ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, reported today that assets invested in the ETFs industry in Asia Pacific (ex-Japan) reached a new record of US$1.37 Tn at the end of the first half of 2025. During June the ETFs industry in Asia Pacific (ex-Japan) gathered net inflows of US$17.18 billion, bringing YTD net inflows to US$114.29 Bn, according to ETFGI's June 2025 Asia Pacific (ex-Japan) ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

The ETF industry in Asia Pacific (excluding Japan) continues its strong momentum in 2025, reaching new milestones:

- Record AUM: Total assets under management hit $1.37 trillion at the end of June, surpassing the previous record of $1.30 trillion set just a month earlier.

- Strong YTD Growth: Assets have grown 18.7% year-to-date, rising from $1.15 trillion at the end of 2024.

- Robust Inflows: June saw net inflows of $17.18 billion, marking the fourth consecutive month of positive flows.

- Historic YTD Inflows: With $114.29 billion in net inflows so far in 2025, this is the second-highest YTD total on record, following the $142.17 billion peak in 2024. The third-highest was $63.72 billion in 2022.

- These figures underscore the region’s growing appetite for ETFs, driven by increasing investor demand across retail and institutional segments.

The S&P 500 rose 5.09% in June, bringing its H1 2025 gain to 6.20%. Developed Markets (ex-US) increased 3.24% in June, and are up a strong 20.29% year-to-date. Top Performers in June: Korea: +16.12% and Israel: +11.60%. Emerging Markets gained 4.80% in June, with a year-to-date increase of 11.41%. Top Performers in June: Taiwan: +8.53% and Turkey: +8.49%, according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

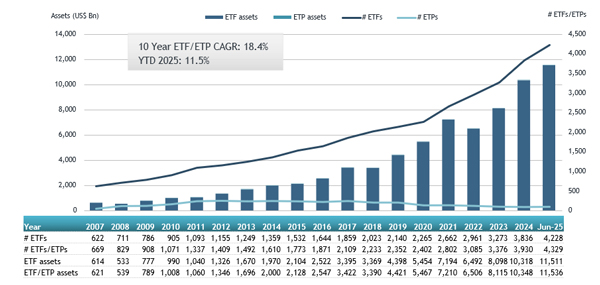

Growth in assets in the ETFs industry in Asia Pacific (ex-Japan) as of the end of June

The ETFs industry in Asia Pacific (ex-Japan) had 3,949 ETFs, with 4,162 listings, assets of US$1.37 Tn, from 281 providers on 21 exchanges in 15 countries.

During June, ETFs gathered net inflows of $17.18 Bn. Equity ETFs gathered net inflows of $2.84 Bn over June, bringing YTD net inflows to $56.66 Bn, lower than the $102.14 Bn in YTD net inflows in 2024. Fixed income ETFs gathered net inflows of $13.09 Bn during June, bringing net inflows for the year through June 2025 to $30.05 Bn, slightly lower than the $30.85 Bn in net inflows YTD in 2024. Commodities ETFs reported net inflows of $0.99 Bn during June, bringing YTD net inflows to $12.06 Bn, higher than the $3.39 Bn in net inflows commodities products had reported year to date in 2024. Active ETFs had net outflows of $0.14 Bn over the month, gathering net inflows for the year to $12.81 Bn, higher than the $5.34 Bn in net inflows YTD in 2024.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $20.71 Bn during June. ChinaAMC SSE Market-Making Corporate Bond ETF (511200 CH) gathered $1.99 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets in June 2025: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

