HKEX regained the top spot from CME Group as the largest exchange group by market capitalisation, benefitting from China's strengthening supervision of Chinese firms listed offshore and the tightening of rules for cross-border data flows.

China's regulatory clampdown has made Hong Kong a more attractive listing venue for Chinese companies looking to avoid the new restrictions for listing in the United States.

The top 5 exchanges by market capitalisation at the end of July were:

| Exchange | Market Cap (USD bn) |

| Hong Kong Exchanges & Clearing | 80.92 |

| CME Group | 75.94 |

| Intercontinental Exchange | 66.54 |

| London Stock Exchange Group | 37.78 |

| Deutsche Boerse | 30.63 |

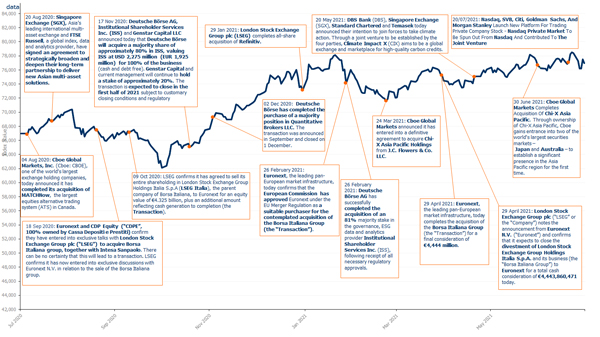

The FTSE Mondo Visione Index gained 0.4% in July, with the index closing the month at 76,954.97 points, up from the June close of 76, 641.18. The index set a new closing all-time high of 78,483.33 on 22 July 2021.

The best performer by capital returns in US dollars was India's BSE, with a 38.5 per cent increase in share price from 1 July 2021 to 30 July 2021. The next best performer was the Bulgarian Stock Exchange with a 24.0 per cent increase, followed by Boursa Kuwait Securities with a 22.3 per cent increase over the same period.

The worst performer by capital returns in US dollars was Brazil's B3, with an 11.6 per cent decrease in share price from 1 July 2021 to 30 July 2021. Warsaw Stock Exchange was the second-worst performer with a 9.7 per cent decline, followed by Dar es Salaam Stock Exchange with a 9.2 per cent decrease over the same period.

Herbie Skeete, Managing Director, Mondo Visione and Co-founder of the Index said:

"HKEX is likely to benefit as China discourages technology companies from listing in the United States with more listings in Hong Kong."

Click here to download July's performance report.

Monthly FTSE Mondo Visione Exchanges Index Performance (Capital Return, USD)

Monthly FTSE Mondo Visione Exchanges Index Performance (Capital Return, USD)

|

July 2014 |

3.1% |

|

August 2014 |

2.3% |

|

September 2014 |

-3.6% |

|

October 2014 |

2.8% |

|

November 2014 |

2.5% |

|

December 2014 |

-0.5% |

|

January 2015 |

-1.0% |

|

February 2015 |

8.5% |

|

March 2015 |

0.0% |

|

April 2015 |

10.7% |

|

May 2015 |

0.1% |

|

June 2015 |

-3.2% |

|

July 2015 |

-2.7% |

|

August 2015 |

-5.3% |

|

September 2015 |

-2.1% |

|

October 2015 |

7.6% |

|

November 2015 |

0.4% |

|

December 2015 |

-2.2% |

|

January 2016 |

-4,7% |

|

February 2016 |

-0.7% |

|

March 2016 |

6.7% |

|

April 2016 |

0.4% |

|

May 2016 |

1.8% |

|

June 2016 |

-2.2% |

|

July 2016 |

5.3% |

|

August 2016 |

2.3% |

|

September 2016 |

-1.6% |

|

October 2016 |

-1.6% |

|

November 2016 |

2.1% |

|

December 2016 |

0.1% |

|

January 2017 |

6.0% |

|

February 2017 |

-0.8% |

|

March 2017 |

1.4% |

|

April 2017 |

0.8% |

|

May 2017 |

1.6% |

|

June 2017 |

5.6% |

|

July 2017 |

2.7% |

|

August 2017 |

0.3% |

|

September 2017 |

3.6% |

|

October 2017 |

-0.7% |

|

November 2017 |

6.4% |

|

December 2017 |

-0.7% |

|

January 2018 |

10% |

|

February 2018 |

-0.5% |

|

March 2018 |

-1.6% |

|

April 2018 |

-1.0% |

|

May 2018 |

-1.5% |

|

June 2018 |

-0.8% |

|

July 2018 |

-0.7% |

|

August 2018 |

2.4% |

|

September 2018 |

-1.7% |

|

October 2018 |

1.0% |

|

November 2018 |

3.1% |

|

December 2018 |

-4.2% |

|

January 2019 |

5.4% |

|

February 2019 |

1.7% |

|

March 2019 |

-2.6% |

|

April 2019 |

4.6% |

|

May 2019 |

1.5% |

|

June 2019 |

4.3% |

|

July 2019 |

2.2% |

|

August 2019 |

3.7% |

|

September 2019 |

-0.8% |

|

October 2019 |

2.0% |

|

November 2019 |

-0.5% |

|

December 2019 |

1.6% |

|

January 2020 |

5.0% |

|

February 2020 |

-7.4% |

|

March 2020 |

-11.5% |

|

April 2020 |

8.0% |

|

May 2020 |

6.7% |

|

June 2020 |

2.3% |

|

July 2020 |

6.6% |

|

August 2020 |

4.9% |

|

September 2020 |

-5.2% |

|

October 2020 |

-6.7% |

|

November 2020 |

8.9% |

|

December 2020 |

7.2% |

|

January 2021 |

0.8% |

|

February 2021 |

1.4% |

|

March 2021 |

-2.7% |

|

April 2021 |

3.3% |

|

May 2021 |

2.5% |

|

June 2021 |

0.4% |

|

July 2021 |

0.4% |

About FTSE Mondo Visione Exchanges Index

The FTSE Mondo Visione Exchanges Index, a joint venture between FTSE Group and Mondo Visione, was established in 2000.

It is the first Index in the world to focus on listed exchanges and other trading venues. The FTSE Mondo Visione Exchanges Index compares performance of individual exchanges and trading platforms and provides a reliable barometer of the health and performance of the exchange sector.

It enables investors to track 32 publicly listed exchanges and trading floors and focuses attention of the market on this important sector.

The FTSE Mondo Visione Exchanges Index includes all publicly traded stock exchanges and trading floors:

- Aquis Exchange

- Australian Securities Exchange Ltd

- B3 SA

- Bolsa Mexicana de Valores SA

- Boursa Kuwait Securities

- BSE

- Bulgarian Stock Exchange

- Bursa de Valori Bucuresti SA

- Bursa Malaysia

- Cboe Global Markets

- CME Group

- Dar es Salaam Stock Exchange PLC

- Deutsche Bourse

- Dubai Financial Market

- Euronext

- Hellenic Exchanges SA

- Hong Kong Exchanges and Clearing Ltd

- Intercontinental Exchange Inc

- Japan Exchange Group, Inc

- Johannesburg Stock Exchange Ltd

- London Stock Exchange Group

- Moscow Exchange

- Multi Commodity Exchange of India

- Nairobi Securities Exchange

- Nasdaq

- New Zealand Exchange Ltd

- Philippine Stock Exchange

- Singapore Exchange Ltd

- Tel Aviv Stock Exchange

- TMX Group

- Warsaw Stock Exchange

- Zagreb Stock Exchange

The FTSE Mondo Visione Exchanges Index is compiled by FTSE Group from data based on the share price performance of listed exchanges and trading platforms.