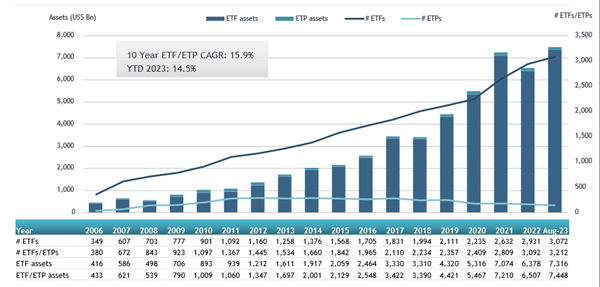

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that the ETFs industry in the United States gathered US$15.37 billion in net inflows during August, bringing year-to-date net inflows to US$300.04 billion. Assets have increased 14.5% year-to-date in 2023, going from $6.51 trillion at end of 2022 to $7.45 trillion, according to ETFGI's August 2023 US ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- ETFs industry in the United States gathered net inflows of $15.37 Bn in August.

- YTD net inflows of $300.04 Bn are the third highest on record, while the highest recorded YTD net inflows are of $594.41 Bn for 2021 and YTD net inflows of $386.21 Bn in 2022.

- 16th month of consecutive net inflows.\

- Assets of $7.45 Tn invested in the ETFs industry in the United States in August.

- Assets increased 14.5% YTD in 2023, going from $6.51 Tn at end of 2022 to $7.45 Tn.

“The S&P 500 decreased by 1.59% in August but is up by 18.73% YTD in 2023. Developed markets excluding the US decreased by 3.92% in August but are up 10.58% YTD in 2023. Netherlands (down 9.59%) and Hong Kong (down 9.13%) saw the largest decreases amongst the developed markets in August. Emerging markets decreased by 5.08% during August but are up 5.44% YTD in 2023. Colombia (down 12.70%) and Pakistan (down 11.09%) saw the largest decreases amongst emerging markets in August.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

ETFs industry in the United States growth in assets as of end of August

At the end of August, the ETFs industry in the United States had 3,212 products, assets of $7.45 Tn, from 295 providers listed on 3 exchanges.

During August, the ETFs industry in the United States gathered net inflows of $15.37 Bn. Equity ETFs gathered net inflows of $1.64 Bn during August, bringing YTD net inflows to $120.77 Bn, significantly lower than the $189.99 Bn YTD in 2022. Fixed income ETFs reported net inflows of $7.65 Bn during August, bringing YTD net inflows to $109.94 Bn, higher than the $106.48 Bn in net inflows YTD in 2022. Commodities ETFs/ETPs reported net outflows of $3.21 Bn during August, bringing YTD net outflows to $4.82 Bn, significantly lower than the $1.29 Bn in net inflows YTD in 2022. Active ETFs attracted net inflows of $9.87 Bn during the month, gathering YTD net inflows of $72.63 Bn, much higher than the $64.33 Bn in net inflows YTD in 2022.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $23.03 Bn during August. Vanguard S&P 500 ETF (VOO US) gathered $4.32 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets August 2023: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Vanguard S&P 500 ETF |

VOO US |

337,505.63 |

29,213.28 |

4,324.92 |

|

iShares Core S&P 500 ETF |

IVV US |

350,203.71 |

12,563.18 |

2,232.49 |

|

iShares 0-3 Month Treasury Bond ETF |

SGOV US |

14,036.91 |

6,582.88 |

1,992.57 |

|

SPDR Bloomberg Barclays 1-3 Month T-Bill ETF |

BIL US |

29,418.00 |

2,612.83 |

1,927.81 |

|

Vanguard Intermediate-Term Treasury ETF |

VGIT US |

16,946.85 |

3,553.84 |

1,261.54 |

|

Vanguard Total Stock Market ETF |

VTI US |

316,839.60 |

11,804.89 |

1,189.04 |

|

iShares Edge MSCI USA Quality Factor ETF |

QUAL US |

32,480.18 |

9,463.15 |

953.07 |

|

iShares Core S&P Mid-Cap ETF |

IJH US |

74,562.82 |

5,328.65 |

943.37 |

|

WisdomTree Floating Rate Treasury Fund |

USFR US |

18,056.02 |

4,944.71 |

898.54 |

|

Invesco BuyBack Achievers ETF |

PKW US |

1,819.94 |

198.86 |

815.42 |

|

Vanguard Total Bond Market ETF |

BND US |

95,232.53 |

10,726.01 |

806.96 |

|

Vanguard Total International Stock Index Fund ETF |

VXUS US |

58,033.53 |

4,392.60 |

760.55 |

|

iShares National Muni Bond ETF |

MUB US |

33,094.77 |

1,235.59 |

743.84 |

|

iShares Treasury Floating Rate Bond ETF |

TFLO US |

10,201.69 |

5,811.91 |

657.67 |

|

PGIM Ultra Short Bond ETF |

PULS US |

5,275.21 |

1,381.18 |

617.90 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

VCIT US |

40,309.44 |

291.01 |

616.89 |

|

SPDR Portfolio High Yield Bond ETF |

SPHY US |

1,970.16 |

1,109.89 |

611.73 |

|

Pacer US Cash Cows 100 ETF |

COWZ US |

14,854.81 |

3,386.74 |

587.59 |

|

Goldman Sachs TreasuryAccess 0-1 Year ETF |

GBIL US |

6,012.35 |

825.92 |

556.44 |

|

Vanguard Information Technology ETF |

VGT US |

55,987.79 |

5,551.83 |

533.38 |

The top 10 ETPs by net assets collectively gathered $267 Mn during August. iPath Bloomberg Commodity Index Total Return ETN (DJP US) gathered $48.51 Mn, the largest individual net inflow.

Top 10 ETPs by net new assets August 2023: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iPath Bloomberg Commodity Index Total Return ETN |

DJP US |

643.55 |

(108.16) |

48.51 |

|

Invesco CurrencyShares Swiss Franc Trust |

FXF US |

201.47 |

(23.45) |

40.48 |

|

Teucrium Wheat Fund |

WEAT US |

204.13 |

23.44 |

33.32 |

|

MicroSectors Gold Miners 3X Leveraged ETN - Acc |

GDXU US |

127.95 |

48.02 |

29.45 |

|

United States Natural Gas Fund LP |

UNG US |

1,165.93 |

1,105.01 |

27.63 |

|

Invesco CurrencyShares Euro Currency Trust |

FXE US |

260.82 |

(30.29) |

24.96 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

322.61 |

423.90 |

24.21 |

|

ProShares Ultra Silver |

AGQ US |

404.21 |

0.74 |

16.34 |

|

United States Copper Index Fund |

CPER US |

150.52 |

(23.31) |

12.96 |

|

ProShares UltraShort DJ-UBS Crude Oil |

SCO US |

219.58 |

(5.50) |

9.14 |

|