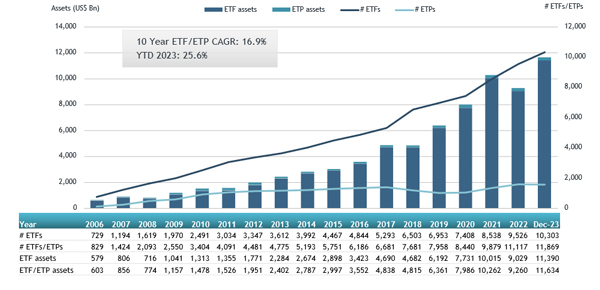

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reports that assets invested in the Global ETFs industry reached a new milestone of US$11.63 trillion at the end of 2023. The global ETFs industry gathered US$171.76 billion in net inflows in December, bringing 2023 net inflows to US$974.87 billion. Assets invested in the global ETFs industry increased by 25.6% in 2023, going from US$9.26 trillion at end of 2022 to US$11.63 trillion, according to ETFGI's December 2023 global ETFs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted)

Highlights

- Assets invested in the Global ETFs industry reached a new milestone of $11.63 trillion at the end of 2023 beating the previous record of $10.99 trillion at the end of November 2023.

- Assets increased 25.6% in 2023, going from $9.26 Tn at end of 2022 to $11.63 Tn.

- Global ETFs industry gathered net inflows of $171.76 Bn during December.

- Net inflows of $974.87 Bn gathered in 2023 are the second highest on record, behind the 2021 net inflows is of $1.29 Tn.

- 55th month of consecutive net inflows.

“The S&P 500 increased by 4.54% in December and was up 26.29% in 2023. The developed markets index excluding the US increased by 5.81% in December and were up 18.14% in 2023. Sweden (up 12.29%) and Australia (up 10.47%) saw the largest increases amongst the developed markets in December. The emerging markets index increased by 3.63% during December and was up 10.87% in 2023. Peru (up 24.95%) and Columbia (up 12.44%) saw the largest increases amongst emerging markets in December.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Global ETFs industry asset growth as of the end of 2023

The Global ETFs industry had 11,869 products, with 23,848 listings, assets of $11.63 Tn, from 731 providers listed on 81 exchanges in 63 countries at the end of 2023.

During December, ETFs gathered net inflows of $171.76 Bn. Equity ETFs saw net inflows of $135.05 Bn during December, bringing 2023 net inflows to $532.41 Bn, higher than the $479.74 Bn in net inflows in 2022. Fixed income ETFs reported net inflows of $21.69 Bn during December, bringing 2023 net inflows to $271.67 Bn, higher than the $236.55 Bn in net inflows in 2022. Commodities ETFs/ETPs reported net outflows of $1.45 Bn during December, bringing 2023 net outflows to $15.55 Bn, slightly less than the $16.41 Bn in net outflows commodities products had in 2022. Active ETFs attracted net inflows of $16.42 Bn during the month, gathering net inflows of $183.36 Bn in 2023, higher than the $123.67 Bn in net inflows in 2022.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $88.04 Bn during December. SPDR S&P 500 ETF Trust (SPY US) gathered $39.41 Bn, the largest individual net inflow.

Top 20 ETFs by net new inflows December 2023: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

SPDR S&P 500 ETF Trust |

|

SPY US |

493,365.06 |

50,667.09 |

39,414.12 |

|

iShares Russell 2000 ETF |

|

IWM US |

67,849.71 |

7,689.49 |

7,627.33 |

|

iShares Core S&P 500 ETF |

|

IVV US |

396,877.86 |

38,101.02 |

5,402.31 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

|

VCIT US |

45,004.60 |

3,597.45 |

4,727.69 |

|

Invesco S&P 500 Equal Weight ETF |

|

RSP US |

49,814.65 |

12,867.80 |

4,319.84 |

|

iShares Core U.S. Aggregate Bond ETF |

|

AGG US |

101,452.25 |

16,711.95 |

2,813.49 |

|

Vanguard S&P 500 ETF |

|

VOO US |

372,417.45 |

42,199.62 |

2,676.66 |

|

Huatai-Pinebridge CSI 300 ETF |

|

510300 CH |

18,519.45 |

9227.34 |

2,582.46 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

345,971.71 |

21,318.66 |

2,192.60 |

|

iShares 20+ Year Treasury Bond ETF |

|

TLT US |

51,626.56 |

24,506.38 |

1,996.99 |

|

Vanguard FTSE Developed Markets ETF |

|

VEA US |

122,707.43 |

7,834.39 |

1,741.81 |

|

China AMC China 50 ETF |

|

510050 CH |

11,343.96 |

4042.67 |

1,608.79 |

|

Vanguard Total Bond Market ETF |

|

BND US |

104,684.93 |

17,370.31 |

1,548.88 |

|

iShares Core MSCI Emerging Markets ETF |

|

IEMG US |

74,723.18 |

6,226.00 |

1,527.21 |

|

SPDR Portfolio S&P 500 ETF |

|

SPLG US |

25,751.39 |

6,890.27 |

1,526.62 |

|

E Fund CSI 300 ETF |

|

510310 CH |

6,709.55 |

4809.46 |

1,372.25 |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

|

HYG US |

18,797.34 |

1,954.17 |

1,261.02 |

|

iShares Core MSCI EAFE ETF |

|

IEFA US |

106,690.50 |

5,117.02 |

1,259.23 |

|

Vanguard Total International Bond ETF |

|

BNDX US |

54,094.57 |

7,666.09 |

1,224.65 |

|

iShares Core S&P 500 UCITS ETF - Acc |

|

CSSPX SW |

71,742.79 |

4,556.43 |

1,214.78 |

The top 10 ETPs by net new assets collectively gathered $1.72 Bn over December.

Invesco Physical Gold ETC - GBP Hdg Acc (SGLS LN) gathered $423.60 Mn, the largest individual net inflow.

Top 10 ETPs by net new inflows December 2023: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

|

SGLS LN |

1,172.65 |

1,031.35 |

423.60 |

|

|

Xtrackers IE Physical Gold ETC Securities - Acc |

|

XGDU LN |

3,165.40 |

(608.29) |

240.98 |

|

SPDR Gold Shares |

|

GLD US |

58,274.10 |

(1,967.78) |

194.20 |

|

Xtrackers Physical Gold ETC (EUR) - Acc |

|

XAD5 GY |

1,962.46 |

(418.61) |

192.04 |

|

iShares Gold Trust |

|

IAU US |

26,425.26 |

(2,966.43) |

162.96 |

|

SPDR Gold MiniShares Trust |

|

GLDM US |

6,362.49 |

482.85 |

159.07 |

|

United States Oil Fund LP |

|

USO US |

1,473.78 |

(437.91) |

124.95 |

|

United States Natural Gas Fund LP |

|

UNG US |

973.87 |

1,210.73 |

80.08 |

|

Perth Mint Gold - Acc |

|

PMGOLD AU |

581.83 |

75.96 |

73.88 |

|

iShares Silver Trust |

|

SLV US |

10,400.33 |

(671.99) |

71.29 |

Investors have tended to invest in Equity ETFs/ETPs during December.