The total assets under management (AUM) for digital asset investment products increased 36.8% to $19.7bn in January; the highest recorded AUM since May 2022. The bullish sentiment was driven by liquidated short positions and a favourable macro environment, reflected in the most recent CPI announcement, which saw Bitcoin's price reach $23,000; its highest level since August 2022.

Despite the positives of the last month, AUM is still down considerably compared to January 2022, following a difficult year for Bitcoin, the wider cryptocurrency market and traditional assets. AUM for Bitcoin-based products and Ethereum-based products are down 38.7% and 39.2% compared to January 2022.

Download the full report for further insights into the digital asset industry.

Key takeaways:

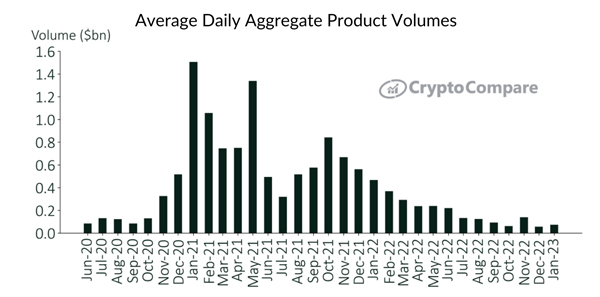

- In January 2023, average daily aggregate product volumes across all digital asset investment products saw a decent recovery, rising 30.0% to $72.5mn. Despite this, volumes are still 84.4% lower compared to January 2022 and 95.2% lower than the all-time high recorded in January 2021.

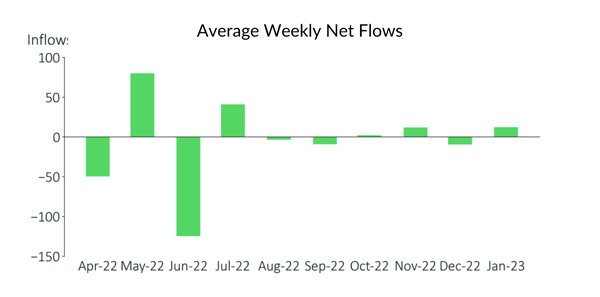

- Net flows saw a significant increase after two months of concern surrounding withdrawals following the collapse of FTX. The average weekly net flows from investment products hit $36.8 million, the highest inflows recorded since November 2022.

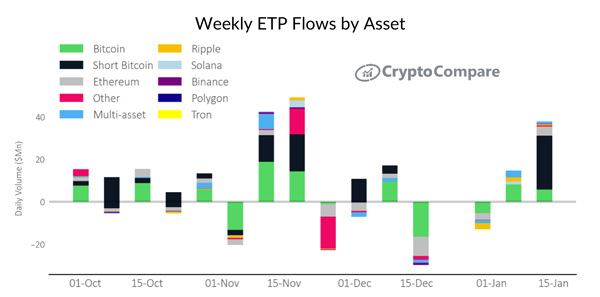

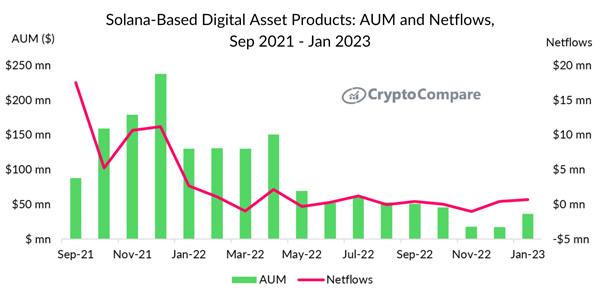

- 2023 weekly flows for Solana-based products surged from negative figures in December to $0.7 million in January, driven partly by the price appreciation of SOL. The rise represented the highest net flow among all digital assets in January and the biggest increase for Solana-based products since July 2022.

- Grayscale's Bitcoin Trust (GBTC) continued to be the dominant trust product in terms of assets under management (AUM), with a market share of 69.3%. The product recorded a 38.4% increase in AUM, to $14.5bn (compared to December), despite the uncertainty surrounding Genesis Trading.

Download Report

Average Daily Aggregate Product Volumes Recover 30% to $72.5m

In January 2023, average daily aggregate product volumes across all digital asset investment products saw a decent recovery, rising 30.0% to $72.5mn. Despite this, volumes are still 84.4% lower compared to January 2022 and 95.2% lower than the all-time high recorded in January 2021.

January Sees Highest Inflows Recorded Since November 2022

Net flows saw a significant increase after months of continued worries about withdrawals due to the collapse of FTX. The increase came as the recent bull market restored investor confidence in the market and the digital asset investment universe. The average weekly net flows from investment products hit $36.8 million, the highest inflows recorded since November 2022.

In January 2023, the weekly net flows varied widely, with Short Bitcoin-based products reporting $12.0mn followed by Bitcoin and Ethereum-based products which recorded $7.9mn and $4.9mn respectively.

Solana-Based Products Bounce Back as the Underlying Asset Rallies

2023 weekly flows for Solana-based products surged from negative figures in December to $0.7 million in January, driven partly by the price appreciation of SOL. The rise represented the highest net flow among all digital assets in January and the biggest increase for Solana-based products since July 2022. The price increase influenced AUM which increased 112% to $36.4mn.

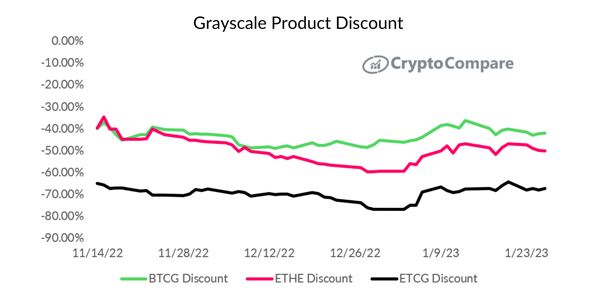

Grayscale Discount Remains as DCG Continues to Be Under Pressure

Grayscale's Bitcoin Trust (GBTC) continued to be the dominant trust product in terms of assets under management (AUM), with a market share of 69.3%. The product recorded a 38.4% increase in AUM, to $14.5bn (compared to December), despite the uncertainty surrounding Genesis Trading. Similarly, Grayscale's Ethereum Trust (ETHE) saw a positive return of 38.7%, with AUM increasing to $4.95bn (with a market share of 23.6%).

Despite the growth in assets under management and trading volume, the discount associated with Grayscale’s GBTC Trust has only slightly narrowed. The situation remains delicate, as Grayscale faced challenges with the bankruptcy announcement of its sister company Genesis due to exposure to FTX in January, and the ongoing lawsuit against the SEC to convert its Bitcoin Trust into an ETF.