ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that ETFs industry in the United States gathered net inflows of US$29.14 billion during April, bringing year-to-date net inflows to US$110.30 billion. During the month, assets invested in ETFs industry in the United States increased by 1.1%, from US$6.90 trillion at the end of March to US$6.98 trillion in April 2023, according to ETFGI's April 2023 US ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- ETFs industry in the United States gathered net inflows of $29.14 Bn in April.

- YTD net inflows of $110.30 Bn are the fifth highest, while the highest recorded YTD net inflows is $329.01 Bn for 2021 and YTD net inflows of $190.16 Bn in 2022.

- 12th month of consecutive net inflows.

- $6.98 Tn invested in ETFs industry in the United States at the end of April.

“The S&P 500 was up 1.56 % in April and is up by 9.17% in the first 4 months of 2023. Developed markets excluding the US increased by 2.45% in April and are up 10.41% YTD in 2023. Switzerland (up 6.41%) and United Kingdom (up 5.28%) saw the largest increases amongst the developed markets in April. Emerging markets decreased by 0.50% during April but are up 2.38% YTD in 2023. Turkey (down 4.79%) and Thailand (down 4.69%) saw the largest decreases amongst emerging markets in April.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

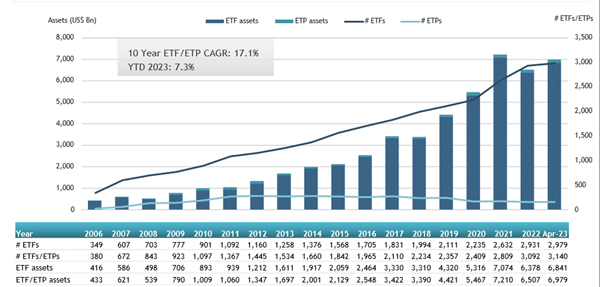

Growth in US ETF and ETP assets as of the end of April 2023

The ETFs industry in the United States had 3,140 products, with assets of $6.979 trillion, from 279 providers listed on 3 exchanges at the end of April.

During April, ETFs gathered net inflows of $29.14 Bn. Equity ETFs/ETPs gathered net inflows of $8.83 Bn over April, bringing YTD net inflows to $11.93 Bn, significantly lower than the $103.33 Bn YTD net inflows in 2022. Fixed income ETFs had net inflows of $12.26 Bn during April, bringing YTD net inflows to $60.82 Bn, higher than the $25.33 Bn YTD net inflows in 2022. Commodities ETFs/ETPs reported net inflows of $490 Mn during April, bringing YTD net inflows to $1.21 Bn, significantly lower than the $14.91 Bn YTD net inflows in 2022. Active ETFs reported net inflows of $6.10 Bn during the month, gathering YTD net inflows of $32.51 Bn, slightly lower than the $33.35 Bn in YTD net inflows in 2022.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $26.38 Bn during April. Vanguard S&P 500 ETF (VOO US) gathered $2.89 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets April 2023: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Vanguard S&P 500 ETF |

VOO US |

292,956.27 |

7,558.47 |

2,886.56 |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

HYG US |

15,342.83 |

(951.33) |

2,475.33 |

|

Xtrackers MSCI USA Climate Action Equity ETF |

USCA US |

2,072.32 |

2,041.06 |

2,041.06 |

|

Financial Select Sector SPDR Fund |

XLF US |

32,387.81 |

2,095.56 |

1,896.90 |

|

SPDR Bloomberg Barclays High Yield Bond ETF |

JNK US |

9,147.41 |

(364.55) |

1,843.26 |

|

iShares 20+ Year Treasury Bond ETF |

TLT US |

36,204.08 |

7,239.66 |

1,571.98 |

|

JPMorgan Equity Premium Income ETF |

JEPI US |

25,360.85 |

7,466.82 |

1,560.06 |

|

Vanguard Total Bond Market ETF |

BND US |

92,563.71 |

5,094.31 |

1,484.72 |

|

iShares Core S&P 500 ETF |

IVV US |

311,839.64 |

(2,604.20) |

1,399.13 |

|

iShares Edge MSCI USA Quality Factor ETF |

QUAL US |

28,545.19 |

8,645.46 |

1,383.93 |

|

Consumer Staples Select Sector SPDR Fund |

XLP US |

18,737.32 |

747.64 |

1,102.29 |

|

SPDR Portfolio S&P 500 ETF |

SPLG US |

16,937.98 |

907.28 |

901.77 |

|

Communication Services Select Sector SPDR Fund |

XLC US |

11,254.74 |

1,345.85 |

891.10 |

|

iShares Core U.S. Aggregate Bond ETF |

AGG US |

89,165.56 |

4,048.24 |

796.59 |

|

Vanguard Total International Bond ETF |

BNDX US |

49,119.92 |

3,126.08 |

758.43 |

|

Invesco QQQ Trust |

QQQ US |

173,936.00 |

(1,519.22) |

712.25 |

|

Vanguard FTSE Europe ETF |

VGK US |

19,337.71 |

1,962.90 |

685.50 |

|

Vanguard Total Stock Market ETF |

VTI US |

285,457.45 |

3,580.17 |

684.68 |

|

ProShares UltraPro Short QQQ |

SQQQ US |

5,657.43 |

4,125.24 |

679.17 |

|

Invesco Russell 1000 Dynamic Multifactor ETF |

OMFL US |

3,500.81 |

1,041.26 |

626.58 |

The top 10 ETPs by net assets collectively gathered $1.50 Bn during April. iShares Gold Trust (IAU US) gathered $574.35 Mn, the largest individual net inflow.

Top 10 ETPs by net new assets April 2023: US

|

Name |

Ticker |

Assets |

NNA |

NNA Apr-23 |

|

iShares Gold Trust |

IAU US |

28,879.66 |

346.90 |

574.35 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

621.01 |

326.82 |

253.28 |

|

SPDR Gold MiniShares Trust |

GLDM US |

6,261.90 |

605.72 |

166.46 |

|

abrdn Physical Gold Shares ETF |

SGOL US |

2,761.66 |

95.76 |

91.68 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

VXX US |

352.53 |

130.19 |

86.80 |

|

ProShares VIX Short-Term Futures ETF |

VIXY US |

254.72 |

74.63 |

74.45 |

|

iShares Silver Trust |

SLV US |

11,592.11 |

68.11 |

72.20 |

|

ProShares Ultra DJ-UBS Natural Gas |

BOIL US |

1,130.06 |

1,744.52 |

60.36 |

|

ProShares UltraShort DJ-UBS Crude Oil |

SCO US |

186.59 |

(81.25) |

58.47 |

|

MicroSectors FANG+ Index -3X Inverse Leveraged ETNs due January 8, 2038 |

FNGD US |

169.99 |

147.63 |

57.99 |

Investors have tended to invest in Fixed Income ETFs/ETPs during April.