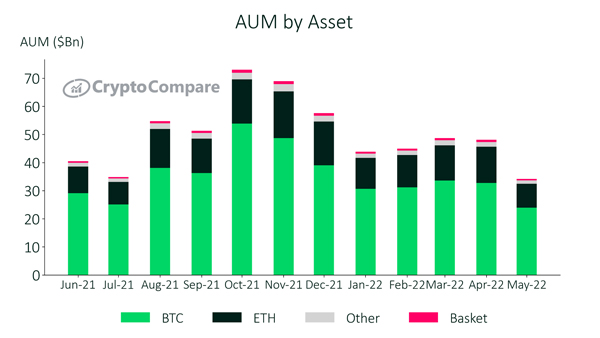

Bitcoin and Ethereum fell by 27.3% and 38.1% respectively in May (data up to 26th), a steep decline following a turbulent month for the two largest cryptocurrencies as the collapse of LUNA and TerraUSD sent shockwaves through the sector. Since April 2022, total AUM across all digital asset investment products has fallen 28.6% to $34.2bn (as of the 26th of May).

Macro sentiment around risk-assets has been the leading narrative in the markets, with the Fed’s hawkish behavior and the ongoing conflict in Ukraine, leading to increased levels of fear amongst market participants. Traditional risk-on assets like equities have also suffered in May, with the S&P 500 falling 5.01% in the same time period.

Access CryptoCompare's latest Digital Asset Management Review for all the latest insights.

Key takeaways:

- In May, Bitcoin’s AUM fell 26.8% to $24.0bn, while slightly gaining market share, currently at 70.1% of total AUM, up from 68.1% in April. Ethereum’s AUM fell 33.9% to $8.52bn while ‘Other’ and ‘Baskets’ AUM fell 30.1% to $1.18bn and 32.7% to $509mn, respectively.

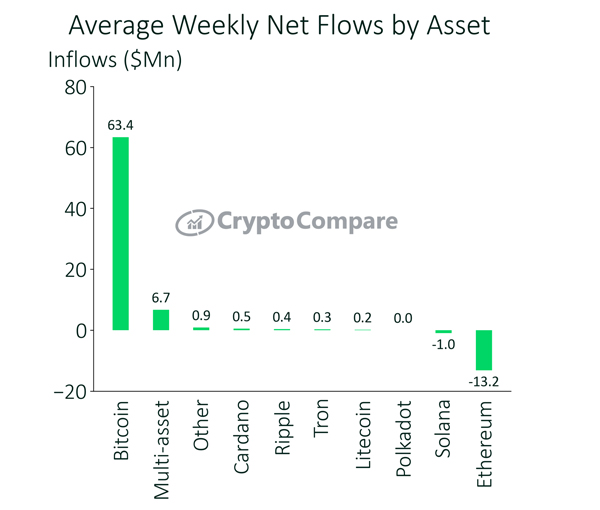

- Weekly net inflows averaged $66.5mn compared to average weekly outflows of -$49.6mn in April. Weekly inflows for Bitcoin-based products averaged $63.4mn, while Ethereum experienced significant average outflows of $-13.2mn per week.

- All companies’ assets under management fell significantly in May, the largest dollar value being Grayscale whose AUM fell by almost $10.6bn to $25.7bn, a month-over-month drop of 29.1%. The largest percentage decrease was seen by Bitwise, with AUM falling 33.8% to $533mn

- Cryptocurrency ETCs have seen a large decline in assets under management alongside the broader market sell-off. XBT Provider by CoinShares - which represents the majority of the ETC market - has seen its product’s AUM fall to the lowest levels in over a year. Their largest product; Bitcoin Tracker Euro, fell 27.0% to $708mn. The Ether Tracker Euro product also saw a steep decline, falling 36.3% to $563mn.

| DOWNLOAD REPORT |

AUM Declines Sharply Following Turbulent May

In May, Bitcoin’s AUM fell 26.8% to $24.0bn, while slightly gaining market share, currently at 70.1% of total AUM, up from 68.1% in April. Ethereum’s AUM fell 33.9% to $8.52bn while ‘Other’ and ‘Baskets’ AUM fell 30.1% to $1.18bn and 32.7% to $509mn, respectively.

Bitcoin Experiences Positive Weekly Flows

Weekly inflows for Bitcoin-based products averaged $63.4mn in May, while Ethereum experienced significant average outflows of -$13.2mn per week. Multi-asset-based products saw inflows averaging $6.67mn, but all other altcoins saw inflows of less than $1mn weekly.

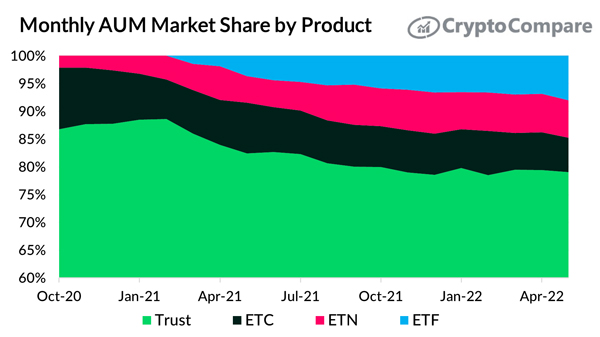

Investment Product Accessibility Crypto Adoption

As cryptocurrency adoption continues to accelerate, less jargon-heavy and easier-to-purchase instruments have seen an influx of investment. ETFs have gained an average of over 0.42% of assets under management market share, per month, while the more complex structures of exchange-traded certificates (which are in nature debt-securities, that use investors cash to buy derivatives, much like a synthetic ETF) have lost 0.26% market share per month. The similarly functional ETN however, has maintained its market share over the last year at ~7%.

The MVIS CryptoCompare Digital Assets Indices can be licensed to clients for a variety of purposes, including:

- Performance measurement and attribution

- Investment product development, as the basis for structured products such as ETPs and futures contracts

- Asset allocation

- Research

Contact CryptoCompare to learn how their indices can help you.