Although the Securities and Exchange Commission (SEC) and Self-Regulatory Organizations (SROs) in 2015 sought deliberate, empirical reviews of the U.S. equity market structure, multiple rules remain in flux. TABB Group’s latest equities research, “2015 US Equity Market in Review: Objects May Be Further than They Appear,” explores the issues at hand in 2016, along with predictions for how each will unfold.

In 2015, SEC Chair Mary Jo White advanced many of the 13 directives she outlined for the U.S. equity market. For each of these directives, report author Valerie Bogard has outlined the timeline for each individual item and predicts what steps will likely be taken in 2016.

Bogard explains that given the recent high levels of volatility, it is expected that regulators will be focused first on market stability over any actions, especially considering possible unintended consequences that may lead to further disruptions. Bogard predicts that the SEC and the Financial Industry Regulatory Authority (FINRA) will publish four rule proposals in 2016 related to mitigating broker conflicts, addressing high-frequency trading, market fairness and transparency.

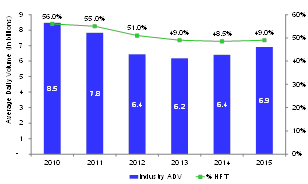

Industry Average Daily Volume / Historical Volatility

Source: TABB Group

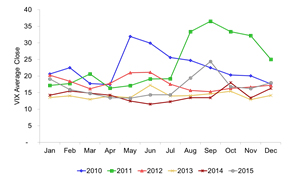

Source: TABB Group

“Two of the major new rulemaking items expected to come out this year are enhanced order routing disclosures to address mitigating broker conflicts and an anti-disruptive trading rule to address fairness and high frequency trading,“ said Bogard. “There will also be a renewed focus on many equity market structure issues still in discussion, including rules related to risk management, exchange-traded products (ETPs) and further expansion of alternative trading system (ATS) transparency.”

The volatility in global markets will also contribute to the equity market structure agenda moving forward. The market showed particularly high volatility and volumes on two days in 2015, specifically: August 24 saw 14.2 billion shares traded after currency devaluation in China led to sharp volatility spikes across the globe; and 12.8 billion shares traded on December 18 after the Federal Reserve raised interest rates.

With the assistance of these two volatile days, 2015 U.S. equity volume was the highest since 2011 with average daily volume at 6.9 billion. “TABB expects similar increases in volume in 2016,” says Bogard. “2016 could possibly mirror 2015 volume increases in that the continued market turmoil in China, as well as the expected rate hikes by the Fed, will once again push volumes higher.”

The report is now available for download by TABB equities clients and pre-qualified media at https://research.tabbgroup.com/search/grid. For more information or to purchase the reports, contact info@tabbgroup.com.