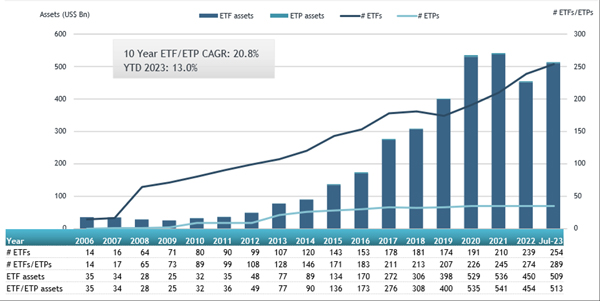

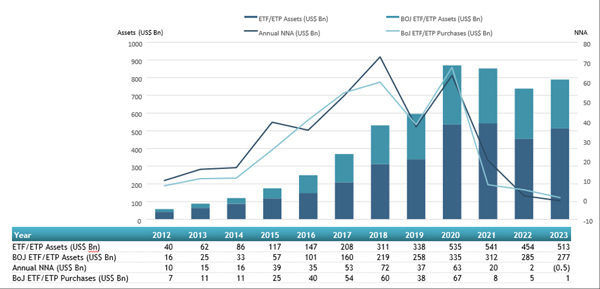

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that assets invested in the ETFs industry in Japan were US$513 billion at the end of July. The ETFs industry in Japan reported net outflows of US$2.27 billion during July, bringing year-to-date net outflows to US$507 million. Assets increased 13.0% YTD in 2023, going from $454.03 Bn at end of 2022 to $512.88 Bn.July, according to ETFGI's July 2023 Japanese ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the ETFs industry in Japan were US$513 billion at the end of July.

- Assets increased 13.0% YTD in 2023, going from $454.03 Bn at end of 2022 to $512.88 Bn.

- Net outflows of $2.27 Bn in July 2023.

- YTD net outflows of $507 Mn gathered in 2023.

- $2.55 Bn in net outflows gathered in the past 12 months.

- 1st month of net outflows.

- Equity ETFs and ETPs listed in Japan saw $2.26 Bn in net outflows in July 2023.

“The S&P 500 increased by 3.21% in July and is up 20.65% year-to-date in 2023. Developed markets excluding the US increased by 3.62% in July and are up 15.09% YTD in 2023. Norway (up 8.97%) and Israel (up 8.06%) saw the largest increases amongst the developed markets in July. Emerging markets increased by 6.15% during July and are up 11.08% YTD in 2023. Turkey (up 20.52%) and Pakistan (up 15.89%) saw the largest increases amongst emerging markets in July.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

ETFs industry in Japan asset growth as at the end of July 2023

At the end of July 2023, the ETFs industry in Japan had 289 products, with 311 listings, assets of $513 Bn, from 15 providers listed on 3 exchanges.

Equity ETFs reported net outflows of $2.26 Bn during July, bringing YTD net outflows to $623 Mn, much lower than the $4.63 Bn in net inflows YTD in July 2022. Fixed income ETFs gathered net inflows of $202 Mn during July, bringing YTD net inflows to 1.25 Bn, higher than the $271 Mn in net inflows YTD in 2022. Commodities ETFs reported net outflows of $16 Mn during July, bringing YTD net inflows to $98 Mn, higher than the $532 Mn in net outflows YTD in 2022.

At the end of July 2023, the Bank of Japan held $277 billion or 53% of the assets invested in the ETFs industry in Japan. During Bank of Japan did not make any ETFs purchases during July.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $2.55 Bn during July. iShares Core TOPIX ETF (1475 JP) gathered $578.79 Mn, the largest individual net inflow.

Top 20 ETFs by net new assets July 2023: Japan

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Core TOPIX ETF |

1475 JP |

9,738.93 |

2,367.22 |

578.79 |

|

MAXIS NIKKEI225 ETF |

1346 JP |

15,219.69 |

275.56 |

436.18 |

|

NEXT FUNDS Nikkei 225 Leveraged Index ETF |

1570 JP |

1,521.45 |

(3,141.35) |

236.86 |

|

iShares Core Nikkei 225 ETF |

1329 JP |

8,209.59 |

254.21 |

230.60 |

|

Listed Index Fund 225 |

1330 JP |

29,935.86 |

(85.77) |

198.12 |

|

iShares 20 Year US Treasury Bond JPY Hedged ETF |

2621 JP |

453.67 |

356.52 |

114.45 |

|

NZAM ETF TOPIX |

2524 JP |

1,272.71 |

12.71 |

86.84 |

|

iShares Core 7-10 Year US Treasury Bond JPY Hedged ETF |

1482 JP |

946.33 |

475.89 |

86.10 |

|

Listed Index Fund US Equity NASDAQ100 Currency Hedge - JPY Hdg |

2569 JP |

235.10 |

42.10 |

70.30 |

|

NEXT FUNDS TOPIX Banks Exchange Traded Fund |

1615 JP |

689.37 |

3.98 |

61.22 |

|

iShares Core Japan Government Bond ETF |

2561 JP |

226.15 |

99.65 |

60.72 |

|

Global X Japan Semiconductor ETF |

2644 JP |

168.07 |

119.01 |

56.75 |

|

NEXT FUNDS Nifty 50 Linked Exchange Traded Fund |

1678 JP |

259.75 |

102.21 |

55.43 |

|

Simplex Nikkei225 Bull 2x ETF |

1579 JP |

175.41 |

(252.83) |

47.60 |

|

iShares MSCI Japan High Dividend ETF |

1478 JP |

432.63 |

65.04 |

46.19 |

|

Listed Index Fund US Bond (Currency Hedge) - JPY Hdg - Acc |

1487 JP |

484.88 |

135.97 |

44.89 |

|

Global X Japan Global Leaders ESG ETF |

2641 JP |

108.09 |

59.88 |

37.90 |

|

NEXT FUNDS Nikkei 225 High Dividend Yield Stock 50 Index Exchange Traded Fund |

1489 JP |

789.06 |

205.72 |

34.95 |

|

NZAM ETF JPX-Nikkei400 |

2526 JP |

415.00 |

33.38 |

33.63 |

|

Listed Index Fund TOPIX |

1308 JP |

62,880.21 |

59.89 |

33.50 |

|