- WSE modifies the WIG20 options expiry cycle as of 18 August 2014. As a result, some options in trading will always expire in the nearest calendar month.

Currently WIG20 index options on WSE expire in the four nearest months of the cycle: March, June, September and December (months of the March quarterly cycle), New dates will be added to the existing cycle as of 18 August 2014. Options will expire 12 times per year and some options in trading will always expire in the nearest calendar month. Options will expire in the three nearest calendar months and in the three subsequent months of the quarterly cycle.

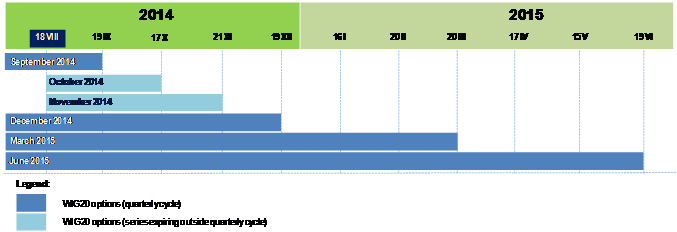

The figure below presents the expiry months of WIG20 options as of 18 August 2014:

“As previously announced, we are offering trade in WIG20 options in a new expiry cycle, which largely expands the range of investment opportunities available on WSE. The addition of new expiry dates of options on the blue-chip stock index complements our offer in this derivatives segment and makes the entire market more attractive. We expect that this will drive more interest in options and consequently we emphasise education offered through free-of-charge national training, conferences and regular webinars,” said Adam Maciejewski, President of the Management Board of WSE.

With the new expiry months of WIG20 options, the abbreviated names of the options will use new letter symbols of the expiry months. The table below presents the codes for all expiry months by call options and put options (the symbols in bold are new).

|

Month |

Call option code |

Put option code |

|

January |

A |

M |

|

February |

B |

N |

|

March |

C |

O |

|

April |

D |

P |

|

May |

E |

Q |

|

June |

F |

R |

|

July |

G |

S |

|

August |

H |

T |

|

September |

I |

U |

|

October |

J |

V |

|

November |

K |

W |

|

December |

L |

X |

In addition to the modification of the expiry cycle, the rules of determining the exercise price will also be modified. The exercise prices of the options currently in trading are staggered 50 points apart for series with the nearest expiry date and 100 points apart for series with longer expiry dates. Under the new rules, the exercise prices of options with the nearest expiry date will be staggered 25 points apart, the exercise prices for options with two subsequent expiry dates 50 points apart, and the exercise prices for options with further expiry dates 100 points apart. Furthermore, the new standard specification of WIG20 options also introduces new rules of setting the minimum number of available exercise prices.

Detailed information about the modification of the standard specification of WIG20 options is available in the Communiqué of the Warsaw Stock Exchange Management Board:

http://www.gpw.pl/komunikaty/?ph_tresc_glowna_start=show&ph_tresc_glowna_cmn_id=53621