- WSE calculates and publishes WIG-CEE index as of 30 May 2012.

- WIG-CEE is a testimony to a growing number of regional issuers and a part of the strategy strengthening the WSE’s position as the CEE financial hub.

The Warsaw Stock Exchange has started as of 30 May 2012 to calculate and publish the Central and Eastern European regional stock index WIG-CEE. After WIG-Poland and WIG-Ukraine, WIG-CEE is the third WSE index mainly based on the criterion of the companies’ country of origin.

WIG-CEE is a total return index and includes dividend and subscription rights income. The index portfolio may include companies from Bulgaria, Croatia, the Czech Republic, Estonia, Hungary, Lithuania, Latvia, Romania, Slovakia, Slovenia, and Ukraine whose shares are listed on the regulated market or in the alternative trading system operated by the Warsaw Stock Exchange.

Companies from a given country may be entered into the list of WIG-CEE index participants provided that at least two companies from such country are listed on the WSE (either on the regulated market or in the ATS) and that such companies are classified in different sectors according to the WSE’s sector classification rules.

On the launch of the WIG-CEE index, the index portfolio is comprised of the following stocks:

|

No. |

NAME |

COUNTRY |

SECTOR |

WEIGHT (%) |

|

1 |

KERNEL |

Ukraine |

Food |

25.16% |

|

2 |

CEZ |

Czech Rep. |

Energy |

25.16% |

|

3 |

MOL |

Hungary |

Fuel |

25.16% |

|

4 |

PEGAS |

Czech Rep. |

Pharma |

4.57% |

|

5 |

ASTARTA |

Ukraine |

Food |

4.20% |

|

6 |

SILVANO |

Estonia |

Retail |

2.13% |

|

7 |

COALENERG |

Ukraine |

Commodities |

2.04% |

|

8 |

FORTUNA |

Czech Rep. |

Other Services |

1.95% |

|

9 |

OLYMPIC |

Estonia |

Hotels & Restaurants |

1.75% |

|

10 |

SOPHARMA |

Bulgaria |

Pharma |

1.39% |

|

11 |

AGROTON |

Ukraine |

Food |

1.03% |

|

12 |

OVOSTAR |

Ukraine |

Food |

1.01% |

|

13 |

MILKILAND |

Ukraine |

Food |

0.99% |

|

14 |

KSGAGRO |

Ukraine |

Food |

0.83% |

|

15 |

SADOVAYA |

Ukraine |

Food |

0.75% |

|

16 |

IMCOMPANY |

Ukraine |

Food |

0.72% |

|

17 |

EUROHOLD |

Bulgaria |

Other Finance |

0.64% |

|

18 |

AVIASG |

Lithuania |

Other Services |

0.49% |

|

19 |

WESTAISIC |

Ukraine |

Electrical Machinery |

0.33% |

|

20 |

AGROWILL |

Lithuania |

Food |

0.16% |

|

21 |

PHOTON |

Czech Rep. |

Eco-Energy |

0.07% |

|

22 |

BGSENERGY |

Czech Rep. |

Eco-Energy |

0.06% |

|

23 |

AGROLIGA |

Ukraine |

Other Services |

0.03% |

|

24 |

ICPD |

Bulgaria |

Investments |

0.02% |

|

25 |

ICMVISION |

Czech Rep. |

IT |

0.01% |

The new index was introduced by WSE CEO Ludwik Sobolewski at the second regional IPO Summit which brings together companies contemplating an IPO on the WSE as well as global banks and investment funds. The new stock index of Central and Eastern European companies is a testimony to the growing number of CEE issuers listed on the markets operated by the WSE and yet another step of the Warsaw Stock Exchange which strengthens its position as the regional leader.

It was our intention to create an index representative of the economies of the entire region of Central and Eastern Europe; we believe that this criterion can interest institutional investors. It is no coincidence that we introduce the index today when the Warsaw Stock Exchange hosts at its head office several hundred representatives of the European capital markets. One of the main reasons to create this index was to demonstrate that foreign companies listed on the trading floor in Warsaw get added value through greater exposure to investors active on the largest, most liquid and most diverse market in this part of Europe,” said WSE CEO Ludwik Sobolewski about the introduction of the WIG-CEE index.

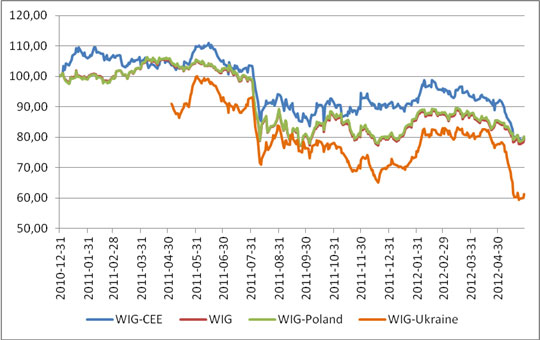

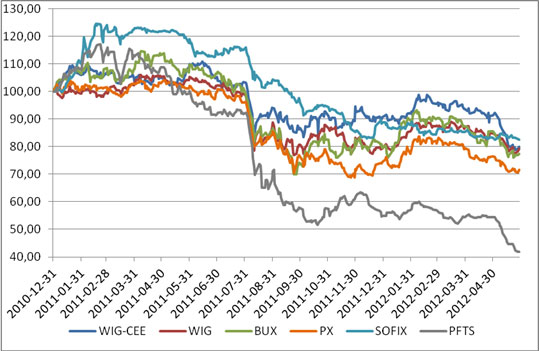

The value of the WIG-CEE index has been determined back to December 2010 and its current value is around 800 points.

Figure 1. WIG-CEE v. Other WSE Indices.

Figure 2. WIG-CEE v. Regional Indices.

For more information about the index, see the Market Data / Market Indices section of the website http://www.gpw.pl.