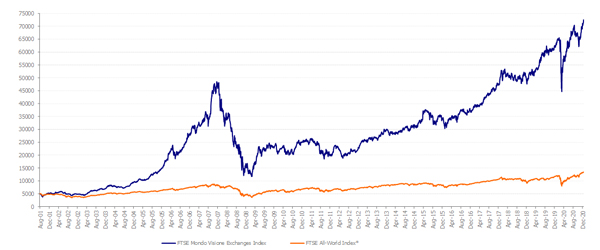

In a tumultuous year dominated by the coronavirus pandemic, financial markets have seen a return to the kind of volatility last seen a decade earlier in the financial crisis. No matter how well they are managed, exchanges are still sensitive with respect to the direction of the market. One way to view them is as a call on the next bull market – they remain profitable in a bear market and could become interesting money machines in the next upturn.

The three months to the end of December saw the FTSE Mondo Visione Exchanges Index up by 8.9%. Greece's Hellenic Exchanges was the best performing exchange in the quarter with Euronext being the worst performer.

The FTSE Mondo Visione Exchanges Index ended the month up 7.2% at 72,499.80 points, up from 67,638.94 on 30 November 2020, setting a new closing all time high of 72,499.80 on 31 December 2020.

Hong Kong Exchanges & Clearing Group ended December as the world's largest exchange operator by market capitalisation.

The top 5 exchanges by market capitalisation at end December were:

| Exchange | Market Cap (USD bn) |

| Hong Kong Exchanges & Clearing | 69.49 |

| CME Group | 64.50 |

| Intercontinental Exchange | 63.73 |

| London Stock Exchange Group | 38.74 |

| Deutsche Boerse | 31.25 |

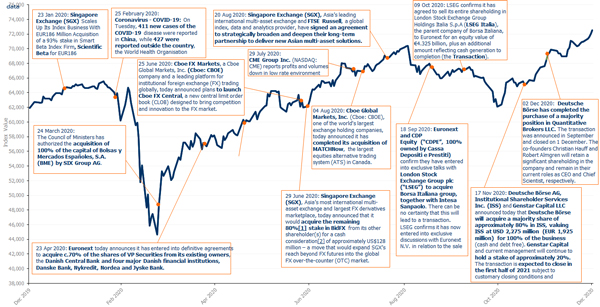

FTSE MONDO VISIONE EXCHANGES INDEX AND THE FTSE ALL-WORLD INDEX PERFORMANCE SINCE 17 AUGUST 2001 (USD CAPITAL RETURN)

Herbie Skeete, Managing Director, Mondo Visione and Co-founder of the Index said:

"There was no shortage of M&A activity in 2020. The purchase by Nasdaq of anti-money-laundering specialist Verafin, S&P Global's purchase of IHS Markit, London Stock Exchange Group soon to be completed acquisition of Refinitiv, the acquisition by Deutsche Boerse of Institutional Shareholder Services are prime examples of the consolidating global exchanges, financial data and information services space as data providers seek to join the dots, with the intention of providing an integrated set of products capable of inter-operating providing full support to the trading process and the surrounding ecosystem across all asset classes now and yet to be invented, enabled or indeed patented by Big Exchange Tech. Where will this all end? Perhaps with financial infrastructure behemoths being too scary and big for regulators to stomach."

Andre Cappon, President of The CBM Group, a New York- based consultancy focused on capital markets said:

"Exchanges and market infrastructures are in the middle of yet another wave of consolidation.

The initial wave, which occurred in the years 2000-2008 was about in-country, regional and global consolidation. That wave is mostly over in the Americas and Europe, though it may still have some room to run in emerging markets.

The current wave seems focused on exchanges and market infrastructures penetrating new asset classes and integrating across the pre-trade space, the trade and post-trade spaces. It seems clear that leading global exchanges are becoming giant integrated market utilities able to support the entire investment process. They already are in overt competition with the sell-side. They have the advantage of being central hubs.

As the Mondo Visione analysis shows, global exchanges and market infrastructures currently are at the peak of their game. Their economic performance and valuations are very strong, a true golden era of giant deals at giant valuations.

Regulators will undoubtedly be worried about concentration of market power. More significantly, new competitors will emerge. They will advantage of new technologies, such as ubiquitous, super-fast internet, blockchain and artificial intelligence to develop new decentralized architectures for the capital markets"

Greece's Hellenic Exchanges was the best performer in December by capital returns in US dollars with a 25.7 per cent increase in share price from 30 November 2020 to 31 December 2020. The next two best performers were Bulgarian Stock Exchange with a 21.1 per cent increase and Croatia's Zagrebacka Burza with a 16.3 per cent increase over the same period.

