ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that ETFs industry in Canada gathered net inflows of US$66 million during January. During the month, assets invested in the ETFs industry in Canada increased by 7.0%, from US$250 billion at the end of December to US$268 billion, according to ETFGI's January 2023 Canadian ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- ETFs industry in Canada gathered net inflows of $66 Mn in January.

- 7th month of consecutive net inflows.

- Assets of $268 Bn invested in ETFs industry in Canada at the end of January.

- Assets have increased 7.0 % in January, going from $250 Bn at the end of 2022, to $268 Bn.

“The S&P 500 increased by 6.28 % in January. Developed markets excluding the US increased by 8.27% in January. Italy (up 14.52%) and the Netherlands (up 14.47%) saw the largest increases amongst the developed markets in January. Emerging markets increased by 6.66% during January. Mexico (up 16.53%) and Czech Republic (up 16.46%) saw the largest increases amongst emerging markets in January.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

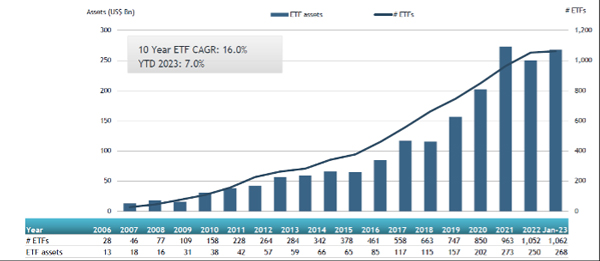

Growth in Canadian ETF assets as of the end of January 2023

The ETFs industry in Canada had 1,062 products, with 1,349 listings, assets of listed $268 Bn, from 42 providers on 2 exchanges at the end of January.

During January, ETFs listed in Canada gathered net inflows of $66 Mn. Equity ETFs suffered net outflows of $537 Mn during January, while in January 2022 they gathered $3.49 Bn in net inflows. Fixed income ETFs reported net outflows of $416 Mn during January, while in January 2002 they gathered $68 Mn in net inflows. Active ETFs attracted net inflows of $845 Mn during the month, slightly lower than the $904 Mn in net inflows in January 2022.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $2.34 Bn during January. CI High Interest Savings ETF (CSAV CN) gathered $390 Mn, the largest individual net inflow.

Top 20 ETFs by net new assets January 2023: Canada

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

CSAV CN |

4,372.58 |

389.80 |

389.80 |

|

|

TD Canadian Aggregate Bond Index ETF |

TDB CN |

731.63 |

344.78 |

344.78 |

|

BMO High Yield US Corporate Bond Index ETF |

ZJK CN |

726.38 |

176.90 |

176.90 |

|

BMO High Yield US Corporate Bond Hedged to CAD Index ETF |

ZHY CN |

682.93 |

174.45 |

174.45 |

|

High Interest Savings Account Fund |

HISA CN |

982.91 |

165.90 |

165.90 |

|

Horizons High Interest Savings ETF |

CASH CN |

1,214.41 |

131.51 |

131.51 |

|

BMO MSCI EAFE Index ETF |

ZEA CN |

4,445.16 |

120.98 |

120.98 |

|

BetaPro Natural Gas Leveraged Daily Bull ETF |

HNU CN |

104.17 |

100.48 |

100.48 |

|

NBI Unconstrained Fixed Income ETF |

NUBF CN |

1,645.28 |

85.75 |

85.75 |

|

iShares Canadian Long Term Bond Index Fund |

XLB CN |

616.25 |

85.23 |

85.23 |

|

TD Canadian Long Term Federal Bond ETF |

TCLB CN |

1,104.33 |

76.67 |

76.67 |

|

Invesco S&P 500 Equal Weighted Index ETF |

EQL CN |

496.08 |

59.25 |

59.25 |

|

Horizons Cdn Select Universe Bond ETF |

HBB CN |

2,264.24 |

59.16 |

59.16 |

|

BMO Mid-Term US IG Corporate Bond Index ETF |

ZIC CN |

2,034.77 |

57.60 |

57.60 |

|

NBI Active International Equity ETF |

NINT CN |

259.84 |

56.27 |

56.27 |

|

Vanguard All-Equity ETF Portfolio |

VEQT CN |

1,799.36 |

55.24 |

55.24 |

|

CI Alternative Investment Grade Credit Fund |

CRED CN |

84.27 |

50.93 |

50.93 |

|

Purpose US Cash ETF |

PSU/U CN |

336.07 |

50.04 |

50.04 |

|

Vanguard Growth ETF Portfolio |

VGRO CN |

2,838.63 |

48.63 |

48.63 |

|

NBI High Yield Bond ETF |

NHYB CN |

801.70 |

46.35 |

46.35 |

Investors have tended to invest in Active ETFs during January.