As 2024 draws to a close, the global exchange sector continues to demonstrate resilience and growth, driven by robust business models, increased trading activity, and strategic advancements. Exchanges are benefiting from a rise in non-trading revenues, equity and derivatives trading, and IPO volumes, setting an optimistic tone for the year ahead.

The FTSE Mondo Visione Index, a leading benchmark for the performance of publicly listed exchanges, closed November at 84,718.72 points, up 2.6% from October’s close of 82,561.44 points.

Top Exchanges by Market Capitalisation in November 2024:

Exchange |

Market Cap (USD bn) |

| Intercontinental Exchange | 92.30 |

| CME Group | 85.69 |

| London Stock Exchange Group | 76.72 |

| Nasdaq | 47.75 |

| Hong Kong Exchanges & Clearing | 47.22 |

Standout Performers of the Month

Aquis Exchange, a UK-based challenger stock exchange listed on the London Stock Exchange, emerged as the top performer in November, with an extraordinary 108.4% share price increase. The strong growth comes as Aquis is set to be acquired by SIX Group in a deal valued at £194 million, representing a staggering 120% premium.

Herbie Skeete, Managing Director of Mondo Visione and Co-founder of the Index, commented:

“Aquis Exchange’s acquisition by SIX is strategically significant. While it may not drive immediate earnings growth, it offers long-term value by expanding SIX’s geographic reach, enhancing technological capabilities, and diversifying revenue streams. This acquisition positions SIX to remain competitive in an evolving market landscape.”

Other notable performers include the Tel Aviv Stock Exchange, which saw an 18.9% rise in share price, and Nasdaq, with a 12.3% increase.

Exchanges Facing Challenges

On the other hand, S.C. Bursa de Valori Bucuresti S.A. recorded the steepest decline in November, with an 18% drop in share price. Brazil’s B3 followed with a 15.5% decrease, and the Saudi Tadawul Group experienced a 9.7% decline.

Looking Ahead

Global exchanges are expected to continue focusing on scaling and diversifying their offerings, particularly in data, analytics, and technology. By enhancing capabilities and competitiveness, exchanges are positioning themselves to capitalize on future growth opportunities in an increasingly dynamic market.

For a detailed breakdown of November’s performance, click here to download the report.

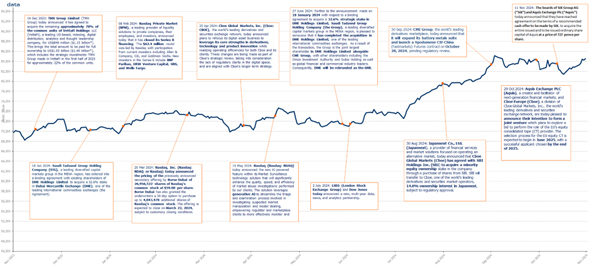

Performance Chart Of The FTSE Mondo Visione Exchanges Index (USD Capital Return)

Source: FTSE Group, data as at 29 November 2024

Monthly FTSE Mondo Visione Exchanges Index Performance (Capital Return, USD)

