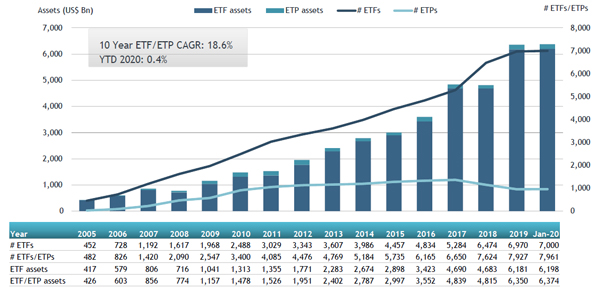

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that ETFs and ETPs listed globally gathered net inflows of US$67.15 billion at the end of January 2020, which is significantly higher than the US$17.23 billion gathered at this point last year. Assets invested in the global ETFs/ETPs industry increased by 0.4%, from US$6.35 trillion at the end of December 2019, to US$6.37 trillion at the end of January, according to ETFGI's January 2020 Global ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets in Global ETFs and ETPs industry reached a new milestone of $6.37 trillion at the end of January.

- The $67.15 Bn in net inflows gathered in January is the 8th highest monthly inflow on record and significantly larger than the $17.23 Bn gathered in January 2019.

- Year-to-date net inflows of $67.15 Bn are the 2nd highest behind only January 2018 with $105.59 Bn.

- Equity products have gathered more net inflows than fixed income products as of the end of January.

"During January the S&P 500 lost 0.04% as markets were affected by the Coronavirus (nCoV) outbreak and offset any optimism on the trade talks with China. Global equities as measured by the S&P Global BMI were also down 1.33% and the S&P Emerging BMI declined 4.3% as well.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of January 2020

The Global ETFs/ETPs industry had 7,961 ETFs/ETPs, with 15,944 listings from 440 providers on 70 exchanges in 58 countries at the end of January.

During January 2020, ETFs/ETPs listed globally gathered net inflows of $67.15 Bn. Equity ETFs/ETPs listed globally gathered net inflows of $34.39 Bn during January, substantially greater than the $8.94 Bn in net outflows equity products attracted during January 2019. Fixed income ETFs/ETPs listed globally attracted net inflows of $21.13 Bn during January, slightly lower than the $23.67 Bn in net inflows fixed income products attracted during January 2019. Commodity ETFs/ETPs reported $4.14 Bn in net inflows during January, which is greater than the $2.77 Bn in net inflows gathered through January 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $32.85 Bn at the end of January, the iShares Core MSCI EAFE ETF (IEFA US) gathered $2.59 Bn alone.

Top 20 ETFs by net new inflows January 2020: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

iShares Core MSCI EAFE ETF |

|

IEFA US |

74,956.79 |

2,585.78 |

2,585.78 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

139,508.97 |

2,506.04 |

2,506.04 |

|

Vanguard Total Bond Market ETF |

|

BND US |

51,596.18 |

2,277.09 |

2,277.09 |

|

iShares Core S&P 500 ETF |

|

IVV US |

200,971.86 |

2,214.24 |

2,214.24 |

|

iShares Core U.S. Aggregate Bond ETF |

|

AGG US |

72,788.91 |

2,163.27 |

2,163.27 |

|

iShares MBS ETF |

|

MBB US |

23,300.50 |

2,027.77 |

2,027.77 |

|

iShares Trust iShares ESG MSCI USA ETF |

|

ESGU US |

3,391.61 |

1,956.27 |

1,956.27 |

|

Vanguard S&P 500 ETF |

|

VOO US |

132,425.32 |

1,930.25 |

1,930.25 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

|

VCIT US |

28,165.35 |

1,887.02 |

1,887.02 |

|

Vanguard Small-Cap ETF |

|

VB US |

28,598.30 |

1,772.45 |

1,772.45 |

|

Vanguard FTSE Developed Markets ETF |

|

VEA US |

77,936.00 |

1,680.51 |

1,680.51 |

|

iShares MSCI EM ESG Optimized ETF |

|

ESGE US |

1,983.60 |

1,227.37 |

1,227.37 |

|

E FundSI SOE The Belt and Road ETF |

|

515110 CH |

1,153.13 |

1,220.24 |

1,220.24 |

|

Industrial Select Sector SPDR Fund |

|

XLI US |

11,601.43 |

1,195.60 |

1,195.60 |

|

Vanguard Growth ETF |

|

VUG US |

49,019.07 |

1,124.24 |

1,124.24 |

|

Vanguard Total International Bond ETF |

|

BNDX US |

25,827.16 |

1,104.56 |

1,104.56 |

|

iShares 0-5 Year High Yield Corporate Bond ETF |

|

SHYG US |

4,627.37 |

1,066.00 |

1,066.00 |

|

Bharat Bond ETF - April 2023 |

|

BETF423 IN |

989.99 |

996.81 |

996.81 |

|

Consumer Discretionary Select Sector SPDR Fund |

|

XLY US |

15,277.10 |

966.95 |

966.95 |

|

TOPIX Exchange Traded Fund |

|

1306 JP |

100,054.05 |

950.51 |

950.51 |

The top 10 ETPs by net new assets collectively gathered $3.53 Bn in January. The iShares Physical Gold ETC (SGLN LN) gathered $863.09 Mn alone.

Top 10 ETPs by net new inflows January 2019: Global

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Physical Gold ETC |

SGLN LN |

8,199.86 |

863.09 |

863.09 |

|

iShares Gold Trust |

IAU US |

18,937.78 |

597.49 |

597.49 |

|

SPDR Gold Shares |

GLD US |

45,988.67 |

509.57 |

509.57 |

|

VelocityShares 3x Long Crude Oil ETN |

UWT US |

432.26 |

338.97 |

338.97 |

|

United States Oil Fund LP |

USO US |

1,290.47 |

313.67 |

313.67 |

|

Invesco Gold ETC |

SGLD LN |

7,671.87 |

245.92 |

245.92 |

|

GBS Bullion Securities |

GBS LN |

4,251.08 |

199.87 |

199.87 |

|

United States Natural Gas Fund LP |

UNG US |

530.76 |

166.75 |

166.75 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

VXX US |

1,104.84 |

158.83 |

158.83 |

|

Xetra Gold EUR |

4GLD GY |

10,523.81 |

139.84 |

139.84 |

Investors have tended to invest in core Equity and core Fixed Income ETFs during January.