The implosion of Archegos caused wide-spread chaos on markets amidst concerns on the potential contagion effect that the sell-off could have on global equity markets where sentiments have recently been dampened by surging bond yields.

Despite returning a solid set of figures for full-year 2020, London Stock Exchange Group's (LSEG's) updated guidance for operating costs and capital expenditure for 2021 provided a strong indication of the challenges that are still to come with integrating Refinitiv, and this had a negative impact on the LSEG share price and performance in March.

The three months to the end of March saw the FTSE Mondo Visione Exchanges Index down by 0.5%. Aquis Exchange was the best performing exchange in the quarter with Croatia's Zagrebacka Burza dd being the worst performer.

The FTSE Mondo Visione Exchanges Index ended the month down 2.7% at 72,106.76 points, down from 74,105.97 on 26 February 2021.

Hong Kong Exchanges & Clearing Group ended March as the world's largest exchange operator by market capitalisation.

The top 5 exchanges by market capitalisation at end March were:

| Exchange | Market Cap (USD bn) |

| Hong Kong Exchanges & Clearing | 74.59 |

| CME Group | 72.36 |

| Intercontinental Exchange | 61.74 |

| London Stock Exchange Group | 34.60 |

| Deutsche Boerse | 30.55 |

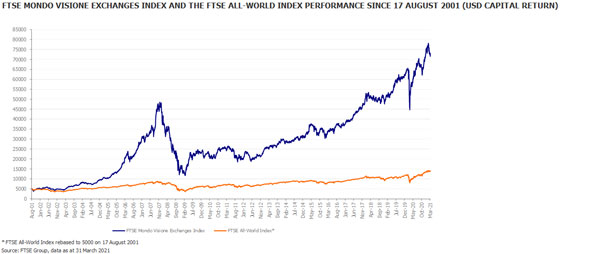

FTSE MONDO VISIONE EXCHANGES INDEX AND THE FTSE ALL-WORLD INDEX PERFORMANCE SINCE 17 AUGUST 2001 (USD CAPITAL RETURN)

Herbie Skeete, Managing Director, Mondo Visione and Co-founder of the Index said:

"The market has given its initial assessment of London Stock Exchange Group's purchase of Refinitiv and that assessment is reflected in the LSEG's position in this month's performance table."

Tel Aviv Stock Exchange was the best performer in March by capital returns in US dollars with a 14.8 per cent increase in share price from 26 February 2021 to 31 March 2021. The next two best performers were Bulgarian Stock Exchange with a 10.2 per cent increase and Japan Exchange Group with a 9.5 per cent increase over the same period.

The FTSE Mondo Visione Exchanges Index worst performer in December by capital returns in US dollars was London Stock Exchange Group with a 28.8 per cent decrease in share price from 26 February 2021 to 31 March 2021. The next two worst performers at the bottom of the table were Croatia's Zagrebacka Burza dd with a 8 per cent decrease and Kenya's Nairobi Securities Exchange with a 8 per cent decrease over the same period.

The FTSE Mondo Visione Exchanges Index fell by 0.5 per cent in the first quarter of 2021 as opposed to a rise of 6.0 per cent in the fourth quarter of 2020 and a fall of 13.9 per cent in the first quarter of 2020.

In Q1 2021, the FTSE Mondo Visione Exchanges Index best performer by capital returns in US dollars was Aquis Exchange with a 31.0 per cent increase in share price from 1 January to 31 March 2021. The next two best performers were Tanzania's Dar es Salaam Stock Exchange with a 25.0 per cent increase and Tel Aviv Stock Exchange with a 21.7 per cent increase.

In Q1 2021, the FTSE Mondo Visione Exchanges Index worst performer by capital returns in US dollars was Croatia's Zagrebacka Burza dd with a 22.3 per cent decrease in share price from 1 January to 31 March 2021. The next two worst performers at the bottom of the table were London Stock Exchange Group with an 22.2 per cent decrease and Brazil's B3 SA with a 18.9 per cent decrease.

