October has seen major developments in the digital asset space. Six ETH Futures ETFs commenced trading on the 2nd, providing investors with a vehicle to gain exposure to ETH futures. Shortly after, Bitcoin's price surged by 7.56% in less than an hour to a peak of $30,009 driven by rumours surrounding BlackRock's application.

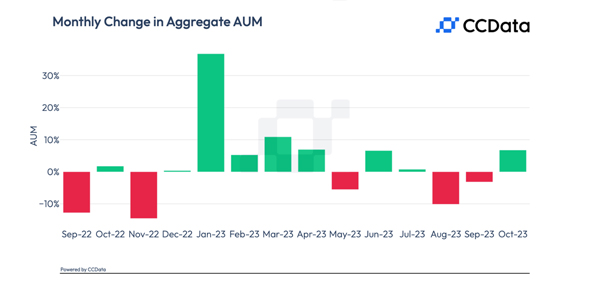

In response to these positive developments, the total assets under management (AUM) for digital asset products surged by 6.74% to reach $31.7 billion, marking the first increase since July 2023. This shift is further exemplified by the narrowing of the Grayscale discount, which has reached its lowest level since 12.6% on October 18th.

Download the full report here.

Key takeaways:

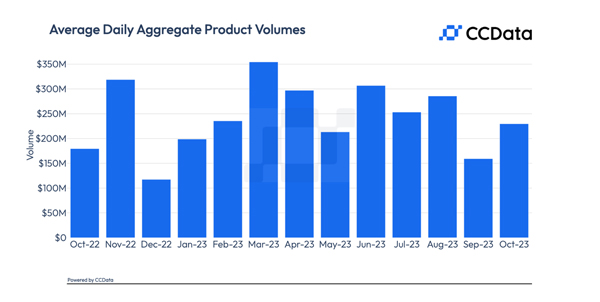

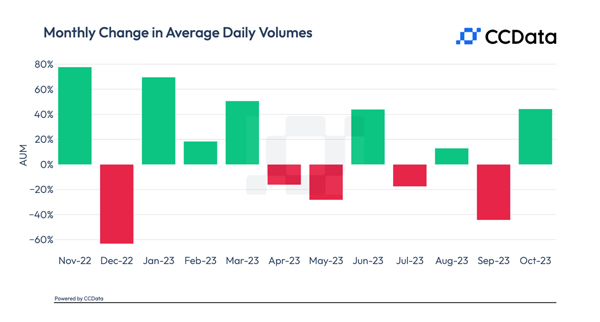

- In October, the total assets under management (AUM) for digital asset products surged by 6.74% to reach $31.7 billion, marking the first increase since July 2023. Average daily aggregate volumes of digital asset investment products also experienced a notable increase, rising 44.3% to $230 million.

- On October 16th, Bitcoin's price surged following rumours of the acceptance of the BlackRock Bitcoin Spot ETF application. Within less than an hour, the price increased by 7.56%, reaching a high of $30,009 and hinting at the possible impact of an ETF approval. Following the initial rumours and a subsequent price dip, Bitcoin has made a strong recovery, with a 28.3% increase from the start of the month up to the 25th. It is currently trading at $34,000 levels.

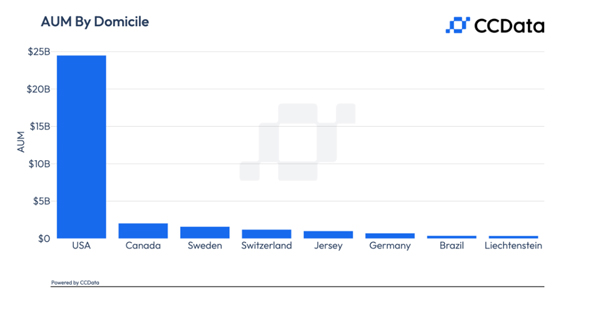

- The United States maintained its dominance in AUM by domicile, with a 3.22% increase to reach $24.5 billion, capturing 77.3% of the market share. Other AUM growth was concentrated in Canada, which accounts for 6.39% of the digital asset product market. Canada saw its AUM increase to $2.03 billion. Germany also observed a notable 16.0% growth to reach $698 million.

