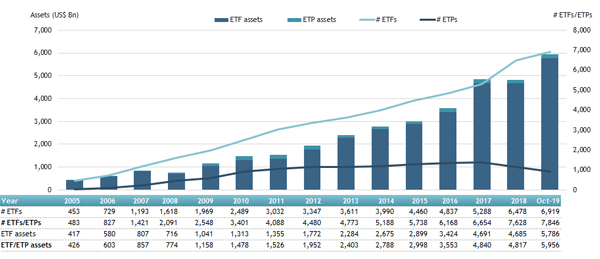

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs and ETPs listed Globally gathered net inflows of US$50.82 billion in October, bringing year-to-date net inflows to US$401.19 billion which is significantly more than the US$379.12 billion gathered at this point in 2018. Assets invested in the Global ETFs/ETPs industry have increased by 3.0%, from US$5.78 trillion at the end of September, to US$5.96 trillion at the end of October, according to ETFGI's October 2019 Global ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the Global ETF/ETP industry hit a new record of $5.96 trillion at the end of October.

- Assets invested in the Global ETF/ETP industry increased by 3.0% in October.

- In October 2019, ETFs/ETPs listed Globally gathered $50.82 billion in net inflows.

- $401.19 billion in year-to-date net inflows are significantly more than the $379.12 billion gathered in 2018.

Global ETF and ETP assets as of the end of October 2019

“The Fed rate cut and the looming hope for an agreement between US-China shaped a favourable investment environment in equity markets globally which led the S&P 500® to gain 3.2% during October. International markets also gained, with the S&P Developed Ex-U.S. and the S&P Emerging BMI both up 4%. The better performance of the Equity Markets reflected into a new record high of $5.96 trillion and higher inflows of ETFs/ETPs exposed to Equity Indices rather than Fixed Income.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

At the end of October 2019, the Global ETF/ETP industry had 7,846 ETFs/ETPs, with 15,752 listings from 428 providers on 69 exchanges in 58 countries.

In October 2019, ETFs/ETPs gathered net inflows of $50.82 billion. Fixed income ETFs/ETPs listed Globally attracted net inflows of $19.72 billion in October, bringing net inflows for 2019 to $191.02 billion, considerably greater than the $72.03 billion in net inflows fixed income products had attracted by the end of October 2018. Equity ETFs/ETPs listed Globally gathered net inflows of $22.87 billion in October, bringing net inflows for 2019 to $158.26 billion, substantially less than the $269.29 billion in net inflows equity products had attracted by the end of October 2018. Commodity ETFs/ETPs gathered $343 million in net inflows bringing net inflows to $2.71 billion for 2019, which is greater than the $94 million in net outflows suffered through October 2018.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $23.11 billion in October, the Vanguard Total Stock Market ETF (VTI US) gathered $2.53 billion alone.

Top 20 ETFs by net new inflows October 2019: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

Vanguard Total Stock Market ETF |

|

VTI US |

126,893.37 |

12,659.24 |

2,532.28 |

|

TOPIX Exchange Traded Fund |

|

1306 JP |

98,034.56 |

16,128.95 |

2,515.47 |

|

iShares MSCI USA Minimum Volatility ETF |

|

USMV US |

36,591.52 |

12,701.27 |

1,509.48 |

|

iShares Edge MSCI USA Quality Factor ETF |

|

QUAL US |

13,475.16 |

4,758.23 |

1,445.19 |

|

iShares US Treasury Bond ETF |

|

GOVT US |

15,221.38 |

7,674.81 |

1,354.52 |

|

UBS ETF (LU) MSCI United Kingdom UCITS ETF (GBP) A-acc |

|

UKGBPB SW |

1,798.39 |

1,017.17 |

1,271.62 |

|

Vanguard Total Bond Market ETF |

|

BND US |

46,385.98 |

7,691.78 |

1,196.09 |

|

Financial Select Sector SPDR Fund |

|

XLF US |

24,270.58 |

(2,818.38) |

1,160.47 |

|

Vanguard Total International Bond ETF |

|

BNDX US |

23,377.24 |

9,530.43 |

1,072.02 |

|

iShares MSCI Japan ETF |

|

EWJ US |

12,898.20 |

(4,070.55) |

1,013.97 |

|

Vanguard Value ETF |

|

VTV US |

52,020.56 |

3,515.90 |

1,006.21 |

|

Daiwa ETF TOPIX |

|

1305 JP |

45,856.63 |

6,626.02 |

899.66 |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

|

HYG US |

19,059.19 |

4,886.09 |

896.97 |

|

Vanguard FTSE 250 UCITS ETF |

|

VMID LN |

2,191.10 |

1,146.66 |

806.71 |

|

China Universal CSI Yangtze River Delta Integrated Development Theme ETF |

|

512650 CH |

794.26 |

794.46 |

794.46 |

|

iShares MBS ETF |

|

MBB US |

19,602.30 |

6,721.63 |

788.60 |

|

iShares Core MSCI Japan IMI UCITS ETF |

|

IJPA LN |

4,696.21 |

983.51 |

783.15 |

|

iShares Gold Trust |

|

IAU US |

17,338.09 |

3,652.68 |

701.57 |

|

Vanguard Dividend Appreciation ETF |

|

VIG US |

39,596.94 |

3,622.52 |

689.03 |

|

ChinaAMC CSI 5G Communications Theme ETF |

|

515050 CH |

668.93 |

670.56 |

670.56 |

The top 10 ETPs by net new assets collectively gathered $2.44 billion in October. The iShares Gold Trust (IAU US) gathered $702 million alone.

Top 10 ETPs by net new inflows October 2019: Global

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Gold Trust |

IAU US |

17,338.09 |

3,652.68 |

701.57 |

|

VelocityShares Daily 2x VIX Short Term ETN |

TVIX US |

1,061.99 |

1,798.46 |

343.75 |

|

WisdomTree Physical Gold |

PHAU LN |

7,933.00 |

121.69 |

327.37 |

|

VelocityShares Daily 3x Long Natural Gas ETN |

UGAZ US |

981.48 |

844.95 |

305.53 |

|

Invesco Gold ETC |

SGLD LN |

7,422.05 |

1,449.74 |

190.86 |

|

iShares Physical Gold ETC |

SGLN LN |

6,908.43 |

1,687.44 |

139.30 |

|

WisdomTree Precious Metals - EUR Daily Hedged |

00XQ GY |

122.55 |

119.88 |

119.89 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

577.22 |

843.26 |

115.82 |

|

Xetra Gold EUR |

4GLD GY |

9,687.29 |

769.71 |

101.02 |

|

WisdomTree WTI Crude Oil |

CRUD LN |

530.62 |

(49.74) |

94.31 |

Investors have tended to invest in Equities and Fixed Income ETFs during October.