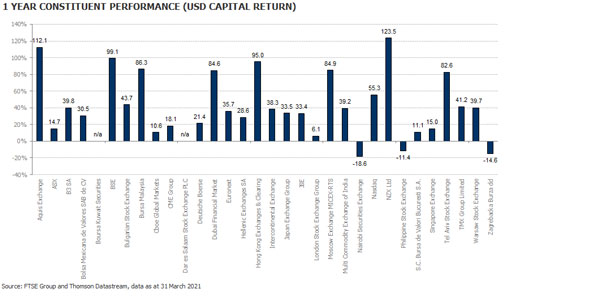

Over the past 12 months, the FTSE Mondo Visione Exchanges Index best performer by capital returns in US dollars was NZX with a 123.5 per cent increase in share price. The next two best performers were Aquis Exchange with a 112.1 per cent increase and India's BSE with a 99.1 per cent increase.

Over the past 12 months, the FTSE Mondo Visione Exchanges Index worst performer by capital returns in US dollars was Kenya's Nairobi Securities Exchange with a 18.6 per cent decrease in share price. The next two worst performers at the bottom of the table were Croatia's Zagrebacka Burza ddwith a 14.6 per cent decrease and Philippine Stock Exchange with a 11.4 per cent decrease.

1 YEAR CONSTITUENT PERFORMANCE (USD CAPITAL RETURN)

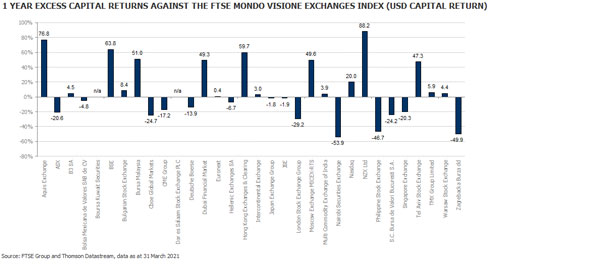

1 YEAR EXCESS CAPITAL RETURNS AGAINST THE FTSE MONDO VISIONE EXCHANGES INDEX (USD CAPITAL RETURN)

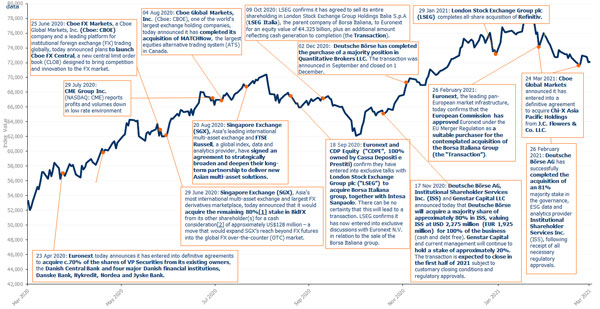

1-YEAR PERFORMANCE CHART OF THE FTSE MONDO VISIONE EXCHANGES INDEX (USD CAPITAL RETURN)

Click here to download March's performance report, including the quarterly analysis.

Monthly FTSE Mondo Visione Exchanges Index Performance (Capital Return, USD)