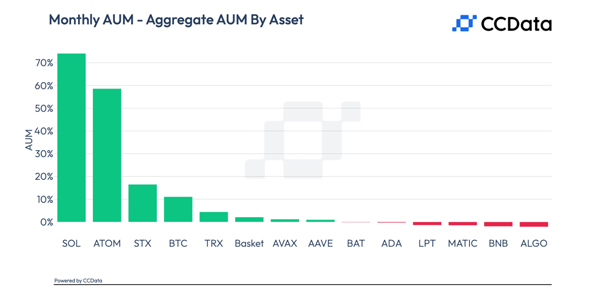

- SOL-based products experience highest percentage increase in AUM

In October. AUM for Bitcoin-based products increased 11.1% to $23.2 billion, recording 73.3% in market share (up from 70.5% in September). ETH-based products, however, saw a decline despite the newly launched ETFs. SOL-based products saw the highest increase in AUM, rising 74.1% to $140 million. - Crypto-related stocks experienced major decline compared to BTC in October. Crypto-related stocks declined against Bitcoin for the second month in a row. COIN (Coinbase Global Inc), RIOT (Riot Platforms Inc), and GLXY (Galaxy Digital Holdings Ltd), all saw declines of 0.56%, 4.93% and 3.01%, respectively.

Digital Asset AUM Sees First Increase Since July Following ETF Rumours

In response to positive market developments in October, the total assets under management (AUM) for digital asset products surged by 6.74% to reach $31.7 billion, marking the first increase since July 2023.

AUM for Bitcoin-based products increased 11.1% to $23.2 billion, recording 73.3% in market share (up from 70.5% in September). ETH-based products, however, saw a decline despite the newly launched ETFs. Aggregate products recorded a decrease of 5.45% to $6.35 billion, recording a market share of 20.1% (down from 22.6% in September).

Average Daily Digital Asset Product Volumes Increase Over 40% In October

In October, the average daily aggregate volumes of digital asset investment products experienced a notable increase of 44.3% to $230 million. The increase reflected the positive sentiment of market participants surrounding ETF approvals.

In terms of product volumes, ProShares BITO continued to dominate volumes with an increase of 30.0% to $104 million in average daily volumes, The increase came after a decrease of 48.0% from September. Grayscale’s GBTC followed with an average daily volume of $62.0 million, a significant 73.7% increase from September.

SOL-Based Products Experience Over 74% Increase in AUM

In October. AUM for Bitcoin-based products increased 11.1% to $23.2 billion, recording 73.3% in market share (up from 70.5% in September). Eth-based products, however, saw a decline despite the newly launched ETFs. SOL-based products saw the highest increase in AUM, rising 74.1% to $140 million.

U.S. Maintains Dominant Region for Digital Asset AUM

The United States maintained its dominance in AUM by domicile, with a 3.22% increase to reach $24.5 billion, capturing 77.3% of the market share. Canada saw its AUM increase to $2.03 billion, mainly due to the performance of products such as Evolve EBIT, Purpose Invest BTCC and 3iQ CoinShares BTCQ.

Germany also observed a notable 16.0% growth to reach $698 million, driven by products like ETC Group BTCE, which increased by 21.0% to $552 million.

The information provided by this report does not constitute any form of advice or recommendation by CCData. Any redistribution of charts appearing in this Review must cite CCData as the sole provider and creator.

About CCData

CCData is an FCA-authorised benchmark administrator and global leader in digital asset data, providing institutional-grade digital asset data and settlement indices. By aggregating and analysing tick data from globally recognised exchanges and seamlessly integrating multiple datasets, CCData provides a comprehensive and granular overview of the market across trade, derivatives, order book, historical, social and blockchain data.