ChinaAMC SSE Market-Making Corporate Bond ETF |

511200 CH |

3,016.81 |

2,988.47 |

1,988.87 |

|

Huatai-PineBridge CSI A500 ETF |

563360 CH |

3,160.23 |

723.53 |

1,889.22 |

|

Yuanta/P-shares Taiwan Top 50 ETF |

0050 TT |

22,196.64 |

6,459.36 |

1,886.71 |

|

Capital TIP Taiwan Select High Dividend ETF |

00919 TT |

13,834.80 |

4,017.80 |

1,702.74 |

|

China Southern SSE Market-Making Corporate Bond ETF |

511070 CH |

3,020.97 |

2,985.27 |

1,496.03 |

|

SSE 10-year T-bond ETF |

511260 CH |

1,930.74 |

1,554.45 |

1,406.90 |

|

E Fund SSE Market-Making Corporate Bond ETF |

511110 CH |

2,971.77 |

2,933.24 |

1,329.61 |

|

GF SZSE Market-Making Credit Bond ETF |

159397 CH |

1,963.95 |

1,946.01 |

969.87 |

|

Ping An China Bond - Medium-High Grade Corporate Bond Spread factors ETF Fund |

511030 CH |

3,045.94 |

1,495.69 |

910.83 |

|

Tianhong SZSE Market-Making Credit Bond ETF |

159398 CH |

1,630.89 |

1,614.42 |

830.09 |

|

Dacheng SZSE Market-Making Credit Bond ETF |

159395 CH |

1,677.25 |

1,662.60 |

793.17 |

|

HFT SSE Market-Making Corporate Bond ETF |

511190 CH |

1,897.36 |

1,869.54 |

732.67 |

|

Tracker Fund of Hong Kong (TraHK) |

2800 HK |

19,683.25 |

(1,698.91) |

694.27 |

|

KB RISE Short Term Specialized Bank Bond Active ETF |

0061Z0 KS |

674.53 |

674.53 |

674.53 |

|

BOSERA SZSE MARKET-MAKING CREDIT BOND ETF |

159396 CH |

1,714.71 |

1,690.75 |

631.75 |

|

Tibet Eastmoney CSI 1-3 Year Treasury Bond ETF |

511160 CH |

1,156.59 |

1,144.82 |

598.00 |

|

MIRAE ASSET TIGER MONEY MARKET ACTIVE ETF |

0043B0 KS |

908.37 |

1,026.10 |

588.66 |

|

Fullgoal ChinaBond 7-10 Year Policy Bank Bond ETF |

511520 CH |

7,265.03 |

2,009.49 |

538.67 |

|

China Universal CNI HK Connect Innovative Drug ETF |

159570 CH |

1,089.06 |

856.14 |

527.05 |

|

HFT CSI Commercial Paper ETF |

511360 CH |

6,838.46 |

2,678.22 |

520.88 |

The top 10 ETPs by net new assets collectively gathered $271.06 Mn during June. Shinhan Securities Shinhan S&P500 VIX S/T Futures ETN E 95 (500095 KS) gathered $84.24 Mn, the largest individual net inflow.

Top 10 ETPs by net inflows in June 2025: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Shinhan Securities Shinhan S&P500 VIX S/T Futures ETN E 95 |

500095 KS |

84.24 |

84.24 |

84.24 |

|

Shinhan Securities Shinhan Inverse 2X Natural Gas Futures ETN B 96 |

500096 KS |

66.21 |

66.21 |

66.21 |

|

Samsung Securities Samsung Bloomberg Inverse 2X WTI Crude Oil Futures ETN B 134 |

530134 KS |

42.46 |

45.96 |

31.84 |

|

Global X Physical Gold Structured |

GOLD AU |

3,062.57 |

219.18 |

27.44 |

|

Global X Physical Silver Structured |

ETPMAG AU |

371.88 |

90.41 |

18.79 |

|

Perth Mint Gold |

PMGOLD AU |

1,059.35 |

175.32 |

16.33 |

|

NH N2 Inverse 2X F-KOSDAQ 150 ETN 98 |

550098 KS |

15.24 |

15.24 |

15.24 |

|

Value Gold ETF |

3081 HK |

362.45 |

(38.46) |

6.04 |

|

Samsung Securities Samsung Inverse 2X Silver Futures ETN H 62 |

530062 KS |

6.20 |

3.10 |

3.10 |

|

Global X Physical Platinum Structured |

ETPMPT AU |

21.33 |

5.25 |

1.83 |

Investors have tended to invest in Fixed Income ETFs/ETPs during June.