ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today assets invested in ETFs and ETPs listed in Middle East and Africa have increased 16.7% year to date as of the end of July. ETFs and ETPs listed in the Middle East and Africa gathered net inflows of US$713 million during July, bringing year-to-date net inflows to US$2.86 billion. During the month, assets invested in the Middle East and Africa ETF/ETP industry increased by 6.1%, from US$37.97 billion at the end of June to US40.29 billion, according to ETFGI's July 2023 Middle East and Africa ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets of $40 Bn invested in ETFs and ETPs listed in the Middle East and Africa at end of July 2023.

- Assets increased 16.7% YTD in 2023, going from $34.53 Bn at end of 2022 to $40.29 Bn.

- Net inflows of $713 Mn invested during July.

- YTD net inflows of $2.86 Mn in 2023 were the third highest on record, after YTD net inflows of $4.66 Bn in 2014 and YTD net inflows of $4.03 Bn in 2022.

- 6th month of consecutive net inflows.

“The S&P 500 increased by 3.21% in July and is up 20.65% year-to-date in 2023. Developed markets excluding the US increased by 3.62% in July and are up 15.09% YTD in 2023. Norway (up 8.97%) and Israel (up 8.06%) saw the largest increases amongst the developed markets in July. Emerging markets increased by 6.15% during July and are up 11.08% YTD in 2023. Turkey (up 20.52%) and Pakistan (up 15.89%) saw the largest increases amongst emerging markets in July.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

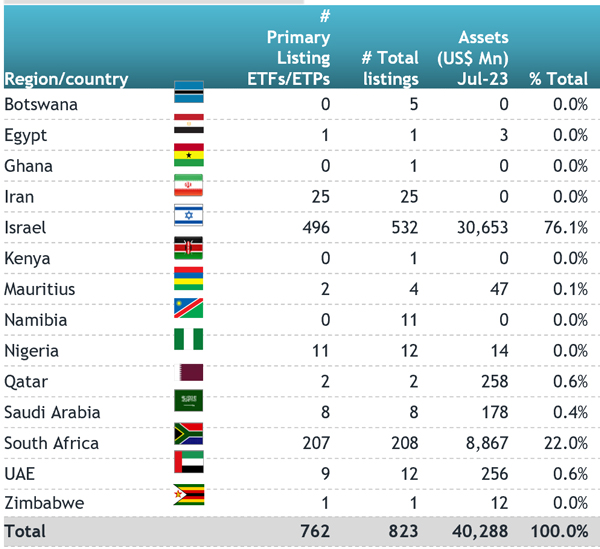

There were 762 ETFs/ETPs listed in 14 countries in the Middle East and Africa , with 823 listings, assets of US$40 Bn, from 54 providers listed on 17 exchanges.

ETFs and ETPs in the Middle East and Africa at the end of July

During July, ETFs gathered net inflows of $713 Mn. Equity ETFs gathered net inflows of $779 Mn during July, bringing YTD net inflows to $2.15 Bn, lower than the $2.54 Bn in net inflows YTD in 2022. Fixed income ETFs had net inflows of $75 Mn during July, bringing YTD net inflows to $444 Mn, higher than the $537 Mn in net outflows YTD in 2022. Commodities ETFs/ETPs reported net outflows of $151 Mn during July, bringing YTD net inflows to $174 Mn, higher than the $233 Mn in net outflows YTD in 2022. Active ETFs reported net inflows of $1 Mn over the month, while gathering net inflows of $93 Mn for the year in Middle East and Africa, much lower than the $1.96 Bn in net inflows YTD in 2022.

Top 20 ETFs by net new assets July 2023: Middle East and Africa

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $973.92 Mn during July. MTF SAL (4D) S&P 500 (MTFF23 IT) gathered $117.46 Mn, the largest individual net inflow.

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

MTF SAL (4D) S&P 500 |

MTFF23 IT |

1,047.64 |

248.12 |

117.46 |

|

Tachlit SAL (4D) S&P 500 |

TCHF76 IT |

980.98 |

346.65 |

111.40 |

|

KSM ETF (4D) NASDAQ 100 |

KSMF52 IT |

295.75 |

84.78 |

90.69 |

|

Psagot ETF (4D) S&P 500 |

PSGF65 IT |

655.24 |

158.43 |

84.84 |

|

KSM ETF (4A) S&P 500 Currency Hedged |

KSMF82 IT |

323.77 |

64.56 |

76.64 |

|

Harel Sal (4D) S&P 500 |

HRLF25 IT |

591.04 |

170.04 |

63.99 |

|

KSM ETF (4A) NASDAQ 100 Currency Hedged |

KSMF83 IT |

218.09 |

70.13 |

60.31 |

|

KSM ETF (4D) S&P Technology |

KSMF158 IT |

91.24 |

51.68 |

53.12 |

|

KSM ETF (4D) S&P 500 |

KSMF80 IT |

826.43 |

65.93 |

43.26 |

|

MORE SAL (4D) S&P 500 |

MORES1 IT |

870.93 |

413.43 |

42.40 |

|

KSM ETF (4A) Index Israeli Banks |

KSMF77 IT |

714.50 |

21.38 |

36.99 |

|

MTF Sal (0A) Tel Bond-Composite IL |

MTFF116 IT |

72.42 |

71.62 |

29.53 |

|

KSM ETF (4D) S&P Health Care |

KSMF152 IT |

43.55 |

27.77 |

28.72 |

|

Harel Sal (00) Tel Bond CPI Linked IL |

HRLF61 IT |

93.24 |

26.75 |

27.38 |

|

Tachlit SAL (00)(!) Tel Bond-Yields IL |

TCHF41 IT |

124.04 |

65.55 |

22.21 |

|

KSM ETF (4D) S&P Financial |

KSMF132 IT |

26.06 |

17.11 |

17.92 |

|

Tachlit SAL (40) TA 125 IL |

TCHF2 IT |

949.82 |

130.12 |

17.88 |

|

Harel Sal (00)(!) Tel Bond - Yields IL |

HRLF69 IT |

84.91 |

25.10 |

17.66 |

|

Satrix MSCI World ETF - Acc |

STXWDM SJ |

506.93 |

107.00 |

16.88 |

|

MORE SAL (00) Tel Bond 60 IL |

MORES10 IT |

19.10 |

19.00 |

14.66 |

Investors have tended to invest in Equity ETFs during July.