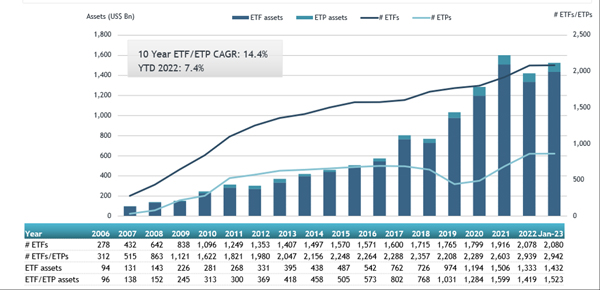

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that the ETFs industry in Europe gathered net inflows of US$19.34 billion during January. During the month, assets invested in the ETFs industry in Europe increased by 7.4% from US$1.42 trillion at the end of December to US$1.52 trillion, according to ETFGI's January 2023 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

“The S&P 500 increased by 6.28 % in January. Developed markets excluding the US increased by 8.27% in January. Italy (up 14.52%) and the Netherlands (up 14.47%) saw the largest increases amongst the developed markets in January. Emerging markets increased by 6.66% during January. Mexico (up 16.53%) and Czech Republic (up 16.46%) saw the largest increases amongst emerging markets in January.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI. Europe ETFs and ETPs asset growth as at the end of January 2023 The European ETFs industry had 2,942 products, with 11,878 listings, assets of $1.52 Tn, from 95 providers listed on 29 exchanges in 24 countries at the end of January. During January, ETFs gathered net inflows to US$19.34 billion. Equity ETFs gathered net inflows of $9.75 Bn in January, lower than the $24.94 Bn in net inflows equity products attracted at this point in January 2021. Fixed income ETFs reported net inflows of $8.91 Bn during January, higher than the $2.79 Bn in net inflows in January 2022. Commodities ETFs reported net outflows of $362 Mn during January, lower than the $1.54 Bn in net inflows in January 2022. Active ETFs attracted net inflows of $730 Mn during the month, higher than the $129 Mn in net inflows active products had reported YTD in 2022. Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $9.60 Bn during January. iShares Core € Corp Bond UCITS ETF (IEBC LN) gathered $1.76 Bn, the largest individual net inflow.

Highlights

Top 20 ETFs by net inflows in January 2023: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

IEBC LN |

13,587.36 |

1,758.39 |

1,758.39 |

|

|

iShares Core MSCI World UCITS ETF - Acc |

IWDA LN |

48,879.87 |

883.63 |

883.63 |

|

PIMCO US Dollar Short Maturity ETF |

MINT LN |

3,187.96 |

735.46 |

735.46 |

|

iShares MSCI China A UCITS ETF - Acc |

IASH LN |

2,929.20 |

648.74 |

648.74 |

|

iShares Core EURO STOXX 50 UCITS ETF (DE) |

SX5EEX GY |

6,216.42 |

509.36 |

509.36 |

|

SPDR Bloomberg Global Aggregate Bond UCITS ETF |

SYBZ GY |

2,681.75 |

480.04 |

480.04 |

|

iShares MSCI China UCITS ETF - Acc |

ICHN NA |

1,174.50 |

420.73 |

420.73 |

|

JPM Carbon Transition Global Equity UCITS ETF – Acc |

JPCT LN |

636.04 |

413.18 |

413.18 |

|

Vanguard FTSE All-World UCITS ETF |

VWRD LN |

15,660.13 |

405.48 |

405.48 |

|

iShares J.P. Morgan EM Local Govt Bond UCITS ETF |

SEML LN |

4,461.64 |

403.43 |

403.43 |

|

iShares € Corp Bond 1-5yr UCITS ETF |

IE15 LN |

4,598.92 |

332.61 |

332.61 |

|

SPDR Bloomberg Barclays EM Local Bond UCITS ETF |

SYBM GY |

2,892.94 |

326.97 |

326.97 |

|

UBS ETF (IE) MSCI Australia UCITS ETF A-acc - Acc |

AUSCHW SW |

749.01 |

308.82 |

308.82 |

|

iShares MSCI Europe Consumer Staples Sector UCITS ETF - Acc |

ESIS GY |

599.56 |

307.31 |

307.31 |

|

iShares MSCI ACWI UCITS ETF - Acc |

ISAC LN |

6,861.59 |

284.93 |

284.93 |

|

iShares MSCI EM ESG Enhanced UCITS ETF |

EEDM LN |

3,307.37 |

283.02 |

283.02 |

|

iShares MSCI EM Asia UCITS ETF - Acc |

CSEMAS SW |

2,046.75 |

279.56 |

279.56 |

|

Xtrackers II iBoxx Sovereigns Eurozone 5-7 UCITS ETF - 1C - Acc |

X57E GY |

641.28 |

275.81 |

275.81 |

|

iShares € Corp Bond ESG UCITS ETF |

SUOE LN |

4,765.58 |

273.77 |

273.77 |

|

iShares Germany Govt Bond UCITS ETF |

SDEU LN |

825.20 |

271.56 |

271.56 |

The top 10 ETPs by net new assets collectively gathered $1.45 Bn during January. WisdomTree Brent Crude Oil - Acc (BRNT LN) gathered $806 Mn the largest individual net inflow. Top 10 ETPs by net inflows in January 2023: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

WisdomTree Brent Crude Oil - Acc |

BRNT LN |

2,131.15 |

805.91 |

805.91 |

|

WisdomTree Copper - Acc |

COPA LN |

877.30 |

328.09 |

328.09 |

|

BTCetc – ETC Group Physical Bitcoin - Acc |

BTCE GY |

422.77 |

47.34 |

47.34 |

|

UBS ETC Industrial Metals USD - Acc |

TIMCI SW |

54.79 |

46.16 |

46.16 |

|

WisdomTree S&P 500 3x Daily Short - Acc |

3USS LN |

87.28 |

42.51 |

42.51 |

|

iShares Physical Silver ETC - Acc |

SSLN LN |

533.42 |

41.81 |

41.81 |

|

WisdomTree Natural Gas 3x Daily Leveraged - Acc |

3NGL LN |

34.97 |

40.42 |

40.42 |

|

WisdomTree Industrial Metals - EUR Daily Hedged - Acc |

EIMT IM |

118.49 |

37.44 |

37.44 |

|

WisdomTree Natural Gas - Acc |

NGAS LN |

75.87 |

33.71 |

33.71 |

|

WisdomTree Aluminium - Acc |

ALUM LN |

188.44 |

29.53 |

29.53 |

Investors have tended to invest in Equity ETFs and ETPs during January.