- For the major African banks, the question is no longer “whether” but “how” they can participate in African growth as there remain major challenges that are cutting into profitability for the time being.

- Strong growth outook in the medium-to-long term

DEVLHON Consulting analysis of retail banking expansion in the past 10 years backs the scenario of a upcoming consolidation on both national and regional levels. According to DEVLHON Consulting’s forecasts of urban nodes and banking activity growths, the branch networks of leading banks should grow between 95% (bull case scenario) and 46% (bear case scenario) between now and 2020, based on a sampling of 19 African markets. This translates into growth of between 1,700 and over 3,600 branches just for the top 3 national players. That equates to the ex nihilo creation of a retail bank network comparable to combined networks of the Moroccan and South African leaders.

Continental footprint and rampant consolidation

Clearly, the reshuffling of the African banking landscape accelerated in the mid-2000s. Today’s sector was born from this first transformation, whose concept is named “bank-africanisation” by DEVLHON Consulting analysts. This trend is characterised by a rampant consolidation and a desire to achieve a continental footprint [see Figures 1 and 2]. Four groups of players have been identified and segmented :

- G1 – Continental banking groups, i.e. African-owned banking groups operating outside domestic market (Standard Bank in South Africa, Attijariwafa in Morocco, UBA in Nigeria);

- G2 – Pan-African or pan-regional African-owned banking groups (Ecobank, Bank of Africa, etc.);

- G3 – Non-African groups : all the subsidiaries of parent groups with non-African capital ownership (Société Générale, Barclays, Standard Chartered);

- G4 – Key countries-focused banks: e.g. KCB, highly focused on Kenya and the EAC zone.

DEVLHON Consulting highlights that, groups G1 and G2 posted the strongest retail network expansion (respectively, +12 % and +9 % branch openings between 2006 and 2010, which compares with +2 % for G3).

In this respect, the big names really stand out. This is the case of the South African and the Moroccan banks in the first place. Following several years of subdued growth, the “Big Four” South African Banks (FirstRand, Standard Bank, Nedbank, Absa) are seeking to recalibrate their presence by raising their fairly weak exposure to the continent (less than 15% of their activity). Meanwhile, Moroccan banking groups (including Attijariwafa and BMCE) which benefit from their many years of experience expanding on the African continent; They are is increasingly emulated, as seen by the game entry in 2012 of Casablanca-based Banque Centrale Populaire (BCP), which now operates in 9 Sub-Saharan African countries.

This is different story for Nigerian banks (including Access Bank, Diamond Bank and UBA) whose gigantic domestic market, central bank-imposed restrictions and AMCON-type [1] restructurings leave them fenced in their domestic market.

Alliance strategies are also becoming a tool, as evidenced by the 20% capital stake taken by South African bank Nedbank in the largest African banking franchise, Ecobank.

New risks and commercial challenges

Not all banks have the means to transform themselves into pan-African banking groups. Some of the obstacles to overcome include achieving critical mass, the complexities of refinancing on growth markets and the difficulty of building high-performance operational, sales and technology platforms. In short, the sort of challenges that can hinder profitability: the ROE [2] of African subsidiaries hovers round 10%, which is less than that generated by the parent group (15% to 20%). For example, Absa’s subsidiaries in Africa are loss-making (excluding those held directly by Barclays).

Expansion into mass-market retail also brings forth exposure to new risks. The regulatory framework should tighten, as countries bring themselves up to international compliance standards (KYC [3], Anti-Money Laundering, Basel II and III). In this context, African risk and product programs models are maturing. As such, for many players, like Ecobank, over 60% of their local subsidiaries have been in operation for less than 6 years.

Besides, product offering and sales strategy are key to the success of the “3 fronts”: the “battle for growth” in all urban as well rural areas; the “battle for market share” on all sub-segments of client/business, and ... last but not least, the “battle for product penetration”. While less than half of their client base is equipped with payment cards, more African players are able to carry out such product innovations today such as mobile payment (eg. M-Pesa in Kenya), despite being complicated to launch, monitor and develop to maturity.

Good things will come to those who did not wait

This evolving banking landscape in Africa makes it difficult to operate on set growth models. The pan-African strategy of the major banking groups is to capture future growth and even monetise distribution capacities. The big players with national positions and financing are typically the most aggressive in terms of expansion. Standard Bank, one of the most internationalised banks and a member of the above-mentioned category, today has a strong exposure to the continent i.e 20% of top line revenue and 15% of tied in capital.

Following the new agreement with its parent group, Barclays, Absa’s revenue exposure to the continent will climb to 15% from 10%. Moroccan banks are also extremely dynamic, both in terms of organic growth and acquisitions. For instance, Attijariwafa’s sub-Saharan subsidiaries already generate nearly 8.6% of its net profit.

The African banking sector’s potential is much like a long-distance race to gain access to savings and management of the customer relationships of tomorrow. Therefore, key to success will be the expansion of branch networks and acquisitions. Such a strategy could work to the advantage of players which expanded into new geographies over the last 5 years. We believe there is clearly a first-mover advantage for those banks. Given that Egyptian banks have been pretty much out of the picture, South African and, probably, Moroccan or Kenyan banks will still be leading the way.

Banking In Emerging Markets - Africa

[1] Asset Management Corporation of Nigeria (AMCON) was the joint initiative of the Ministry of Finance and the Central Bank of Nigeria and was established to purchase non-performing loans from Nigerian universal banks and recapitalise them

[2] Return on Equity

[3] Know Your Customer rules

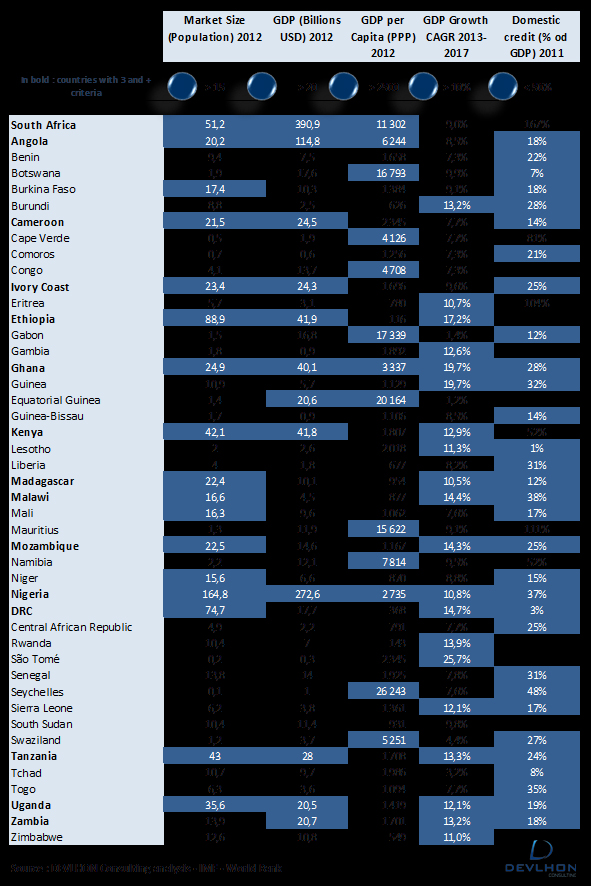

Figure 1 : Growth markets for retail banking in Africa

Source : DEVLHON Consulting analysis - IMF - World Bank

Figure 2 : Presence in Sub- Sub-Saharan Africa (G1 to G 4 banking groups)

Source : DEVLHON Consulting analysis