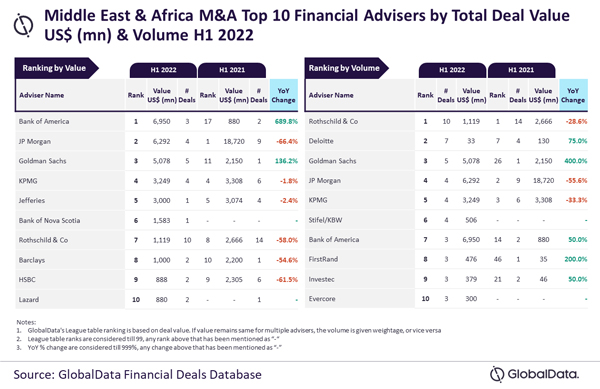

Bank of America and Rothschild & Co have emerged as the top mergers and acquisitions (M&A) financial advisers in the Middle East & Africa region for H1 2022 by value and volume, respectively, according to the latest Financial Advisers League Table by GlobalData, a leading data and analytics company.

GlobalData’s Financial Deals Database reveals that Bank of America achieved its leading position by value by advising on $7 billion worth of deals. Meanwhile, Rothschild & Co led by volume by advising on a total of 10 deals.

According to GlobalData’s report, ‘Global and Middle East & Africa M&A Report Financial Adviser League Tables H1 2022’, a total of 609 M&A deals worth $46.2 billion were announced in the region during H1 2022.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Rothschild & Co was the only firm to register double-digit deal volume but lagged behind in terms of value and had to settle for the seventh position in terms of this metric. Meanwhile, Bank of America, which advised on about one-third of the number of deals advised by Rothschild & Co, has managed to top by value. The involvement in the $6.7 billion Gold Fields–Yamana Gold deal played a pivotal role for Rothschild & Co in securing the top position by value.”

An analysis of GlobalData’s Financial Deals Database reveals that JP Morgan occupied the second position by value by advising on $6.3 billion worth of deals, followed by Goldman Sachs with $5.1 billion, KPMG with $3.2 billion and Jefferies with $3 billion.

Meanwhile, Deloitte occupied the second position in terms of volume with seven deals, followed by Goldman Sachs with five deals, JP Morgan with four deals and KPMG with four deals.