|

July 2014 |

3.1% |

|

August 2014 |

2.3% |

|

September 2014 |

-3.6% |

|

October 2014 |

2.8% |

|

November 2014 |

2.5% |

|

December 2014 |

-0.5% |

|

January 2015 |

-1.0% |

|

February 2015 |

8.5% |

|

March 2015 |

0.0% |

|

April 2015 |

10.7% |

|

May 2015 |

0.1% |

|

June 2015 |

-3.2% |

|

July 2015 |

-2.7% |

|

August 2015 |

-5.3% |

|

September 2015 |

-2.1% |

|

October 2015 |

7.6% |

|

November 2015 |

0.4% |

|

December 2015 |

-2.2% |

|

January 2016 |

-4,7% |

|

February 2016 |

-0.7% |

|

March 2016 |

6.7% |

|

April 2016 |

0.4% |

|

May 2016 |

1.8% |

|

June 2016 |

-2.2% |

|

July 2016 |

5.3% |

|

August 2016 |

2.3% |

|

September 2016 |

-1.6% |

|

October 2016 |

-1.6% |

|

November 2016 |

2.1% |

|

December 2016 |

0.1% |

|

January 2017 |

6.0% |

|

February 2017 |

-0.8% |

|

March 2017 |

1.4% |

|

April 2017 |

0.8% |

|

May 2017 |

1.6% |

|

June 2017 |

5.6% |

|

July 2017 |

2.7% |

|

August 2017 |

0.3% |

|

September 2017 |

3.6% |

|

October 2017 |

-0.7% |

|

November 2017 |

6.4% |

|

December 2017 |

-0.7% |

|

January 2018 |

10% |

|

February 2018 |

-0.5% |

|

March 2018 |

-1.6% |

|

April 2018 |

-1.0% |

|

May 2018 |

-1.5% |

|

June 2018 |

-0.8% |

|

July 2018 |

-0.7% |

|

August 2018 |

2.4% |

|

September 2018 |

-1.7% |

|

October 2018 |

1.0% |

|

November 2018 |

3.1% |

|

December 2018 |

-4.2% |

|

January 2019 |

5.4% |

|

February 2019 |

1.7% |

|

March 2019 |

-2.6% |

|

April 2019 |

4.6% |

|

May 2019 |

1.5% |

|

June 2019 |

4.3% |

|

July 2019 |

2.2% |

|

August 2019 |

3.7% |

|

September 2019 |

-0.8% |

|

October 2019 |

2.0% |

|

November 2019 |

-0.5% |

|

December 2019 |

1.6% |

|

January 2020 |

5.0% |

|

February 2020 |

-7.4% |

|

March 2020 |

-11.5% |

|

April 2020 |

8.0% |

|

May 2020 |

6.7% |

|

June 2020 |

2.3% |

|

July 2020 |

6.6% |

|

August 2020 |

4.9% |

|

September 2020 |

-5.2% |

|

October 2020 |

-6.7% |

|

November 2020 |

8.9% |

|

December 2020 |

7.2% |

|

January 2021 |

0.8% |

|

February 2021 |

1.4% |

|

March 2021 |

-2.7% |

About FTSE Mondo Visione Exchanges Index

The FTSE Mondo Visione Exchanges Index, a joint venture between FTSE Group and Mondo Visione, was established in 2000.

It is the first Index in the world to focus on listed exchanges and other trading venues. The FTSE Mondo Visione Exchanges Index compares performance of individual exchanges and trading platforms and provides a reliable barometer of the health and performance of the exchange sector.

It enables investors to track 32 publicly listed exchanges and trading floors and focuses attention of the market on this important sector.

The FTSE Mondo Visione Exchanges Index includes all publicly traded stock exchanges and trading floors:

- Aquis Exchange

- Australian Securities Exchange Ltd

- B3 SA

- Bolsa Mexicana de Valores SA

- Boursa Kuwait Securities

- BSE

- Bulgarian Stock Exchange

- Bursa de Valori Bucuresti SA

- Bursa Malaysia

- Cboe Global Markets

- CME Group

- Dar es Salaam Stock Exchange PLC

- Deutsche Bourse

- Dubai Financial Market

- Euronext

- Hellenic Exchanges SA

- Hong Kong Exchanges and Clearing Ltd

- Intercontinental Exchange Inc

- Japan Exchange Group, Inc

- Johannesburg Stock Exchange Ltd

- London Stock Exchange Group

- Moscow Exchange

- Multi Commodity Exchange of India

- Nairobi Securities Exchange

- Nasdaq

- New Zealand Exchange Ltd

- Philippine Stock Exchange

- Singapore Exchange Ltd

- Tel Aviv Stock Exchange

- TMX Group

- Warsaw Stock Exchange

- Zagreb Stock Exchange

The FTSE Mondo Visione Exchanges Index is compiled by FTSE Group from data based on the share price performance of listed exchanges and trading platforms.