Crude Oil - Acc (BRNT LN) gathered $1.01 Bn the largest individual net inflow.

Top 10 ETPs by net inflows in December 2022: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

WisdomTree Brent Crude Oil - Acc |

BRNT LN |

1,345.43 |

915.05 |

1,009.63 |

|

Invesco Physical Gold ETC - EUR Hdg Acc |

SGLE IM |

555.04 |

482.07 |

230.23 |

|

WisdomTree Natural Gas 3x Daily Short - Acc |

3NGS LN |

91.34 |

187.34 |

90.19 |

|

Invesco Physical Gold ETC - Acc |

SGLD LN |

14,679.50 |

757.89 |

79.39 |

|

WisdomTree WTI Crude Oil - Acc |

CRUD LN |

851.69 |

(1,252.85) |

56.60 |

|

WisdomTree Copper - Acc |

COPA LN |

492.72 |

58.66 |

45.76 |

|

WisdomTree Physical Gold - EUR Daily Hedged - Acc |

GBSE GY |

379.46 |

338.63 |

43.64 |

|

WisdomTree Natural Gas 3x Daily Leveraged - Acc |

3NGL LN |

27.67 |

(9.87) |

30.08 |

|

Xtrackers IE Physical Gold ETC Securities - Acc |

XGDU LN |

3,382.51 |

1,237.68 |

29.80 |

|

Royal Mint Responsibly Source Physical Gold ETC - Acc |

RMAU LN |

791.13 |

520.33 |

26.23 |

Investors have tended to invest in Equity ETFs and ETPs during December.