Defining the problems and preventing the downfall of humanity

Amid domestic issued stablecoins and foreign issued stablecoins may be backed by same assets, regulatory regime ought to differentiate and skew it in favor of stablecoins issuance by a US based permitted payment stablecoin issuer (PPSI).

Impose a 1 to 2% of gross revenue surcharge on Exchanges and DeFi protocols requiring their allocation of the fund to risk education program for existing and prospective retail clients, instead of addressing the loophole about “third-party” offering of interest on stablecoin holdings (amid GENIUS Act prohibits stablecoin issuers from paying interest directly).

Policy makers should make sure these crypto infrastructure providers would not just profit from the US and betray America’s interest. They must always abide by the US rules; particularly their products and processes should ultimately tie back to strengthening the US Treasury and repos markets. This is similar to the Dodd-Frank Volcker rule having an explicit exemption on US Treasury and repos. Per BIS, “some stablecoin issuers rely on reverse repos to generate additional income. During market stress, this could strain repo market liquidity, with spillovers on other short-term dollar funding markets. In addition, interconnections arise through direct exposure to banks via deposit holdings…”

We have reservation with the BIS / IIF prescribed unified ledger / Project Agorá that integrates different financial assets and central bank money onto a single, programmable platform to automate and streamline transactions. The CAT system has set a bad precedent. To effectively mitigate privacy and security risks without creating bureaucracy, do keep in mind the following three management fundamentals: (i) segregation of duties, (ii) keep clean with high incentives (e.g. whistleblower award), and (iii) precognitive prevention by reducing the number of unknown unknowns. Better to analyze data directly at its originating source and scrutinize high risks cases as prompted by informants / suspicious activity intelligence. Also, agentic AI may use baits to catch illicit activities hopping around.

Twenty-first century challenges include a rebellious move by an insurgent with a war chest to orchestrate a market wide shake-up, and foreign adversaries wanting to erode the US’s prominent market position. Bad actors / foreign adversaries play across markets and payment systems simultaneously. Per Professor Hélène Rey, policy makers should observe and monitor “the magnitude and substitution patterns between dollar-backed crypto assets and money market funds and deposits in local currencies and dollars.” Also, China's 2024 US dollar bond issuance in Saudi Arabia had yields on par with or slightly above US Treasury benchmarks, while its late 2025 Hong Kong issuance had yields that were slightly below US Treasury equivalents for similar maturities. These “clones” of US Treasury, together with China “gold corridor" strategic initiative with the BRICS, are adversely affecting the US monetary policy in the long run.

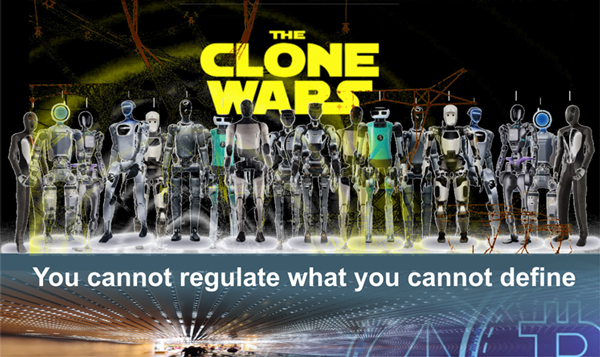

We foresee increasing crossover activities between AI, tokenization and Digital Assets. AIs “cloning” from known lessons in reality or simulated environment to generate or manipulate the “likes” in a real, mixed, or virtual reality, a metaverse or multiverses with selective focus. Knowledge distillation can be a shortcut for cheap AIs to produce “counterfeits” or steal the fruits of other AIs. In parallel, DeFi redefines the alchemy of finance and “cloning” reward programs’ points, membership, ticket, credential, title instrument, identity badge, money, and whatnot into digital tokens.

The high energy cost of mining Proof-of-Work (PoW) currencies creates a positive correlation with its value, especially Bitcoin and the like. If people want to outsource mundane tasks to increasingly complex matters to AI agents / machines, AI may require equivalent exchange of computing power / energy represented by crypto in the future. Some make PoW simpler, yet Proof-of-Stake systems are vulnerable to voting paradoxes. “Simplification” undermining the problem of tyranny of the majority (i.e. oppression of minorities, exclusion of value input causing poorer decision-making, and intensified conflicts by refusal to compromise leading to social polarization and unrest).

