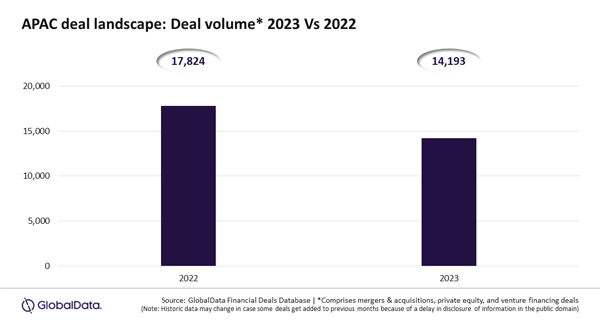

In line with the global trend, the deal activity in the Asia-Pacific (APAC) region remained subdued in 2023. A total of 14,193 deals (mergers & acquisitions (M&A), private equity (PE) and venture capital (VC)) were announced in the region during 2023, a decline of 20.4% compared to the 17,824 deals announced during the previous year, according to GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Deal Database reveals that all the deal types under the coverage recorded decline in volume during the year. The number of M&A deals declined by 13.5%, whereas the volume of PE and VC deals were down by, 24.7% and 26.3%, respectively.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Mirroring the global trend, every category of deals saw a downturn over the year, with PE/VC firms experiencing a particularly significant decrease in deal-making activities.

“Investor sentiment took a substantial hit in 2023, attributed to macroeconomic challenges, inflation, elevated interest rates, concerns about recession, and ongoing geopolitical conflicts.”

Meanwhile, deal activity remained subdued across most of the key markets in the APAC region during the year. For instance, leading APAC markets China, India, Japan, Australia, South Korea, Singapore, Hong Kong, Indonesia and New Zealand witnessed decline in deal volume by 16%, 26.1%, 15.9%, 22.4%, 30%, 21.3%, 25.9%, 34.2% and 13.6%, respectively, during 2023 compared to 2022.

.jpg)