ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, reports record Q1 net inflows of US$463.51 billion into the global ETFs, according to ETFGI's March 2025 Global ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted)

Highlights

- Record Q1net inflows of $463.51 Bn, while the second highest Q1 net inflows were $397.51 Bn in 2024 and the third highest Q1 net inflows were of $360.72 Bn in 2021.

- Net inflows of $158.81 Bn during March.

- 70th month of consecutive net inflows.

- Assets of $15.19 Tn invested in the ETFs industry globally at the end of March, below the record high assets of $15.50 Tn at the end of February 2025.

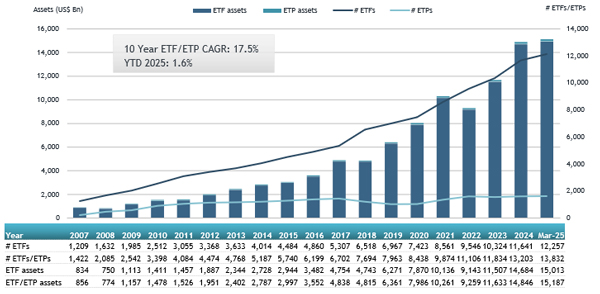

- Assets increased 1.6% YTD in 2025, going from $14.85 Tn at end of 2024 to $15.19 Tn.

“The S&P 500 index decreased by 5.63% in March and us down by 4.27% YTD in 2025. The developed markets excluding the US index decreased by 0.36% in March and is up 5.70% YTD in 2025. Denmark (down 11.58%) and United States (down 6.34%) saw the largest decreases amongst the developed markets in March. The emerging markets index increased by 0.65% during March and is up 0.91% YTD in 2025. Czech Republic (up 14.00%) and Greece (up 13.13%) saw the largest increases amongst emerging markets in March,” according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Growth in assets in the Global ETFs industry as of the end of March

The Global ETFs industry has 13,832 products, with 27,411 listings, assets of $15.19 Tn, from 852 providers on 81 exchanges in 63 countries at the end of Q1.

During March, ETFs gathered net inflows of $158.81 Bn. Equity ETFs gathered net inflows of $86.29 Bn, bringing Q1 net inflows to $211.58 Bn, lower than the $234.73 Bn in net inflows equity products had attracted in Q1 2024. Fixed income ETFs reported net inflows of $15.70 Bn during March, bringing Q1 net inflows to $81.26 Bn, higher than the $62.75 Bn in net inflows in Q1 2024. Commodities ETFs reported net inflows of $9.44 Bn during March, bringing Q1 net inflows to $21.91 Bn, much higher than the $6.26 Bn in net outflows in Q1 2024. Active ETFs attracted net inflows of $41.52 Bn during the month, gathering Q1 net inflows for the year of $145.26 Bn, much higher than the $71.82 Bn in net inflows in Q1 2024.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $73.27 Bn during March. iShares Core S&P 500 ETF (IVV US) gathered $23.63 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets March 2025: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

iShares Core S&P 500 ETF |

|

IVV US |

575,114.18 |

23,053.24 |

23,632.05 |

|

Vanguard S&P 500 ETF |

|

VOO US |

590,466.10 |

34,102.62 |

6,447.90 |

|

iShares 0-3 Month Treasury Bond ETF |

|

SGOV US |

39,394.49 |

9,517.15 |

3,867.75 |

|

SPDR Portfolio S&P 500 ETF |

|

SPLG US |

58,665.66 |

7,884.33 |

3,556.42 |

|

SPDR Bloomberg Barclays 1-3 Month T-Bill ETF |

|

BIL US |

41,045.87 |

4,795.50 |

3,159.34 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

438,402.31 |

9,269.61 |

3,014.32 |

|

SPDR Gold Shares |

|

GLD US |

91,821.81 |

5,964.40 |

2,856.87 |

|

ProShares UltraPro QQQ |

|

TQQQ US |

19,600.17 |

1,314.91 |

2,801.69 |

|

Vanguard Growth ETF |

|

VUG US |

144,666.92 |

3,894.34 |

2,775.93 |

|

Vanguard FTSE Europe ETF |

|

VGK US |

21,711.61 |

3,549.97 |

2,424.67 |

|

Direxion Daily Semiconductors Bull 3x Shares |

|

SOXL US |

7,439.53 |

1,406.54 |

2,422.70 |

|

iShares Russell 1000 Growth ETF |

|

IWF US |

96,338.56 |

483.57 |

2,366.56 |

|

Vanguard Total International Stock Index Fund ETF |

|

VXUS US |

82,848.77 |

3,970.95 |

2,290.79 |

|

Schwab US Dividend Equity ETF |

|

SCHD US |

70,929.50 |

3,845.59 |

2,080.89 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

|

VCIT US |

51,493.10 |

1,909.31 |

1,840.17 |

|

iShares 7-10 Year Treasury Bond ETF |

|

IEF US |

34,957.72 |

2,524.19 |

1,742.15 |

|

NEXT FUNDS TOPIX Exchange Traded Fund |

|

1306 JP |

153,914.17 |

1,685.11 |

1,616.87 |

|

iShares Russell 2000 ETF |

|

IWM US |

63,336.14 |

(1,775.92) |

1,472.46 |

|

Direxion Daily TSLA Bull 2X Shares |

|

TSLL US |

4,158.56 |

3,441.33 |

1,471.97 |

|

iShares Core S&P 500 UCITS ETF |

|

CSSPX SW |

108,923.61 |

3,760.55 |

1,425.83 |

The top 10 ETPs by net new assets collectively gathered $1.88 Bn over March. iShares Physical Gold ETC (SGLN LN) gathered $474.09 Mn, the largest individual net inflow.

Top 10 ETPs by net new assets March 2025: Global

|

Name |

|

Ticker |

Asset |

NNA |

NNA |

|

|

SGLN LN |

21,565.57 |

1,506.07 |

474.09 |

|

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

|

GOLD FP |

7,093.31 |

504.78 |

330.94 |

|

Japan Physical Gold ETF |

|

1540 JP |

4,430.63 |

416.69 |

219.78 |

|

MicroSectors FANG+ 3X Leveraged ETN |

|

FNGB US |

152.81 |

197.18 |

186.27 |

|

WisdomTree Core Physical Gold |

|

WGLD LN |

1,703.04 |

306.64 |

153.83 |

|

WisdomTree Industrial Metals |

|

AIGI LN |

643.90 |

115.36 |

142.57 |

|

Royal Mint Responsibly Source Physical Gold ETC |

|

RMAU LN |

1,327.46 |

134.53 |

96.41 |

|

Global X Physical Gold |

|

GOLD AU |

2,575.02 |

187.94 |

95.78 |

|

Inverse VIX Short-Term Futures ETNs due March 22 2045 |

|

VYLD US |

90.02 |

90.02 |

90.02 |

|

Leverage Shares 3x Tesla ETP |

|

TSL3 LN |

169.15 |

132.49 |

85.71 |

Investors have tended to invest in Equity ETFs during March.