CCData's latest Stablecoins & CBDCs Report offers insight into the latest developments in the stablecoin and CBDC sector, focusing on analysis that relates to market capitalisation, trading volume, peg deviation and more.

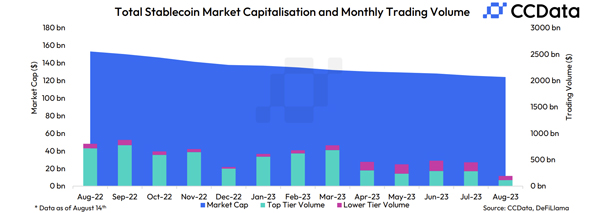

The total stablecoin market cap continued to decrease in August, recording its 17th consecutive month of decline, falling 1.28% to $124bn. This is the lowest stablecoin market cap recorded since August 2021

Access the full report here.

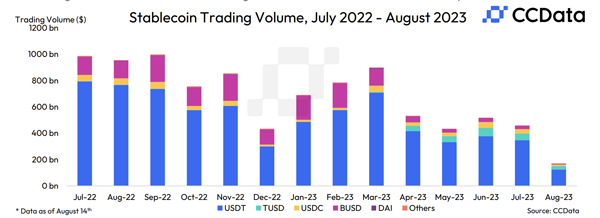

- Stablecoin trading volumes fell 6.14% to $453bn as volatility continued to decline. The end-of-month stablecoin volumes for July were the second-lowest monthly stablecoin trading volume recorded on centralised exchanges this year, and the third-lowest since April 2019.

- In August, the market cap of USDT fell 0.62% to $83.3bn, recording the first decline in end-of-month market cap for USDT since October 2022. The market cap dominance of USDT, however, rose to 67.1% from 66.7% with all of the top stablecoins registering a decline in market cap in August.

- The market cap of First Digital Labs’ FDUSD stablecoin jumped 1410% to $305mn in August, following its launch on Binance last month. The FDUSD trading pairs - which were introduced on Binance with a zero-fee trading promotion - reached $507mn in August (as of the 14th). This makes FUSD the fifth most active stablecoin pair on the exchange.

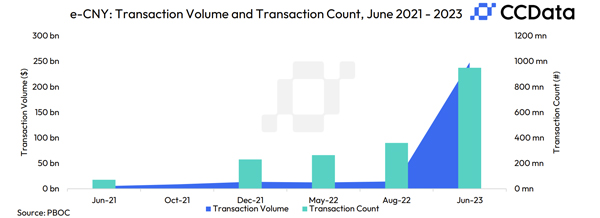

- The latest update from China's Central Bank indicates a 1600% increase in the transaction volume of the Chinese CBDC, e-CNY, which now stands at 1.8tn RMB or $248bn compared to figures published in August 2022.

- In August, PayPal launched its USD-pegged stablecoin, PYUSD, on Ethereum. The fully diluted market cap of the stablecoin is currently $27mn. The stablecoin was launched by PayPal to offer cost-effective transactions, programmable capabilities, and swift settlement times compared to traditional methods.

FDUSD Becomes the 10th Largest Stablecoin After Launching on Binance

First Digital Labs’ FDUSD, which was launched last month, has seen its market cap jump 1410% to $305mn in August following its launch on Binance. The trading volumes on FDUSD pairs reached $507mn in August, however, the stablecoin is still only the fifth largest stablecoin on Binance.

Trading volumes for the stablecoin are set to benefit from Binance's zero-fee trading promotion, with more trading pairs yet to be listed. Currently, the USDT-FDUSD trading pair is the most active, trading $437mn and accounting for 86.2% of the trading volume of the stablecoin.

Stablecoin Market Cap Declines for 17th Consecutive Month

In August, the total market capitalisation of stablecoins fell 1.28% to $124bn, the lowest stablecoins market cap since August 2021. This is the seventeenth consecutive month of decline in stablecoins market capitalisation.

BUSD and TUSD saw significant declines of 9.35% and 9.15% to $3.37bn and $2.75bn, respectively, likely due to the launch of the new stablecoin, First Digital USD (FDUSD) on Binance.

E-CNY Transaction Volume Surges as China Onboards New Utilities for CBDC

As per the latest update from China’s Central Bank Governor, the transaction volume of the Digital Yuan reached 1.8tn RMB or $248bn as of June 2023. The number of transactions made using the e-CNY also surged to 950mn. This represents a 1600% increase in transaction volume and a 164% increase in transaction count from the previous update in August 2022

The surge in transaction volume and count coincides with an increased effort from the government to bring new utility to the digital currency.

Stablecoins Trading Volume Reaches Second Lowest Monthly Volume of the Year

In July, stablecoin trading volumes fell 6.14% to $453bn as volatility continued to decline. This was the second-lowest monthly stablecoin trading volume on centralised exchanges this year and the third-lowest monthly stablecoin volume since April 2019.

Stablecoin trading volumes on centralised exchanges have reached $194bn in August (as of the 13th) and are on track to record historically low monthly figures.

The information provided by this report does not constitute any form of advice or recommendation by CCData. Any redistribution of charts appearing in this Review must cite CCData as the sole provider and creator.

CCData is an FCA-authorised and regulated global leader in digital asset data, providing institutional and retail investors with high-quality real-time and historical data and index solutions. Leveraging its track record of success in data expertise, CCData's thought-leadership reports and analytics offer objective insights into the digital asset industry.