The FTSE Mondo Visione Exchanges Index worst performer in December by capital returns in US dollars was Philippine Stock Exchange with a 3.1per cent decrease in share price from 30 November 2020 to 31 December 2020. The next two worst performers at the bottom of the table were ASX with a 2.2 per cent decrease and JSE with a 2.1 per cent decrease over the same period.

The FTSE Mondo Visione Exchanges Index rose by 8.9 per cent in the fourth quarter of 2020 as opposed to a rise of 6.0 per cent in the third quarter of 2020 and a rise of 3.1 per cent in the fourth quarter of 2019.

In Q4 2020, the FTSE Mondo Visione Exchanges Index best performer by capital returns in US dollars was Greece's Hellenic Exchanges with a 44.1 per cent increase in share price from 1 October to 30 September 2020. The next two best performers were NZX with a 31.8 per cent increase and Aquis Exchange with a 30.8 per cent increase.

In Q4 2020, the FTSE Mondo Visione Exchanges Index worst performer by capital returns in US dollars was Euronext with a 12.0 per cent decrease in share price from 1 October to 30 September 2020. The next two worst performers at the bottom of the table were Japan Exchange Group with an 8.2 per cent decrease and Kenya's Nairobi Securities Exchange with a 6.2 per cent decrease.

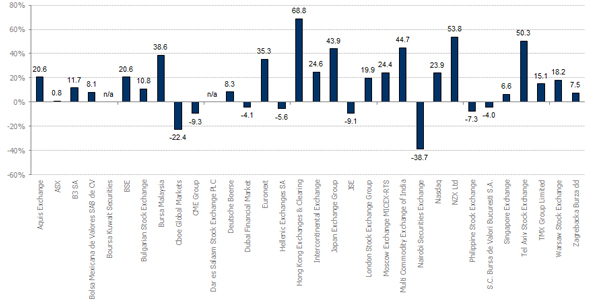

In 2020, the FTSE Mondo Visione Exchanges Index best performer by capital returns in US dollars was Hong Kong Exchanges & Clearing with a 68.8 per cent increase in share price. The next two best performers were NZX with a 53.8 per cent increase and Tel Aviv Stock Exchange with a 50.3 per cent increase.

In 2020, the FTSE Mondo Visione Exchanges Index worst performer by capital returns in US dollars was Kenya's Nairobi Securities Exchange with a 38.7 per cent decrease in share price. The next two worst performers at the bottom of the table were Cboe Global Markets with a 22.4 per cent decrease and CME Group with a 9.3 per cent decrease.

1 YEAR CONSTITUENT PERFORMANCE (USD CAPITAL RETURN)

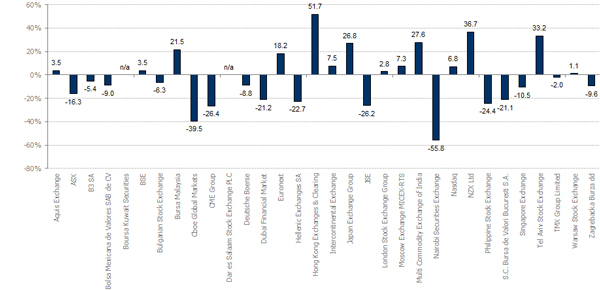

1 YEAR EXCESS CAPITAL RETURNS AGAINST THE FTSE MONDO VISIONE EXCHANGES INDEX (USD CAPITAL RETURN)

1-YEAR PERFORMANCE CHART OF THE FTSE MONDO VISIONE EXCHANGES INDEX (USD CAPITAL RETURN)

Click here to download December's performance report, including the quarterly analysis.

