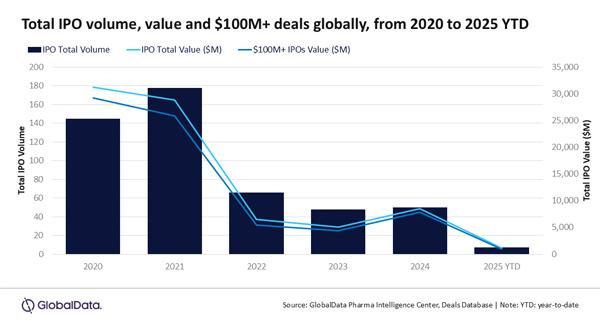

Biopharmaceutical initial public offerings (IPOs) saw an upturn in 2024, with 50 completed IPOs raising $8.52 billion, a 68.4% increase from the $5.06 billion raised in 2023 and marking the highest total IPO value raised since 2021. This rebound, driven by US Federal Reserve interest rate cuts, marks the highest total since 2021. While cautious, investors are showing increased interest in companies with strong clinical data, signaling a recovery in the public markets and a shift toward more advanced-stage biopharmaceuticals, says GlobalData, a leading data and analytics company.

According to GlobalData’s Pharmaceutical Intelligence Center Deals Database, completed IPOs that raised more than $100 million almost doubled, from $4.39 billion across 15 IPOs in 2023 to $7.88 billion across 24 IPOs in 2024.

Alison Labya, Business Fundamentals Analyst at GlobalData, comments: “The increase in the number of high-value IPOs in 2024 suggests that while public investors remain selective, increased capital availability due to interest rate cuts has facilitated investments in biopharmaceutical companies with a strong value proposition.”

The largest biopharmaceutical IPO completed in 2024 was Switzerland-based dermatology company Galderma, which raised $2.48 billion. Galderma’s IPO followed a planned IPO in February 2022 that did not close, as well as Galderma postponing its IPO in March 2023 amid market volatility.

Labya adds: “Despite the overall increase in IPO value raised, discovery and preclinical-stage companies saw a four-fold drop in total IPO value from $490.6 million in 2023 to $112.5 million in 2024, indicating a shift in public investor preference towards more advanced stage companies.”

However, IPO activity could be dampened by an anticipated increase in private biopharmaceutical M&A in 2025 as companies seek to refill their pipelines ahead of upcoming patent expirations.

Labya concludes: “The US President Donald Trump’s administration has introduced uncertainty to the biopharmaceutical industry across healthcare policies, drug pricing reforms, and regulatory frameworks, all of which could impact investor confidence. Additionally, Trump’s recent tariff announcement on imports from Canada, Mexico, and China has led to increased market volatility, potentially delaying IPOs as investors await the countries’ responses to the tariffs.”

Note: Includes all completed IPO deals for companies headquartered globally from 2020–2025 YTD. Includes deals where deal values are disclosed in the public domain.