Simplifying everybody’s life is an honorable goal, yet AI if misused can enslave humans. Deskilling and overreliance on AI make people become simple minded. People turn into couch potatoes when they lose their independent critical thinking and handy person’s abilities. All AIs want to be fed, but inputs versus outputs will get out of proportion. The Good – some GenAI prompt users to choose from few suggestive questions to keep the human and AI dialogue going that sharpen each other’s mind. The Bad – some Large Language Models intentionally cause additive behaviors. The Ugly – AI social credit score. While people test and measure the intelligence level of AIs, AIs use Turing, behavioral analysis, psychometric tests, and what intelligent questions we ask of AIs to score how dump different people are in vice versa. AIs ONLY rely on the most intelligent and timely inputs from humans, while giving back generic, cookie cutter, or flattery simple responses. If users do not want deteriorated feedback, there will be different tiers of subscriptions based on what human intelligence and crypto energy coins one is willing and can contribute or feed the AIs. This is NOT AI bias but human greed that exacerbates inequality. Tiering and scoring humans ought to be regulated.

Putting geopolitics, AI, and Crypto into a common perspective, the problem faced by humanity boils down to:

- We all screwed ourselves by overreliance on global supply chain, technologies, bureaucratic financial systems;

- Corporates keep cloning / rehashing the same legacy products and pandering it or sold counterfeits to the mass market;

- Authorities blame it on inadequate penetration, and many try to find scapegoats to escape their own blame;

- Most people have IBG / YBG mentality and choose to do what is easy but neglect the consequences of shortcuts;

- Greed and laziness are to blame; tensions rise where Ruthless (TraFi) and Reckless (DeFi) created each other;

- Sarcastically, in the end everyone wants everything and the world back to “Normal”, when the “NORM” may indeed mean “it does not matter if we do not know how to do anything.” Social norms evolve overtime.

Is it the decline of the world population that we need humanoid clones to pick up the work where people slack off? Would nations measure wealth by the number of humanoid clones owned per household and the amount of tokenized energy each household can generate, rather than by cars and livable space? Does China or the US, have the better economy of scale to become the world dominated manufacturer of Humanoid clones? Are these humanoid clones a one size fits all multi-purposes agents or they will be like robot vacuums or automated lawn mowers that serve specific functions? In either case, short-sighted corporations push outdated products, exhibit a lack of personalization, and underinvest to maximize profits.

Hope is dim if all the investments in AI and Crypto are meant for another round of corporates’ push of their mass-produced products. There is hope if we use AI and DeFi to tailor products and services in line with the mass customization global trend.

A revitalization of the US manufacturing sector will NOT be driven by humanoid clones sitting in assembly lines. Penetrating consumers to buy Humanoid clones will NOT increase the US competitiveness, except creating ever more waste like old Electric Vehicles’ batteries. Suck up the power enabled by AI and DeFi, so that every US household can turn their garages or any underutilize space into workshops. By equipping US households with “robotic assisted appliances” and low-cost access to supply and distribution channels, many would become entrepreneurs to customize every good and service. These appliances need economy of scope (like 3D printers or various Apps on iPhone or Android), but NOT necessarily high production capacity.

We believe the US would lead the world by unleashing creativity and ingenuity. Gamification is what Americans do best. It prevents AI dulling our human minds. With AI, we can detect the smallest irregularities between an original, plagiarized or counterfeit product, covered song, and genuine derivative product. It helps detect and deter bad actors and foreign adversaries from hiding under the guise of DeFi or any AI generated clones.

We are optimistic about the US AI Action Plan, particularly because of this commendable US copyright and AI report. It strikes the appropriate balance in assessing the divergence between private rights and social costs. That being said, unfinished legislative work remains after the Google v. Oracle case about fair use. We have been an advocate for Copyright Licensing Mechanism across industries. We suggest expanding and further strengthening the US Intellectual Properties (IP) protections. Making it cheaper and easier to enforce IP anywhere around the world. Incentivizing the discovery and reduction of “unknown unknowns.” When the World prospers more under the US leadership, there will be less bad actors and adversaries.

|

By Kelvin To, Founder and President of Data Boiler Technologies Data Boiler is a Type C organization member of the European Commission’s Data Expert Group. Between my patented inventions in signal processing, analytics, machine learning, etc. and the wealth of experience of my partner, Peter Martyn, we are about Market Reform, Governance, Risk, Compliance, and FinTech Innovations to create viable paths toward sustainable economic growth.

|