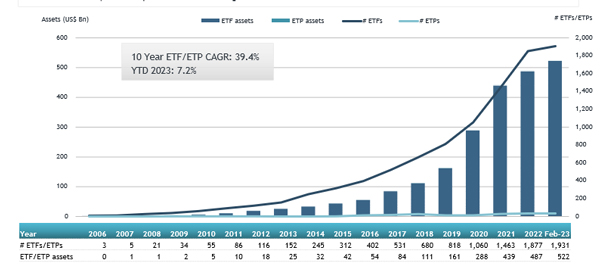

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that actively managed ETFs listed globally gathered net inflows of US$14.30 billion during February, bringing year-to-date net inflows to US$24.92 billion. Assets invested in actively managed ETFs increased by 21.5%, from US$429.72 billion at the end of January 2023 to US$522 billion, according to ETFGI's February 2023 Active ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets of $522 Bn invested in actively managed ETFs industry at the end of February 2023.

- Assets increased 7.2% year-to-date in 2023, going from $487 Bn at the end of 2022 to $522 Bn.

- Net inflows of $14.30 Bn during February 2023.

- Year-to-date net inflows of $24.92 Bn in 2023 are the second highest on record, after year-to-date net inflows in 2021 of $32.81 Bn.

- 35th month of consecutive net inflows.

“The S&P 500 decreased by 2.44 % in February but is up by 3.69% YTD in 2023. Developed markets excluding the US decreased by 2.59% in February but are up 5.47% YTD in 2023. Israel (down 6.97%) and Hong Kong (down 6.94%) saw the largest decreases amongst the developed markets in February. Emerging markets decreased by 5.57% during February but are up 0.72% YTD in 2023. Colombia (down 11.62%) and Thailand (down 9.38%) saw the largest decreases amongst emerging markets in February.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

There are 1,931 Active ETFs listed globally, with 2,434 listings, assets of $522 Bn, from 361 providers listed on 32 exchanges in 24 countries at the end of February.

Equity focused actively managed ETFs listed globally gathered net inflows of $8.08 Bn over February, bringing year to date net inflows to $17.46 Bn, higher than the $9.31 Bn in net inflows gathered YTD in 2022. Fixed Income focused actively managed ETFs listed globally attracted net inflows of $6.10 Bn during February, bringing YTD net inflows in 2023 to $7.59 Bn, slightly lower than the $8.16 Bn in net inflows YTD in 2022.

Substantial inflows can be attributed to the top 20 active ETFs/ETPs by net new assets, which collectively gathered

$8.49 Bn during February. JPMorgan Equity Premium Income ETF (JEPI US) gathered $1.9 Bn, the largest individual net inflow.

Top 20 actively managed ETFs/ETPs by net new assets February 2023

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

JPMorgan Equity Premium Income ETF |

JEPI US |

21,482.06 |

4,298.76 |

1,856.15 |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

25,144.46 |

1,182.39 |

919.44 |

|

Hwabao WP Cash Tianyi Listed Money Market Fund |

511990 CH |

17,015.98 |

(909.76) |

489.45 |

|

CI High Interest Savings ETF |

CSAV CN |

4,719.41 |

841.88 |

452.08 |

|

Putnam ESG Core Bond ETF |

PCRB US |

431.24 |

435.83 |

429.62 |

|

PGIM Ultra Short Bond ETF |

PULS US |

4,230.36 |

343.03 |

383.92 |

|

Putnam Sustainable Leaders ETF |

PLDR US |

333.13 |

338.25 |

338.79 |

|

Innovator U.S. Equity Power Buffer ETF - February |

PFEB US |

556.32 |

333.34 |

332.51 |

|

Dimensional US Core Equity 2 ETF |

DFAC US |

17,653.18 |

665.05 |

317.51 |

|

SPDR DoubleLine Total Return Tactical ETF |

TOTL US |

2,686.78 |

340.12 |

313.28 |

|

Horizons High Interest Savings ETF |

CASH CN |

1,486.39 |

439.11 |

307.60 |

|

JPMorgan International Research Enhanced Equity ETF |

JIRE US |

5,362.71 |

218.29 |

286.08 |

|

Avantis U.S. Small Cap Value ETF |

AVUV US |

5,747.88 |

596.11 |

283.74 |

|

JPMorgan Nasdaq Equity Premium Income ETF |

JEPQ US |

1,676.92 |

629.77 |

271.22 |

|

Janus Henderson AAA CLO ETF |

JAAA US |

2,311.35 |

369.99 |

266.01 |

|

Ossiam ESG Low Carbon Shiller Barclays Cape US Sector UCITS ETF - Acc |

5HEE GY |

1,301.59 |

275.65 |

263.00 |

|

AXS Short Innovation ETF |

SARK US |

538.32 |

341.30 |

256.82 |

|

Fidelity Total Bond ETF |

FBND US |

3,232.58 |

532.36 |

255.74 |

|

First Trust TCW Opportunistic Fixed Income ETF |

FIXD US |

3,582.49 |

523.26 |

242.77 |

|

PIMCO Enhanced Short Maturity Strategy Fund |

MINT US |

8,803.39 |

(75.54) |

222.88 |

Investors have tended to invest in Equity actively managed ETFs/ETPs during February.