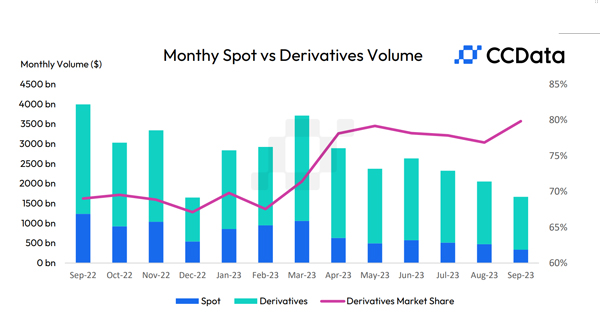

In September, the combined spot and derivatives trading volume on centralised exchanges fell for the third consecutive month, dropping 20.3% to $1.67tn. This was the lowest combined monthly trading volume recorded since December 2022. The lack of volatility, combined with the seasonality effects that have historically been seen in Q3, has led to centralised exchanges recording the lowest combined quarterly volumes since Q4 2020.

Download the full report here.

Key takeaways:

- Spot trading volumes continue to decline to multi-year lows. Spot trading volume on centralised exchanges fell for the third consecutive month, falling 29.2% to $336bn. This was the lowest recorded monthly spot trading volume since March 2019.

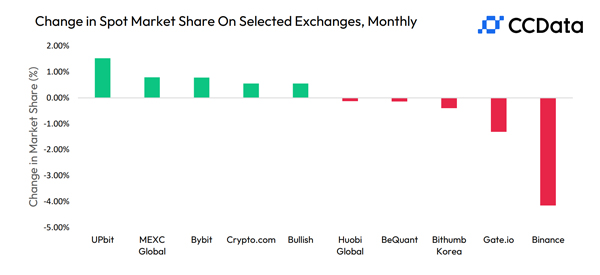

- Binance's market share declined for the seventh consecutive month. Spot trading volumes on Binance decreased by 36.8%, falling to $115 billion in September and recording the lowest monthly spot volumes for the exchange since October 2020. This reduction also marked the third consecutive decline in volumes since June 2023, causing Binance's market share among spot trading exchanges to currently stand at 34.3% — its lowest since June 2022.

- Derivatives market share reaches a new all-time high. The derivatives trading volume on centralised exchanges fell 17.7% to $1.33tn, recording the lowest monthly derivatives trading volume since December 2020. The market dominance of derivatives trading on centralised exchanges is now at 79.9%, a new all-time high for the sector.

- BTC pairs endure a notable 33.0% plunge in market depth YTD. The liquidity for BTC trading pairs decreased in August, with 1% market depth across selected exchanges dropping 7.67% to 4,683 BTC. This represents a 33.0% decline in the market depth of BTC pairs since the start of the year.

Combined Spot & Derivatives Volume Reach Lowest Level Since December 2022

In September, the combined spot and derivatives trading volume on centralised exchanges fell for the third consecutive month, dropping 20.3% to $1.67tn. This was the lowest combined monthly trading volume recorded since December 2022. The lack of volatility, combined with the seasonality effects that have historically been seen in Q3, has led to centralised exchanges recording the lowest combined quarterly volumes since Q4 2020.

Binance’s Market Share Declines for Seventh Consecutive Month

In September, spot trading volume on Binance fell 36.8% to $115bn, recording the lowest monthly volumes for the exchange since October 2020. This was also the third consecutive decline in volumes since June. The market share of Binance among spot trading exchanges is currently at 34.3%, the lowest since June 2022. The drop in volumes was further exacerbated by the halting of zero-fee trading promotion for BTC-TUSD pairs last month.

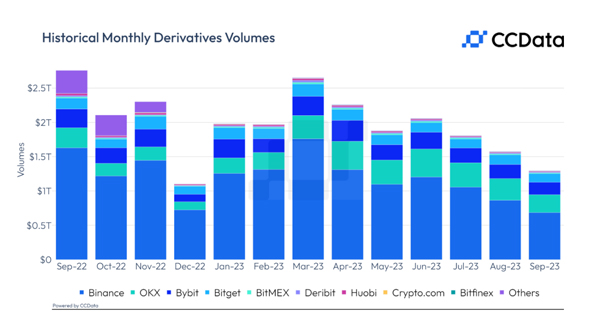

Meanwhile, derivatives trading volumes on Binance fell 20.8% to $686bn, recording the lowest monthly volumes since December 2020. Binance continues to dominate derivatives with a market share of 51.5%. However, its dominance has dropped to the lowest level since March 2022.

Derivatives Market Share Hit New All-Time High

The derivatives trading volume on centralised exchanges fell 17.7% to $1.33tn, recording the lowest monthly derivatives trading volume since December 2020. The market dominance of derivatives trading on centralised exchanges is now at 79.9%, a new all-time high for the sector. Though the derivatives trading volumes have declined for the third consecutive month, the drop in spot trading volume has outpaced the former leading to an increase in the derivatives market share.

Although Binance’s dominance has dropped by 13.9% since its yearly high of 65.4% in February, it continues to be the largest venue for derivatives trading with a market share of 51.5%. In the meantime, OKX, Bybit and Bitget have capitalised on Binance’s decline, increasing their market share to 19.6%, 13.6% and 9.43% respectively.

The information provided by this report does not constitute any form of advice or recommendation by CCData. Any redistribution of charts appearing in this Review must cite CCData as the sole provider and creator.

About CCData

CCData is an FCA-authorised benchmark administrator and global leader in digital asset data, providing institutional-grade digital asset data and settlement indices. By aggregating and analysing tick data from globally recognised exchanges and seamlessly integrating multiple datasets, CCData provides a comprehensive and granular overview of the market across trade, derivatives, order book, historical, social and blockchain data.