CCData's latest Stablecoins & CBDCs Report offers insight into the latest developments in the stablecoin and CBDC sector, focusing on analysis that relates to market capitalisation, trading volume, peg deviation and more.

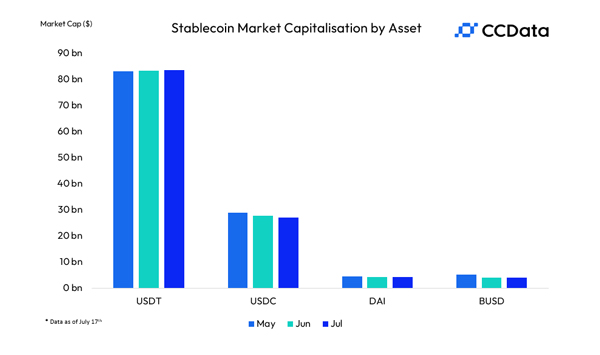

In July, USDT continued to exert its dominance, recording a new all-time high market cap of $83.8bn (as of July 17th). TetherUSD now accounts for 65.9% of the stablecoins sector by market cap.

The market capitalisation of USDC and BUSD continued to decline, falling 3.01% and 4.57% to $26.9bn and $3.96bn, respectively. This is the seventh consecutive month of decline in market capitalisation for USDC and its lowest market cap since June 2021.

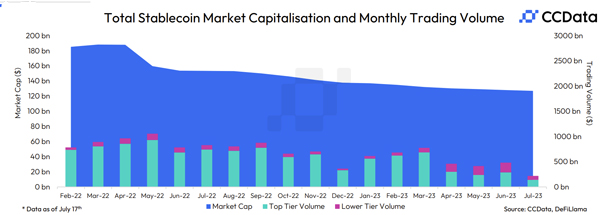

- In July, the trend surrounding the declining market capitalisation of stablecoins continued for the 16th consecutive month, falling 0.82% to $127bn. This is now the lowest stablecoins market cap reached since August 2021. Meanwhile, the market cap dominance of stablecoins fell to 10.3% from 10.5% in July. (data as of the 17th).

- The price of USDT and USDC fell as low as $0.73 and $0.82 on Binance US in July. The discount associated with stablecoins and other assets on the exchange is likely a response to the suspension of fiat operations last month, following the SEC’s lawsuit.

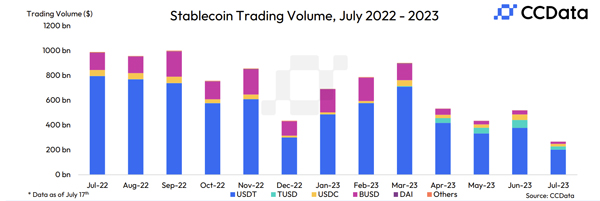

- Stablecoin trading volume rose 16.6% to $483bn in June, recording the first increase in monthly trading volume since March as the filing of spot ETF applications by multiple TradFi companies resulted in a rise in trading activity. As of the 17th of July, only $219bn has been traded.

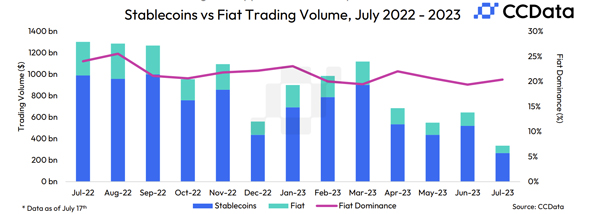

- In June, the trading volume of fiat trading pairs rose 10.4% to $125bn, however, the market share of fiat trading pairs fell to its all-time low against stablecoins trading pairs by volume, reaching 19.4%.

USDT Continues To Dominate Stablecoin Landscape

In July, USDT continued to exert its dominance, recording a new all-time high market cap of $83.8bn (as of July 17th). TetherUSD now accounts for 65.9% of the stablecoins sector by market cap.

The market capitalisation of USDC and BUSD continued to decline, falling 3.01% and 4.57% to $26.9bn and $3.96bn, respectively. This is the seventh consecutive month of decline in market capitalisation for USDC and its lowest market cap since June 2021.

Stablecoin Market Cap Declines for 16th Consecutive Month

In July, the total market capitalisation of stablecoins fell 0.82% to $127bn, the lowest stablecoins market cap since August 2021. This is the sixteenth consecutive month of decline in stablecoins market capitalisation.

Stablecoin market dominance is currently at 10.3%, falling from 10.5% in June. This is currently below its all-time high of 16.6% recorded in December 2022.

Stablecoin Trading Volume Rises For the First Time Since March

In June, stablecoin trading volumes rose 16.6% to $482bn, after the filing of spot Bitcoin ETFs by multiple TradFi companies, including BlackRock and Fidelity, spiked the optimism and trading activity in the market. This was the first increase in monthly stablecoin trading volumes since March 2023.

Stablecoins trading volume on centralised exchanges reached $219bn in July (as of the 16th).

Fiat Dominance Hits All-Time Low As Exchanges Grapple With On-Ramp Issues

In June, the trading volume of fiat trading pairs rose 10.4% to $125bn, however, the market share of fiat trading pairs fell to its all-time low against stablecoins trading pairs by volume, reaching 19.4%.

The decline in fiat dominance and trading volumes in comparison to stablecoins could be attributed to the ongoing issues of several exchanges with their fiat banking partner.

The information provided by this report does not constitute any form of advice or recommendation by CCData. Any redistribution of charts appearing in this Review must cite CCData as the sole provider and creator.

CCData is an FCA-authorised and regulated global leader in digital asset data, providing institutional and retail investors with high-quality real-time and historical data and index solutions. Leveraging its track record of success in data expertise, CCData's thought-leadership reports and analytics offer objective insights into the digital asset industry.

.jpg)