- The volume of trading in all derivatives was 875.0 thousand instruments in May 2013.

- The number of open interest was 254.5 thousand at the end of May 2013.

WIG20 futures

- The volume of trading in WIG20 futures was 541.0 thousand contracts in May 2013;

- The number of open interest in WIG20 futures was 117.4 thousand contracts at the end of May 2013.

Options

- The volume of trading in WIG20 options was 78.7 thousand options in May 2013;

- The number of open interest was 63.7 thousand options at the end of May 2013.

Single-stock futures

- The volume of trading in single-stock futures was 51.4 thousand contracts in May 2013;

- The number of open interest in single-stock futures was 13.5 thousand contracts at the end of May 2013;

- The most traded single-stock futures in May were:

No. Underlying Trading volume (#) in May 2013

- PKO BP SA 15 704

- KGHM S.A. 13 100

- PKN ORLEN SA 9 741

- PZU SA 2 888

- GRUPA LOTOS SA 2 307

Currency futures

- The volume of trading in currency futures was 199.1 thousand contracts in May 2013*;

- The most traded currency futures in May 2013 were USD/PLN futures. The volume of trading in USD/PLN futures was 176.3 thousand contracts, representing 88.6% of the volume of trading in all currency futures;

- The number of open interest in currency futures was 47.9 thousand contracts at the end of May 2013.

For more statistics, see Table 1 and Figures 1 and 2 below.

*All figures concerning trade in derivatives include the change in the standard specification of currency futures contracts as of 1 May 2012 whereby the size of such contracts was divided by 10.

Table 1 Volume of trading (including block trades):

- in May 2013;

- in June 2012 – May 2013;

- number of open interest (NOI) at the end of May 2013.

|

INSTRUMENT |

|

|

||||||||||

|

VOLUME OF TRADING |

NOI |

|||||||||||

|

(#) |

(#) |

|||||||||||

|

MAY |

JAN - MAY 2013 |

JAN - MAY 2012 |

CHANGE |

LAST 12 MONTHS JUN'12-MAY'13 |

2012 |

CHANGE |

END OF MAY |

|||||

|

2013 |

2012 |

CHANGE |

(%) |

(%) |

2013 |

2012 |

CHANGE |

|||||

|

(%) |

|

|

|

(%) |

||||||||

|

WIG20 FUTURES |

540 967 |

931 075 |

-41,90% |

3 266 206 |

4 037 508 |

-19,10% |

8 305 738 |

9 077 040 |

-8,50% |

117 379 |

110 341 |

6,38% |

|

mWIG40 FUTURES |

3 204 |

1 196 |

167,89% |

12 936 |

6 381 |

102,73% |

20 603 |

14 048 |

46,66% |

849 |

241 |

252,28% |

|

SINGLE STOCK FUTURES |

51 406 |

44 105 |

16,55% |

313 241 |

229 479 |

36,50% |

624 092 |

540 330 |

15,50% |

13 544 |

14 683 |

-7,76% |

|

CURRENCY FUTURES |

199 074 |

116 667 |

70,63% |

1 099 183 |

186 988 |

487,84% |

1 873 130 |

960 935 |

94,93% |

47 922 |

23 914 |

100,39% |

|

WIG20 OPTIONS |

78 710 |

56 160 |

40,15% |

317 348 |

232 414 |

36,54% |

800 298 |

715 364 |

11,87% |

63 713 |

49 482 |

28,76% |

|

INDEX PARTICIPATION UNITS |

1 635 |

3 019 |

-45,84% |

3 810 |

11 085 |

-65,63% |

21 335 |

28 610 |

-25,43% |

11 082 |

13 505 |

-17,94% |

|

TOTAL |

874 996 |

1 152 222 |

-24,06% |

5 012 724 |

4 598 855 |

6,57% |

11 645 196 |

11 336 327 |

2,72% |

254 489 |

212 166 |

19,95% |

*The statistics of currency futures contracts include the change of the standard specification of currency futures as of 1 May 2012 whereby the size of such contracts was divided by 10.

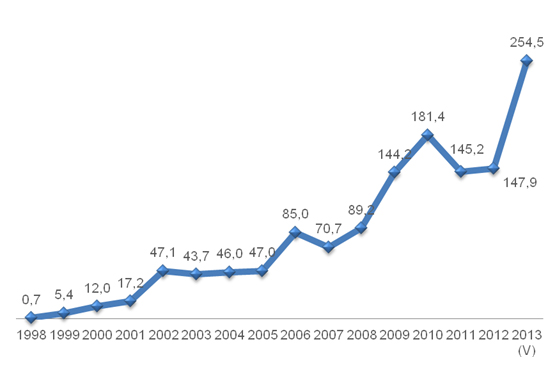

Figure 1 Annual volume of trading (including block trades) in all derivative instruments listed on the WSE in 1998 – May 2013 (million instruments).

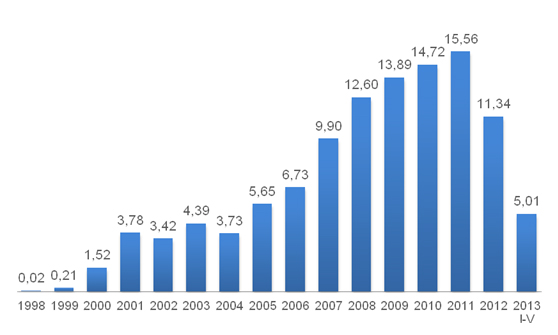

Figure 2 Total number of open interest in all derivative instruments at year-end and at the end of May 2013 (thousand instruments).