Monthly FTSE Mondo Visione Exchanges Index Performance (Capital Return, USD)

|

July 2014 |

3.1% |

|

August 2014 |

2.3% |

|

September 2014 |

-3.6% |

|

October 2014 |

2.8% |

|

November 2014 |

2.5% |

|

December 2014 |

-0.5% |

|

January 2015 |

-1.0% |

|

February 2015 |

8.5% |

|

March 2015 |

0.0% |

|

April 2015 |

10.7% |

|

May 2015 |

0.1% |

|

June 2015 |

-3.2% |

|

July 2015 |

-2.7% |

|

August 2015 |

-5.3% |

|

September 2015 |

-2.1% |

|

October 2015 |

7.6% |

|

November 2015 |

0.4% |

|

December 2015 |

-2.2% |

|

January 2016 |

-4,7% |

|

February 2016 |

-0.7% |

|

March 2016 |

6.7% |

|

April 2016 |

0.4% |

|

May 2016 |

1.8% |

|

June 2016 |

-2.2% |

|

July 2016 |

5.3% |

|

August 2016 |

2.3% |

|

September 2016 |

-1.6% |

|

October 2016 |

-1.6% |

|

November 2016 |

2.1% |

|

December 2016 |

0.1% |

|

January 2017 |

6.0% |

|

February 2017 |

-0.8% |

|

March 2017 |

1.4% |

|

April 2017 |

0.8% |

|

May 2017 |

1.6% |

|

June 2017 |

5.6% |

|

July 2017 |

2.7% |

|

August 2017 |

0.3% |

|

September 2017 |

3.6% |

|

October 2017 |

-0.7% |

|

November 2017 |

6.4% |

|

December 2017 |

-0.7% |

|

January 2018 |

10% |

|

February 2018 |

-0.5% |

|

March 2018 |

-1.6% |

|

April 2018 |

-1.0% |

|

May 2018 |

-1.5% |

|

June 2018 |

-0.8% |

|

July 2018 |

-0.7% |

|

August 2018 |

2.4% |

|

September 2018 |

-1.7% |

|

October 2018 |

1.0% |

|

November 2018 |

3.1% |

|

December 2018 |

-4.2% |

|

January 2019 |

5.4% |

|

February 2019 |

1.7% |

|

March 2019 |

-2.6% |

|

April 2019 |

4.6% |

|

May 2019 |

1.5% |

|

June 2019 |

4.3% |

|

July 2019 |

2.2% |

|

August 2019 |

3.7% |

|

September 2019 |

-0.8% |

|

October 2019 |

2.0% |

|

November 2019 |

-0.5% |

|

December 2019 |

1.6% |

|

January 2020 |

5.0% |

|

February 2020 |

-7.4% |

|

March 2020 |

-11.5% |

|

April 2020 |

8.0% |

|

May 2020 |

6.7% |

|

June 2020 |

2.3% |

|

July 2020 |

6.6% |

|

August 2020 |

4.9% |

|

September 2020 |

-5.2% |

|

October 2020 |

-6.7% |

|

November 2020 |

8.9% |

|

December 2020 |

7.2% |

About FTSE Mondo Visione Exchanges Index

The FTSE Mondo Visione Exchanges Index, a joint venture between FTSE Group and Mondo Visione, was established in 2000.

It is the first Index in the world to focus on listed exchanges and other trading venues. The FTSE Mondo Visione Exchanges Index compares performance of individual exchanges and trading platforms and provides a reliable barometer of the health and performance of the exchange sector.

It enables investors to track 32 publicly listed exchanges and trading floors and focuses attention of the market on this important sector.

The FTSE Mondo Visione Exchanges Index includes all publicly traded stock exchanges and trading floors:

- Aquis Exchange

- Australian Securities Exchange Ltd

- B3 SA

- Bolsa Mexicana de Valores SA

- Boursa Kuwait Securities

- BSE

- Bulgarian Stock Exchange

- Bursa de Valori Bucuresti SA

- Bursa Malaysia

- Cboe Global Markets

- CME Group

- Dar es Salaam Stock Exchange PLC

- Deutsche Bourse

- Dubai Financial Market

- Euronext

- Hellenic Exchanges SA

- Hong Kong Exchanges and Clearing Ltd

- Intercontinental Exchange Inc

- Japan Exchange Group, Inc

- Johannesburg Stock Exchange Ltd

- London Stock Exchange Group

- Moscow Exchange

- Multi Commodity Exchange of India

- Nairobi Securities Exchange

- Nasdaq

- New Zealand Exchange Ltd

- Philippine Stock Exchange

- Singapore Exchange Ltd

- Tel Aviv Stock Exchange

- TMX Group

- Warsaw Stock Exchange

- Zagreb Stock Exchange

The FTSE Mondo Visione Exchanges Index is compiled by FTSE Group from data based on the share price performance of listed exchanges and trading platforms.