CCData is delighted to announce the launch of the industry's first institutional-grade ESG Benchmark and underlying data solutions.

ESG mandates are becoming increasingly prevalent amongst institutional investors and funds, with global ESG-related assets under management (AUM) forecasted to reach $33.9 trillion by 2026. The ESG Benchmark was created to meet the increased demand from ESG-focused investors and support the development of ESG indices and financial products.

This new benchmark, created by CCData in partnership with CCRI, provides a framework for assessing the ESG risks and opportunities associated with 40 of the largest, most liquid digital assets, over 11 core categories of evaluation.

Key Findings:

- Ethereum was the only asset to achieve an AA grade in the first ESG Benchmark, followed by Solana and Cardano with a grade A. Looking at individual categories, Stellar Lumens led in the environmental section, while Ethereum and Polkadot topped the Social and Governance categories, respectively. Despite strong social and governance scores, Bitcoin placed 20th overall, due to its large electrical consumption.

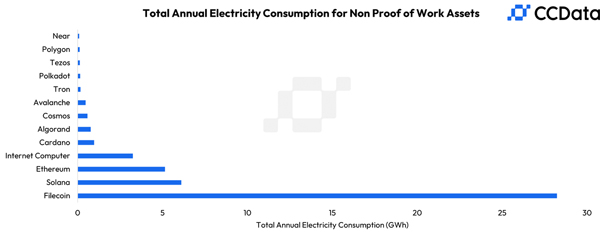

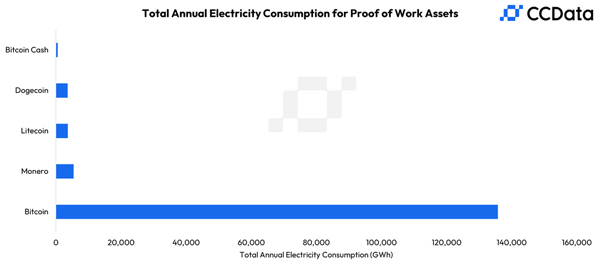

- 90% of the electricity consumed by the analysed assets can be attributed to Bitcoin. The environmental concerns regarding the electricity intensity of digital assets remain central, with Bitcoin consuming more than 100 TWh per year. Some of the analysed Proof-of-Stake assets consume 10,000 times less electricity than BTC.

- 62.5% of the analysed assets have a carbon intensity of electricity usage that is lower than the current global average of 459 gCO₂/kWh. The carbon intensity of most examined assets typically falls between 300 tbo 400 gCO₂/kWh, which is just under the global average of 459 gCO₂/kWh. Proof-of-Work-based assets showcase a higher carbon intensity of around 500gCO₂/kWh.

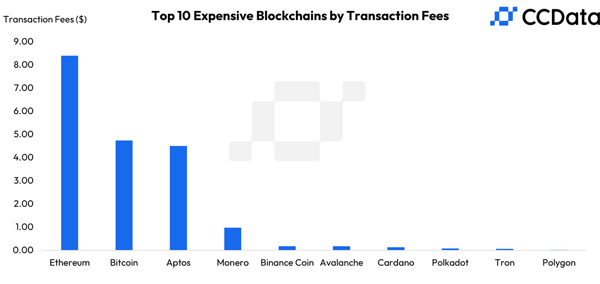

- $2.98 is the average transaction fee required to transact on the analysed blockchains and protocols. Despite the availability of blockchains with low transaction fees, average transaction costs are still high, with the majority of transactions occurring on blockchains with high fees.

- The top 10 wallets control 50% or more of the token supply for 20% of the analysed assets. The concentration of wealth and power is rising among protocols. This is concerning as the unequal distribution of protocol tokens significantly undermines fairness within the industry, posing a substantial threat to inclusivity.

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

Ethereum Tops First ESG Asset Ratings While Bitcoin Places 20th

Ethereum was the only asset to achieve an AA grade in the first ESG Benchmark, followed by Solana and Cardano with a grade A. Looking at individual categories, Stellar Lumens led in the environmental section, while Ethereum and Polkadot topped the Social and Governance categories, respectively.

Despite strong social and governance scores, Bitcoin placed 20th overall, due to its large electrical consumption.

Differences In Extent of Electricity Consumption Remains Striking

The environmental concerns regarding the electricity intensity of digital assets remain central, with Bitcoin consuming more than 100 TWh per year. Some Proof-of-Stake-based assets, however, consume 10,000 times less electricity than Bitcoin, with the largest asset by market capitalisation accounting for ~90% of the electricity consumed by analysed assets.

Average Transaction Costs Remain High

Despite the availability of Blockchains with low transaction fees, the majority of transactions occur on blockchains with high fees. $2.98 is the average transaction fee required to transact on the analysed blockchains and protocols. This high fee requirement creates barriers to entry, hampers adoption, and impacts the accessibility and inclusivity of blockchains.

Looking for custom ESG data solutions?

The benchmark offers digital asset ESG ratings for 40 of the largest, most liquid crypto assets and is supported by thousands of hours of research, utilising both qualitative and quantitative metrics to assess a broad range of ESG parameters.

If you would like to enquire about any of the underlying ESG data, then please contact us at sales@ccdata.io. Complete ESG data and rankings are available, while constituent data from environmental, social and governance can also be derived for more detailed analysis in each of these distinct areas.

Learn About CCData's ESG Data Solutions