|

July 2014 |

3.1% |

|

August 2014 |

2.3% |

|

September 2014 |

-3.6% |

|

October 2014 |

2.8% |

|

November 2014 |

2.5% |

|

December 2014 |

-0.5% |

|

January 2015 |

-1.0% |

|

February 2015 |

8.5% |

|

March 2015 |

0.0% |

|

April 2015 |

10.7% |

|

May 2015 |

0.1% |

|

June 2015 |

-3.2% |

|

July 2015 |

-2.7% |

|

August 2015 |

-5.3% |

|

September 2015 |

-2.1% |

|

October 2015 |

7.6% |

|

November 2015 |

0.4% |

|

December 2015 |

-2.2% |

|

January 2016 |

-4,7% |

|

February 2016 |

-0.7% |

|

March 2016 |

6.7% |

|

April 2016 |

0.4% |

|

May 2016 |

1.8% |

|

June 2016 |

-2.2% |

|

July 2016 |

5.3% |

|

August 2016 |

2.3% |

|

September 2016 |

-1.6% |

|

October 2016 |

-1.6% |

|

November 2016 |

2.1% |

|

December 2016 |

0.1% |

|

January 2017 |

6.0% |

|

February 2017 |

-0.8% |

|

March 2017 |

1.4% |

|

April 2017 |

0.8% |

|

May 2017 |

1.6% |

|

June 2017 |

5.6% |

|

July 2017 |

2.7% |

|

August 2017 |

0.3% |

|

September 2017 |

3.6% |

|

October 2017 |

-0.7% |

|

November 2017 |

6.4% |

|

December 2017 |

-0.7% |

|

January 2018 |

10% |

|

February 2018 |

-0.5% |

|

March 2018 |

-1.6% |

|

April 2018 |

-1.0% |

|

May 2018 |

-1.5% |

|

June 2018 |

-0.8% |

|

July 2018 |

-0.7% |

|

August 2018 |

2.4% |

|

September 2018 |

-1.7% |

|

October 2018 |

1.0% |

|

November 2018 |

3.1% |

|

December 2018 |

-4.2% |

|

January 2019 |

5.4% |

|

February 2019 |

1.7% |

|

March 2019 |

-2.6% |

|

April 2019 |

4.6% |

|

May 2019 |

1.5% |

|

June 2019 |

4.3% |

|

July 2019 |

2.2% |

|

August 2019 |

3.7% |

|

September 2019 |

-0.8% |

|

October 2019 |

2.0% |

|

November 2019 |

-0.5% |

|

December 2019 |

1.6% |

|

January 2020 |

5.0% |

|

February 2020 |

-7.4% |

|

March 2020 |

-11.5% |

|

April 2020 |

8.0% |

|

May 2020 |

6.7% |

|

June 2020 |

2.3% |

|

July 2020 |

6.6% |

|

August 2020 |

4.9% |

|

September 2020 |

-5.2% |

|

October 2020 |

-6.7% |

|

November 2020 |

8.9% |

|

December 2020 |

7.2% |

|

January 2021 |

0.8% |

|

February 2021 |

1.4% |

|

March 2021 |

-2.7% |

|

April 2021 |

3.3% |

|

May 2021 |

2.5% |

|

June 2021 |

0.4% |

|

July 2021 |

0.4% |

|

August 2021 |

0.1% |

|

September 2021 |

-4.2% |

|

October 2021 |

5.9% |

|

November 2021 |

-5.6% |

|

December 2021 |

4.9% |

|

January 2022 |

-2.2% |

|

February 2022 |

-3.5% |

|

March 2022 |

3.5% |

|

April 2022 |

-8.6% |

|

May 2022 |

-5.1% |

|

June 2022 |

-0.7% |

|

July 2022 |

2.4% |

|

August 2022 |

-3.9% |

|

September 2022 |

-8.8% |

|

October 2022 |

-1.1% |

|

November 2022 |

11.5% |

|

December 2022 |

-2.9% |

|

January 2023 |

3.8% |

|

February 2023 |

-4.1% |

|

March 2023 |

5.0% |

|

April 2023 |

0.9% |

|

May 2023 |

-3.9% |

|

June 2023 |

3.8% |

|

July 2023 |

4.6% |

|

August 2023 |

-2.3% |

|

September 2023 |

-3.0% |

|

October 2023 |

-0.6% |

|

November 2023 |

7.7% |

|

December 2023 |

3.8% |

|

January 2024 |

-2.7% |

|

February 2024 |

4.3% |

|

March 2024 |

-0.1% |

|

April 2024 |

-3.8% |

|

May 2024 |

1.3% |

|

June 2024 |

-0.4% |

|

July 2024 |

3.2% |

|

August 2024 |

8.2% |

|

September 2024 |

4.7% |

|

October 2024 |

-1.2% |

|

November 2024 |

2.6% |

About FTSE Mondo Visione Exchanges Index

The FTSE Mondo Visione Exchanges Index, a joint venture between FTSE Group and Mondo Visione, was established in 2000.

It is the first Index in the world to focus on listed exchanges and other trading venues. The FTSE Mondo Visione Exchanges Index compares performance of individual exchanges and trading platforms and provides a reliable barometer of the health and performance of the exchange sector.

It enables investors to track 33 publicly listed exchanges and trading floors and focuses attention of the market on this important sector.

The FTSE Mondo Visione Exchanges Index includes all publicly traded stock exchanges and trading floors:

- Aquis Exchange

- Australian Securities Exchange Ltd

- B3 SA

- Bolsa de Comercio Santiago

- Bolsa Mexicana de Valores SA

- Boursa Kuwait Securities

- BSE

- Bulgarian Stock Exchange

- Bursa de Valori Bucuresti SA

- Bursa Malaysia

- Cboe Global Markets

- CME Group

- Dar es Salaam Stock Exchange PLC

- Deutsche Bourse

- Dubai Financial Market

- Euronext

- Hellenic Exchanges SA

- Hong Kong Exchanges and Clearing Ltd

- Intercontinental Exchange Inc

- Japan Exchange Group, Inc

- Johannesburg Stock Exchange Ltd

- London Stock Exchange Group

- Multi Commodity Exchange of India

- Nairobi Securities Exchange

- Nasdaq

- New Zealand Exchange Ltd

- Philippine Stock Exchange

- Saudi Tadawul Group

- Singapore Exchange Ltd

- Tel Aviv Stock Exchange

- TMX Group

- Warsaw Stock Exchange

- Zagreb Stock Exchange

The FTSE Mondo Visione Exchanges Index is compiled by FTSE Group from data based on the share price performance of listed exchanges and trading platforms.