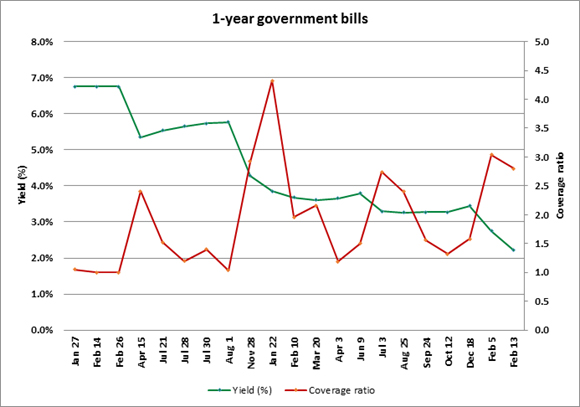

- Jordanian government bond yields continued to drop, as 1-year T-bill yields dropped to reach a low of 2.213%, down 124 basis points so far in 2015.

- The auction follows the CBJ’s decision to cut rates by 25 basis points effective July 9th, in view of the issuance of a $1.5 billion Eurobond, couple with weak GDP and credit growth.

- Meanwhile, coverage ratios for all government bonds remained high above 290%.

Furthermore, today, the CBJ cut the amount of weekly CD’s auctioned from 1 billion JD to 900 million JD, in an indication that it will gradually drop the amount.

- This will push excess liquidity levels further up and reduce rates in the market, as banks will have fewer alternatives to park excess liquidity.

- Overall, the significant drop in rates highlights the drop in the government’s need to borrow coupled with high levels of liquidity in the banking system, and indicates a low interest rate environment with historically low yields.

- The drop in yields is mainly due to the new monetary policy framework introduced by CBJ in February and the recent rate cut, and the positive effect lower oil prices on government balances and external accounts may have.

- Meanwhile, excess liquidity levels have increased to reach 4 billion JD (including 1 billion JD weekly CDs), leading to downward pressure on rates.

- Looking ahead, yields could drop further, as the government is planning on issuing a $500 million bond not guaranteed by the U.S. government, while it is also planning on issuing Sukuks this year.

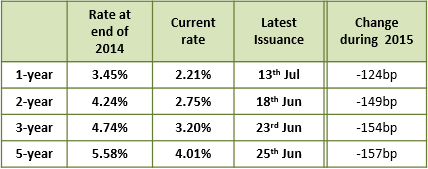

- Bond yields have dropped across all durations, as show in the table below: